The Sapphire Gateway II tables provided in this article enable users to understand which data can be imported into or exported from their SapphireOne data file. When creating a template for importing data, the user has two options. One option is to export data out of an existing data file and use the exported tab-delimited txt file as a template, which can then be populated with the new data intended for import. Alternatively, SapphireOne also has these tables saved as a Word document, allowing users to employ the cut-and-paste method to create the required template.

Never directly import gateway files into an active live data file. First, prepare a recent version of your production data file using the same build as the server, and initiate it in Single User Mode. Conduct a trial import with the intended data and meticulously review the outcome, ensuring particularly that the columns in the import file align correctly with the appropriate fields in your data file replica. After confirming the test import is accurate and everything appears in order, proceed to create a backup of the production (live) data file, and only then carry out the actual import. If discrepancies are detected, identify and rectify the issues in the import file, then re-attempt the import with a new copy of the production data file. Always prioritise testing before importing your data.

For detailed instructions, refer to the separate article in this section of the knowledge base titled “Sapphire Gateway II Templates,” which outlines this procedure.

Clients #CL? – API Gateway Tables

| A | CLA |

| B | [Clients]ID |

| C | [Clients]Name |

| D | [Clients]PostalAddr_Line1 |

| E | [Clients]PostalAddr_Line2 |

| F | [Clients]PostalCity_ Line3 |

| G | [Clients]PostalState_Line4 |

| H | [Clients]PostalZip_Code |

| I | [Clients]MainPhoneNo. |

| J | [Clients]Contact1_Name |

| K | [Clients]Contact1_Position |

| L | [Clients]Contact1_Phone |

| M | [Clients]Class |

| N | [Clients]Area |

| O | CLB |

| P | [Clients]PhysicalAddr_Line1 |

| Q | [Clients]PhysicalAddr_Line2 |

| R | [Clients]PhysicalCity_Line3 |

| S | [Clients]PhysicalState_Line4 |

| T | [Clients]PhysicalZip_Code |

| U | [Clients]Delivery_Instru |

| V | [Clients]Contact2_Name |

| W | [Clients]Contact2_Position |

| X | [Clients]Contact2_Phone |

| Y | [Clients]Facsimile (Client) |

| Z | [Clients]Open_Item |

| AA | [Clients]UDF1 |

| AB | [Clients]UDF2 |

| AC | [Clients]UDF3 |

| AD | [Clients]UDF4 |

| AE | [Clients]Client_Email |

| AF | [Clients]Tag |

| AG | [Clients]Tag2 |

| AH | CLC |

| AI | [Clients]EDI_Location |

| AJ | [Clients]Country |

| AK | [Clients]Tax_No |

| AL | [Clients]Tax_Exempt |

| AM | [Clients]Tax_Code |

| AN | [Clients]Tax_Rate |

| AO | [Clients]Default_GL |

| AP | [Clients]Credit_Limit |

| AQ | [Clients]Credit_Stop |

| AR | [Clients]Order_No |

| AS | [Clients]Discount1 |

| AT | [Clients]Discount_Days |

| AU | [Clients]Discount2 |

| AV | [Clients]Payment_Terms |

| AW | [Clients]Due_Days |

| AX | [Clients]Bank |

| AY | [Clients]Branch |

| AZ | [Clients]Drawer |

| BA | [Clients]Discount_price |

| BB | CLD |

| BC | [Clients]Total Due |

| BD | [Clients]Unposted_Total |

| BE | [Clients]Unposted_Receipt |

| BF | [Clients]Opening_Balance |

| BG | [Clients]Balance1 |

| BH | [Clients]30_Day_Balance |

| BI | [Clients]60_Day_Balance |

| BJ | [Clients]90+Day_Balance |

| BK | [Clients]Balance5 |

| BL | [Clients]Overdue |

| BM | [Clients]Notes |

| BN | [Clients]Last_Transaction |

| BO | [Clients]Last_Receipt |

| BP | [Clients]Last_Receipt_Am |

| BQ | [Clients[Rep |

| BR | [Clients]CLDept |

| BS | [Clients]Reseller |

| BT | [Clients]MCountry |

| BU | [Clients]PCountry |

| BV | [Clients]ParentClient |

| BW | [Clients]Auto_Client_Credit_Stop_Days |

| BX | [Clients]FX_Code |

Comments for Client Import

Specific items to watch for

- [Clients]Class – Client classification – the method of differences between clients (e.g based on purchases, tiers etc…)

- [Clients]Area – Separate grouping from class, it could refer to salesman territory if needed. Or refers to Client’s area (e.g Northern beaches area)

- [Clients]Open_Item – Allocate receipts to invoices – Not balance put forward. (1 = on, 0 = off) – usually, all modern clients have this feature on.

- [Clients]UDF X – The field can store any sortable / grouping type information. This field can be renamed as a record information. Can be used for many purposes including freight terms.

- [Clients]Client_Email – Client email field not related to invoices and statements. the one for invoices and statements appears in different spreadsheet.

- [Clients]Tag – Quite often used for data entry person.

- [Clients]EDI_Location – An internal location that is manually being set up in SapphireOne – for EDI customisation purposes.

- [Clients]Tax_No – ABN for Australian clients, NZBN for New Zealand.

- [Clients]Tax_Code – Enter “S” for when Standard GST applies.

- [Clients]Tax_Rate – GST Rate. e.g “10” for Australian customers and “15” for NZ customers.

- [Clients]Default_GL – Sales GL.

- [Clients]Credit_Stop – A toggle – on/off. On means credit stop enabled. Off means credit stop disabled. (1 = on, 0 = off)

- [Clients]Order_No – Order number required for this client – yes or no. (1 = on, 0 = off)

- [Clients]Discount1 – Manual discount. In order to manage regular discounts per client class use the Price Book functionality.

- [Clients]Discount_Days – If youre running prompt payment discount – you can set it a term of days. The due date is only set by terms.

- [Clients]Discount2 – Related to product discount. Simple product discount if you wish to use this.

- [Clients]Payment_Terms – “PaymentTerms” receives a few possible options with the following index: 1 – 7 Days.2 – 14 Days.9 – Other.

- [Clients]Due_Days – Optional term to payment terms that lets you choose other and how many days.

- [Clients]Bank – Useful for customers that have direct debit setups.

- [Clients]Discount_price – Relates to default price under client class. (1= standard, 2 = PriceA etc…)

- [Clients]MCountry – Mailing country.

- [Clients]PCountry – Physical country.

- [Clients]ParentClient – A child client can add a parent that receives statements for children.

- [Clients]Auto_Client_Credit_Stop_Days – Number of days for client to put a credit stop.

- [Clients]FX Code – Refers to currency used by client. the actual rates are set up in FX currency settings.

Importing Client Balances (NEW data files ONLY)

During the setting up of a new SapphireOne data file the current Client Balances will need to be entered. This may be done by the creation of special spreadsheets as seen below. Data must only be in the cells as seen below. The cells in the spreadsheet as listed below must have the correct data entered.

If any data is in other cells it will overwrite data already in the data file.

If the is no data in a cell in the spreadsheet, SapphireOne will leave these cells as they are, if they contain any existing data.

Client Balances Import table

| A | #CLD | Must be #CLD to enable importing data across to column BU. |

| B | [Clients]ID | ID must be unique. Duplicates will over write existing ID’s and new ID’s in the file will create new Clients. |

| BD | [Clients]Total Due | Total of the 30 60 and 90 balances in BI, BJ, BK. This value must be correct as the system will not add them up. |

| BE | [Clients]Unposted_Total | Un-posted should not generally be imported. Check with SapphireOne support if this is required |

| BF | [Clients]Unposted_Receipt | Un-posted should generally not be imported. Check with SapphireOne support if this is required |

| BG | [Clients]Opening_Balance | Opening balance for the Client. |

| BI | [Clients]30_Day_Balance | Client 30 day balances |

| BJ | [Clients]60_Day_Balance | Client 60 day balances |

| BK | [Clients]90+Day_Balance | Client 90 day balances |

Comments for Client Import

Specific items to watch for

- Checkboxes – Entering 0, zero will leave them as un-ticked. Entering 1 will tick them.

- Case Insensitive – True and False may also be used and is not upper or lower case dependent.

- Checkbox Selection – True or true will set a checkbox as active. False or false will set the checkbox as inactive.

- Blank Columns/Cells – Remember also that no entry into a cell tells SapphireOne to leave it as it is.

- AJ Cell – This column sets the Tax Code. For Australia enter an S. That will be for most of your Clients and alter any others as required. This will work and apply the tax but if the inventory item has a tax code set and the “Use” checkbox is selected it will override the setting in a Client or Vendor.

- AK Cell – Setting the tax code to S as above will not write in the actual rate into the data file so this must be forced. So, for a tax code of S enter in 10 for 10%. Other rates as applicable.

For importing the Client aged balances, the following details to be used

- CLD Syntax – Use the #CLD syntax with the applicable Client ID only, all other fields must be blank.

- BI, BJ & BK Cells – This where the aged 30 60 and 90 day balances in the order as listed here.

- BD Cell – This is where the sum of the 30 60 and 90 day balances is stored and it must be precise.

- Calculating Value of BD – Create a calculated cell beyond Column/Cell BU that adds up the balance of Columns/Cells BI, BJ and BK.

- For example any cell beyond BU may be used, BV, BW and so on as it will not be read by SapphireOne as it will ignore any data beyond Cell BU.

- Transferring Value – Then copy in the calculated values back into the BD field.

- Calculating Value of BD – Create a calculated cell beyond Column/Cell BU that adds up the balance of Columns/Cells BI, BJ and BK.

- BG Cell – This is where the the Clients opening balance is entered.

Vendors #VE – API Gateway Tables

| #VEA | #VEC | #VEX | ||||||

| [Vendors]ID | [Vendors]Tax_Exempt | [Vendors]ID | ||||||

| [Vendors]Name | [Vendors]Tax_Code | [Vendors]Alpha_1_20 | ||||||

| [Vendors]PostalAddr_Line1 | [Vendors]Tax_Rate | [Vendors]Alpha_2_20 | ||||||

| [Vendors]PostalAddr_Line2 | [Vendors]Default_GL | [Vendors]Alpha_3_20 | ||||||

| [Vendors]PostalCity_Line3 | [Vendors]Credit_limit | [Vendors]Alpha_4_20 | ||||||

| [Vendors]PostalState_Line4 | [Vendors]Credit_Stop | [Vendors]Alpha_5_40 | ||||||

| [Vendors]PostalZip_Code | [Vendors]Order_No | [Vendors]Alpha_6_40 | ||||||

| [Vendors]MainPhoneNo. | [Vendors]Discount_1 | [Vendors]Alpha_7_60 | ||||||

| [Vendors]Contact1_Name | [Vendors]Discount_Days | [Vendors]Alpha_8_80 | ||||||

| [Vendors]Contact1_Position | [Vendors]Discount_2 | [Vendors]Real_1 | ||||||

| [Vendors]Contact1_Phone | [Vendors]Finance_Terms | [Vendors]Real_2 | ||||||

| [Vendors]Class | [Vendors]Due_Days | [Vendors]Real_3 | ||||||

| [Vendors]Area | [Vendors]Payee | [Vendors]Real_4 | ||||||

| [Vendors]Bank_Name | [Vendors]Real_5 | |||||||

| #VEB | [Vendors]BSB | [Vendors]Real_6 | ||||||

| [Vendors]PhysicalAddr_Line1 | [Vendors]Bank_Account _No | [Vendors]Real_7 | ||||||

| [Vendors]PhysicalAddr_Line2 | [Vendors]MCountry | [Vendors]Real_8 | ||||||

| [Vendors]PhysicalCity_Line3 | [Vendors]PCountry | [Vendors]Date_1 | ||||||

| [Vendors]PhysiaclState_Line4 | #VED | [Vendors]Date_2 | ||||||

| [Vendors]PhysicalZip_Code | [Vendors]Total_Owing | [Vendors]Date_3 | ||||||

| [Vendors]Pickup_Instruct | [Vendors]Unposted_Total | [Vendors]Date_4 | ||||||

| [Vendors]Contact2_Name | [Vendors]Unposted_Paymen | [Vendors]Time_1 | ||||||

| [Vendors]Contact2_Position | [Vendors]Opening_Balance | [Vendors]Time_2 | ||||||

| [Vendors]Contact2_Phone | [Vendors]Balance1 | [Vendors]Text_1 | ||||||

| [Vendors]Facsimile (Vendor) | [Vendors]30+_Day_Balance | [Vendors]Text_2 | ||||||

| [Vendors]Open_Item | [Vendors]60+_Day_Balance | |||||||

| [Vendors]UDF1 | [Vendors]90+_Day_Balance | |||||||

| [Vendors]UDF2 | [Vendors]Balance5 | |||||||

| [Vendors]UDF3 | [Vendors]OverDue | |||||||

| [Vendors]UDF4 | [Vendors]Warning_Message | |||||||

| [Vendors]Vendor_Email | [Vendors]Notes | |||||||

| [Vendors]Tag | [Vendors]Company | |||||||

| [Vendors]Tag2 | [Vendors]VeDept | |||||||

| [Vendors]Tag3 | [Vendors]Active(0 or 1) CB | |||||||

| [Vendors]Tax_No | [Vendors]Parent_LK | |||||||

| [Vendors]FX_Code |

Vendors – Specific items to watch for

- [Vendors]ID:Is a unique identifier assigned to each vendor within SapphireOne.

- [Vendors]Name: The official name of the vendor.

- [Vendors]PostalAddr_Line1: The first line of the vendor’s postal address.

- [Vendors]PostalAddr_Line2: The second line of the vendor’s postal address.

- [Vendors]PostalCity_Line3: The city part of the vendor’s postal address.

- [Vendors]PostalState_Line4: The state part of the vendor’s postal address.

- [Vendors]PostalZip_Code: The postal or zip code for the vendor’s postal address.

- [Vendors]MainPhoneNo.: The main telephone number for the vendor.

- [Vendors]Contact1_Name: The name of the primary contact person at the vendor.

- [Vendors]Contact1_Position: The job position of the primary contact person.

- [Vendors]Contact1_Phone: The direct phone number for the primary contact person.

- [Vendors]Class: A classification field used to categorise vendors.

- [Vendors]Area: Used for grouping vendors for reporting purposes.

- [Vendors]PhysicalAddr_Line1: The first line of the vendor’s physical address.

- [Vendors]PhysicalAddr_Line2: The second line of the vendor’s physical address.

- [Vendors]PhysicalCity_Line3: The city part of the vendor’s physical address.

- [Vendors]PhysiaclState_Line4: The state part of the vendor’s physical address.

- [Vendors]PhysicalZip_Code: The postal or zip code for the vendor’s physical address.

- [Vendors]Pickup_Instruct: Instructions for picking up items from the vendor.

- [Vendors]Contact2_Name: The name of a secondary contact person at the vendor.

- [Vendors]Contact2_Position: The job position of the secondary contact person.

- [Vendors]Contact2_Phone: The direct phone number for the secondary contact person.

- [Vendors]Facsimile: The fax number for the vendor.

- [Vendors]Open_Item: Indicates whether the vendor operates on an open item basis.

- [Vendors]UDF1 – [Vendors]UDF4: User Defined Fields for additional vendor information.

- [Vendors]Vendor_Email: The email address for the vendor.

- [Vendors]Tag – [Vendors]Tag3: Tags for additional categorisation and reporting.

- [Vendors]Tax_Exempt: Checkbox is used to indicate whether a vendor is exempt from tax. This is particularly relevant for Australian companies dealing with overseas clients, where the overseas clients should not be charged Australian tax

- [Vendors]Tax_No: The vendor’s tax identification number.

- [Vendors]Tax_Code: The tax code applicable to the vendor.

- [Vendors]Tax_Rate: The tax rate associated with the vendor’s tax code.

- [Vendors]Default_GL: The default General Ledger code for transactions with this vendor.

- [Vendors]Credit_limit: The maximum credit limit set for the vendor.

- [Vendors]Credit_Stop: Indicates whether the vendor is on credit stop.

- [Vendors]Order_No: A field for the vendor’s order number requirement.

- [Vendors]Discount_1 and [Vendors]Discount_2: Fields for any applicable discounts.

- [Vendors]Discount_Days: The number of days within which a discount is applicable.

- [Vendors]Finance_Terms: Terms related to financial arrangements with the vendor.

- [Vendors]Due_Days: The number of days until payment is due to the vendor.

- [Vendors]Payee: The name of the payee for payments.

- [Vendors]Bank_Name: The name of the vendor’s bank.

- [Vendors]BSB: The Bank-State-Branch number for the vendor’s bank account.

- [Vendors]Bank_Account_No: The vendor’s bank account number.

- [Vendors]MCountry: The Mailing country where the vendor is located.

- [Vendors]PCountry: The Physical country where the vendor is located.

- [Vendors]Total_Owing: The total amount currently owed to the vendor.

- [Vendors]Unposted_Total: The total of unposted transactions with the vendor.

- [Vendors]Unposted_Paymen: Unposted payments related to the vendor.

- [Vendors]Opening_Balance: The opening balance for the vendor.

- [Vendors]Balance1 – [Vendors]Balance5: Various balance fields for financial tracking.

- [Vendors]30+_Day_Balance – [Vendors]90+_Day_Balance: Aged balance fields showing amounts overdue by 30, 60, and 90+ days.

- [Vendors]OverDue: Indicates if the vendor has any overdue amounts.

- [Vendors]Warning_Message: A field for any warning messages related to the vendor.

- [Vendors]Notes: A field for notes about the vendor.

- [Vendors]Company: The company within your organisation that is linked to the vendor.

- [Vendors]VeDept: The department within your organisation that deals with the vendor.

- [Vendors]Active(0 or 1) CB: A checkbox indicating whether the vendor is active (1) or inactive (0).

- [Vendors]Parent_LK: A reference to a field or identifier used within SapphireOne to denote the link or relationship between a vendor record and its parent entity in the database.

- [Vendors]FX_Code : Current currency traded with Vendor.

- [Vendors]Alpha_1_20 – [Vendors]Alpha_8_80: Alphanumeric fields of varying lengths for additional data.

- [Vendors]Real_1 – [Vendors]Real_8: Numeric fields for financial data.

- [Vendors]Date_1 – [Vendors]Date_4: Date fields for various purposes.

- [Vendors]Time_1 and [Vendors]Time_2: Time fields for time-specific data.

- [Vendors]Text_1 and [Vendors]Text_2: Text fields for additional information.

Inventory , Client and Vendor Classes

| Inventory Class #IC | |

| A | #IC |

| B | [InventoryClass]ID |

| C | [InventoryClass]Name |

| D | [InventroyClass]Department |

| E | [InventoryClass]IN_Type |

| F | [InventoryClass]PR_Type |

| G | [InventoryClass]Notes |

| Client Class #CC | |

| A | #CC |

| B | [ClientClass]ID |

| C | [ClientClass]Description |

| D | [ClientClass]Notes |

| Vendor Class #VC | |

| A | #VC |

| B | [VE_Class]ID |

| C | [VE_Class]Name |

| D | [VE_Class]Notes |

Base Inventory #IN?

| A | #INA | Y | [Inventory]Tax_Code | AX | [Inventory]Allocated | ||

| B | [Inventory]ID | Z | [Inventory]Tax_Rate | AY | [Inventory]Unposted | ||

| C | [Inventory]Name | AA | [Inventory]Vendor | AZ | [Inventory]Average_Cost | ||

| D | [Inventory]Class_LK | AB | [Inventory]Depart | BA | [Inventory]Last_Cost | ||

| E | [Inventory]Std_Units | AC | [Inventory]Tag1 | BB | [Inventory]Last_Date_In | ||

| F | [Inventory]PriceStdSellPrice | AD | [Inventory]Tag2 | BC | [Inventory]Price_Book | ||

| G | [Inventory]StockCtrlType | AE | [Inventory]Tag3 | BD | [Inventory]Decimals | ||

| H | [Inventory]StockCostType | AF | [Inventory]Tag4 | BE | [Inventory]Dec_Prices | ||

| AG | [Inventory]Tag5 | BF | [Inventory]No_Disc | ||||

| #INB | AH | [Inventory]Tag6 | BG | [Inventory]Print | |||

| I | [Inventory]Sec_Units | BH | [Inventory]OnCostFactor | ||||

| J | [Inventory]Minimum | BI | [Inventory]FX_code | ||||

| K | [Inventory]Maximum | #IND | BJ | [Inventory]Fixed_Cost | |||

| L | [Inventory]Carton_Qty | AI | [Inventory]Price_A | BK | [Inventory]Web | ||

| M | [Inventory]Gl_Sales_Acc | AJ | [Inventory]Price_B | BL | [Inventory]Project Link | ||

| N | [Inventory]GL_CostOfSale | AK | [Inventory]Price_C | BM | [Inventory]Discontinued | ||

| O | [Inventory]GL_Asset_Acc | AL | [Inventory]Price_D | BN | [Inventory]Season | ||

| P | [Inventory]GL_VarianceAcc | AM | [Inventory]Price_E | BO | [Inventory]Indent | ||

| Q | [Inventory]Notes | AN | [Inventory]Price_F | BP | [Inventory]CartonVol | ||

| AO | [Inventory]Price_G | BQ | [Inventory]Url | ||||

| #INC | AP | [Inventory]Price_H | BR | [Inventory]TableA | |||

| R | [Inventory]Weight | AQ | [Inventory]Price_Exempt | BS | [Inventory]TableB | ||

| S | [Inventory]Height | AR | [Inventory]UPC/Barcode | #INE | |||

| T | [Inventory]Width | AS | [Inventory]Second_ID | BT | [Inventory]BuildViaBGJ (CB) | ||

| U | [Inventory]Depth | AT | [Inventory]Table_ID | BU | [Inventory]Kit_Item (CB) | ||

| V | [Inventory]PalletQty | AU | [Inventory]Current_Stock | BV | [Inventory]Kit_Style (CB) | ||

| W | [Inventory]Location | AV | [Inventory]On_Order | BW | [Inventory]BillSerialOption | ||

| X | [Inventory]Stocktake | AW | [Inventory]On_Backorder | BX | [Inventory]NeedToBuild |

- ID – Identification Name/Number.

- Name – Inventory Item Name / Short description.

- Class_LK – Classification linked to.

- Std_Units – Standard Units.

- PriceStdSellPrice – Standard Price to be listed.

- StockCtrlType – Stock Control Type to be listed.

- StockCostType – Stock Costs Type to be listed.

- Sec_Units – Second Units.

- Minimum – Minimum amounts to be listed.

- Maximum – Maximum amounts to be listed.

- Carton_Qty – Quantity in a Carton.

- Gl_Sales_Acc – General Ledger Sales Account.

- GL_CostOfSale – General Ledger Cost of Sale.

- GL_Asset_Acc– General Ledger Assets Account number.

- GL_VarianceAcc – General Ledger Variance account number.

- Notes – Additional Inventory Items notes.

- Weight – Total Weight of Inventory Item.

- Height – Total Height of Inventory Item.

- Width – Total Width of Inventory Item.

- Depth – Total Depth of Inventory Item.

- PalletQty – Total quantity per Pallet of Inventory Item.

- Location – Location of inventory item e.g Warehouse, Bay, Storage Unit, ETC…

- Stocktake – Inventory Count.

- Tax_Code – Taxation current code.

- Tax_Rate – Taxation current rate.

- Vendor – Vendor Name/ID.

- Depart – Departure date.

- Tag1 – Customisable tag – any additional information can go here (Gender, Size, Style Code).

- Tag2 – Additional Customisable tag – any additional information can go here.

- Tag3 – Additional Customisable tag – any additional information can go here.

- Tag4 – Additional Customisable tag – any additional information can go here.

- Tag5 – Additional Customisable tag – any additional information can go here.

- Tag6 – Additional Customisable tag – any additional information can go here.

- Price_A – Optional Price.

- Price_B – Additional Optional Price.

- Price_C – Additional Optional Price.

- Price_D – Additional Optional Price.

- Price_E – Additional Optional Price.

- Price_F – Additional Optional Price.

- Price_G – Additional Optional Price.

- Price_H – Additional Optional Price.

- Price_Exempt – Additional Optional Price.

- UPC/Barcode – Barcode / Sequence.

- Second_ID – Additional Identification number/name.

- Table_ID – Table identification number/name (for linking / grouping purposes)

- Current_Stock – Current Stock amount.

- On_Order – Amount of inventory items on order.

- On_Backorder – Amount of inventory items on back-order.

- Allocated – Amount of inventory items allocated.

- Unposted – Amount of inventory items un-posted.

- Average_Cost – Average cost per item.

- Last_Cost – Last cost per item.

- Last_Date_In – Last arrival date in.

- Price Book – Is a list that provides information regarding the inventory item existing.

- Dec_Prices – Decimal prices.

- Decimal – Mark if item has been measured in decimal quantities.

- No_Disc – Mark for unavailability of stock.

- Print – Physical copy / document for the inventory item.

- OnCostFactor – Additional expenses or costs regarding the inventory item.

- FX_code – Tax code / rate.

- Fixed_Cost – Fixed cost / rate.

- Web – Website link to inventory item.

- Project_Link – Project code to link to.

- Discontinued – Mark if item is no longer being carried/sold.

- Season – Season for the inventory item.

- Indent – Sold / requested whilst not in stock.

- CartonVol – Volume per storage unit.

- Url – URL per item.

- TableA – Additional information for linking/grouping. (Colour, Size, Gender, Collection…)

- TableB – Additional information for linking/grouping. (Colour, Size, Gender, Collection…)

Notes for #INE from above

- BuildViaBJI = BGJ only.

- Kit_Item = Manufacture from Invoices Kit.

- Kit_Style = Copy lines to Invoice.

Leave them all blank if you want to manufacture from Invoice, since this is the default.

- BillSerialOptions are as follows.

| 1= Auto Serialise. | 2= Use Component. | 3= Enter Serial on Sale. | 4= Leave as zero for none. |

There are additional Inventory tables following in this article.

Column W. The SapphireOne will override gateway with the Default Location specified in Master Defaults, Inventory page Default Location, and ignore the location entered here in column W.

Check Boxes:

The entry of either 0, zero or False will un-tick the check box. Remember also that no entry into a cell tells SapphireOne to leave it as it is. The entry of either 1 or True will tell the system to enter a tick into the checkbox. Upper or lower case is ignored by the system as it just looks for the word true True or false False.

Additional Base Inventory import tables

Note that these are stand alone tables that all commence with A cell with the table syntax.

| A | #INF | A | #INX | |

| B | [Inventory]ID | B | [Inventory]ID | |

| C | [Inventory]Name | C | [Inventory]Alpha_1_20 | |

| D | [Inventory]Class_LK | D | [Inventory]Alpha_2_20 | |

| E | [Inventory]Std_Units | E | [Inventory]Alpha_3_20 | |

| F | [Inventory]Std_sale_Price | F | [Inventory]Alpha_4_20 | |

| G | [Inventory]Stock_Ctrl_Type | G | [Inventory]Alpha_5_40 | |

| H | [Inventory]Stock_Cost_Type | H | [Inventory]Alpha_6_40 | |

| I | [Inventory]Bin’Bin Nº | I | [Inventory]Alpha_7_60 | |

| J | [Inventory]Bin’Bin_Qty | J | [Inventory]Alpha_8_80 | |

| K | [Inventory]Bin’Bin Nº | K | [Inventory]Alpha_9_80 | |

| L | [Inventory]Bin’Bin_Qty | L | [Inventory]Alpha_10_80 | |

| M | RepeatBinNo&Qtyasdesired | M | [Inventory]Alpha_11_80 | |

| N | [Inventory]Alpha_12_80 | |||

| A | #INP | O | [Inventory]Real_1 | |

| B | [Inventory]ID | P | [Inventory]Real_2 | |

| C | [Inventory]Name | Q | [Inventory]Real_3 | |

| D | [Inventory]Class_LK | R | [Inventory]Real_4 | |

| E | [Inventory]Std_Units | S | [Inventory]Real_5 | |

| F | [Inventory]Std_sale_Price | T | [Inventory]Real_6 | |

| G | [Inventory]Stock_Ctrl_Type | U | [Inventory]Real_7 | |

| H | [Inventory]Stock_Cost_Type | V | [Inventory]Real_8 | |

| I | [Inventory]Price_A | W | [Inventory]Date_1 | |

| J | [Inventory]Price_B | X | [Inventory]Date_2 | |

| K | [Inventory]Price_C | Y | [Inventory]Date_3 | |

| L | [Inventory]Price_D | Z | [Inventory]Date_4 | |

| M | [Inventory]Price_E | AA | [Inventory]Time_1 | |

| N | [Inventory]Price_F | AB | [Inventory]Time_2 | |

| O | [Inventory]Price_G | AC | [Inventory]Text_1 | |

| P | [Inventory]Price_H | AD | [Inventory]Text_2 | |

| Q | [Inventory]Price_Exempt | AE | [Inventory]CAlpha_1 | |

| R | [Inventory]UPC | AF | [Inventory]CAlpha_2 | |

| S | [Inventory]Long_Desc | AG | [Inventory]CAlpha_3 | |

| T | [Inventory]UDF1 | AH | [Inventory]CAlpha_4 | |

| U | [Inventory]UDF2 | AI | [Inventory]CAlpha_5 | |

| V | [Inventory]UDF3 | AJ | [Inventory]CAlpha_6 | |

| W | [Inventory]UDF4 | AK | [Inventory]CAlpha_7 | |

| X | [Inventory]last_cost | AL | [Inventory]CAlpha_8 | |

| Y | [Inventory]Last_Date_IN | AM | [Inventory]CAlpha_9 | |

| Z | [Inventory]Ven_Inv_ID | AO | [Inventory]CAlpha_10 | |

| AA | [Inventory]Ven_Inv_Desc | AP | [Inventory]CBool_1 | |

| AB | [Inventory]Lead_time | AQ | [Inventory]CBool_2 | |

| AC | [Inventory]Stocking_Month | AR | [Inventory]CBool_3 | |

| AD | [Inventory]MarginCode | AS | [Inventory]CBool_4 |

Comments for Importing Base Inventory

The importing of base inventory will automatically create Location Inventory stock according to the location as set in master defaults.

- AC to AH Cells – These cells will write the tag names from Tag through to Tag6 that are displayed on the first page of an Inventory Inquiry.

- AZ & BA Cells – AZ is Average Cost and BA is Last cost. If price book is to be used and it is to be linked to a cost, both columns will have to be written with the same values as price book normally refers to the average cost for its calculations.

- BJ Cell – This cell will write a fixed cost into an Inventory item. It should be noted that when the Fixed Cost cell is entered, SapphireOne will use the Fixed cost when price book does its calculations.

- F Cell This data in this cell enters the Standard Price as seen on the first page of an Inventory Inquiry.

- Cell G – This is the stock control type and a number entered into this cell will determine how it is set. Once the inventory item is open the user has 10 options for setting the Stock Control Type.

- 1=Non-Diminishing, 2=Normal, 3=Serial, 4=Batch, 5=Item, 6+Activity, 7=Hire, 8=Asset, 9=Vouched and 10=General Ledger.

- Cell G – This is the stock control type and a number entered into this cell will determine how it is set. Once the inventory item is open the user has 10 options for setting the Stock Control Type.

- H Cell – This cell sets the Costing Type, 1=Average, 2=Standard, 3=Item & 4=Fixed.

- Y Cell – This cell set the Tax Code. If inventory items themselves are to set the tax code applicable to either a purchase or a sale this will have to be set accordingly. The most common usage in Australia would be a Tax code of S.

- Z Cell – This cell sets the actual Tax Rate. Setting the tax code to S as above will not write in the actual rate into the data file so this must be forced. So, for a tax code of S enter in 10 for 10-%. Enter other rates as applicable.

- BC Cell – If price book is to be used don’t forget to set this checkbox as active, 1 or true, otherwise price book will not be used when setting selling or purchase prices.

Additional Vendors Inventory Items #INV – API Gateway Tables

This is different to other importing functions within the SapphireOne system as the items contained in the table below are in a sub-table. Exporting data out of these sub tables is not recommended. Please check with SapphireOne support before attempting to do so.

| A | #INV |

| B | [Inventory_Vendors] Vendor_ID (As in a Vendor Inquiry) |

| C | [Inventory_Vendors] Inventory_ID (Base ID as in an Inventory Inquiry) |

| D | [Inventory_Vendors] Vendors Product ID (As supplied by the Vendor) |

| E | [Inventory_Vendors] Vendors Product Name (As supplied by the Vendor) |

| F | [Inventory_Vendors] Lead_Time (In Days) |

| G | [Inventory_Vendors] Price (In dollars and cents) |

There is provision in an Inventory Items master file to have a number of preferred Vendors on the second Page More Details. Normally the Vendors Product ID and Names as supplied by them are used for inventory items.

Sometimes these are not suitable and the most common cause for not using them would be if this would result in duplicate ID’s. So within this list there is provision for the entry of the Vendors Product ID and Name as supplied by them for an item if it is different to what is used as the main ID’s and Names.

So as follows:

- B & C Cells – These cells are the System ID’s as set up within the user’s data file system using either a Vendor Inquiry or an Inventory Inquiry.

- D & E Cells – These are the Vendors Product ID and Product Name for the item or product if different.

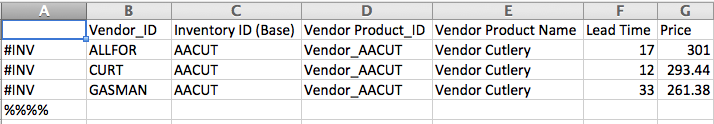

The tab delineated text file as seen below was imported into Bondi Blue for AACUT. This could be extended by the use of a different Inventory ID (Base) column entries.

Note that the first line does not have an entry in cell A1 so the complete row is ignored by the system.

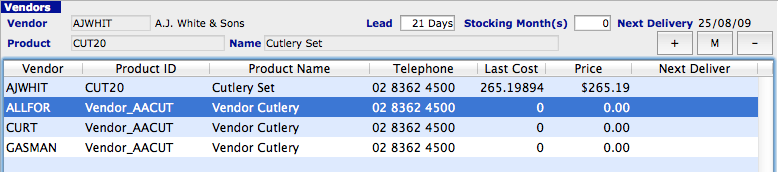

The result was as seen below in the screenshot.

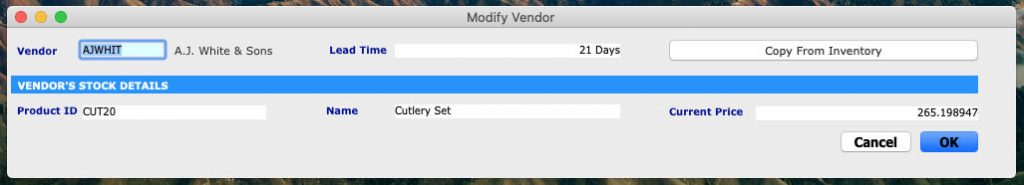

In this list of Vendors on the second page of an Inventory Inquiry the user has to first highlight a line and double click. The details will be displayed in a small alert allowing the user to make modifications as required.

Remember to TEST all imports into a copy of your data file before importing into a live data file.

Base Inventory MSDS page #MSDS

This table imports data into the MSDS Page of a Base Inventory Inquiry.

While the page name is MSDS all Alpha, Real and Date data entry field headings are able to be altered by the user the page may be used for the storing of virtually any type of data.

| A | #MSDS | AC | [Inventory]MSDS_Alpha23 | |

| B | [Inventory]MSDS_Sequence No | AD | [Inventory]MSDS_Alpha24 | |

| C | [Inventory]MSDS_Title | AE | [Inventory]MSDS_Alpha25 | |

| D | [Inventory]MSDS_Inventory Link | AF | [Inventory]MSDS_Alpha26 | |

| E | [Inventory]MSDS_Tag | AG | [Inventory]MSDS_Alpha27 | |

| F | [Inventory]MSDS_Order | AH | [Inventory]MSDS_Alpha28 | |

| G | [Inventory]MDSD_Alpha1 | AI | [Inventory]MSDS_Alpha29 | |

| H | [Inventory]MSDS_Alpha2 | AJ | [Inventory]MSDS_Alpha30 | |

| I | [Inventory]MSDS_Alpha3 | AK | [Inventory]MSDS_Real1 | |

| J | [Inventory]MSDS_Alpha4 | AL | [Inventory]MSDS_Real2 | |

| K | [Inventory]MSDS_Alpha5 | AM | [Inventory]MSDS_Real3 | |

| L | [Inventory]MSDS_Alpha6 | AN | [Inventory]MSDS_Real4 | |

| M | [Inventory]MSDS_Alpha7 | AO | [Inventory]MSDS_Real5 | |

| N | [Inventory]MSDS_Alpha8 | AP | [Inventory]MSDS_Real6 | |

| O | [Inventory]MSDS_Alpha9 | AQ | [Inventory]MSDS_Real7 | |

| P | [Inventory]MSDS_Alpha10 | AR | [Inventory]MSDS_Real8 | |

| Q | [Inventory]MSDS_Alpha11 | AS | [Inventory]MSDS_Real9 | |

| R | [Inventory]MSDS_Alpha12 | AT | [Inventory]MSDS_Real10 | |

| S | [Inventory]MSDS_Alpha13 | AU | [Inventory]MSDS_Date1 | |

| T | [Inventory]MSDS_Alpha14 | AV | [Inventory]MSDS_Date2 | |

| U | [Inventory]MSDS_Alpha15 | AW | [Inventory]MSDS_Date3 | |

| V | [Inventory]MSDS_Alpha16 | AX | [Inventory]MSDS_Date4 | |

| W | [Inventory]MSDS_Alpha17 | AY | [Inventory]MSDS_Date5 | |

| X | [Inventory]MSDS_Alpha18 | AZ | [Inventory]MSDS_Date6 | |

| Y | [Inventory]MSDS_Alpha19 | BA | [Inventory]MSDS_Date7 | |

| Z | [Inventory]MSDS_Alpha20 | BB | [Inventory]MSDS_Date8 | |

| AA | [Inventory]MSDS_Alpha21 | BC | [Inventory]MSDS_Date9 | |

| AB | [Inventory]MSDS_Alpha22 | BD | [Inventory]MSDS_Date10 |

Barcodes #BC

The Inventory ID must be the Base ID, and not the location ID. Both read and write work the same. The system will read consecutive rows of data to the same Base Inventory ID as consecutive Barcodes for that same item and add them in the order as entered.

| A | #BC |

| B | [Inventory_Barcode]Barcode |

| C | [Inventory_Barcode]Base_Inventory_Lk |

| D | [Inventory_Barcode]Qty |

| E | [Inventory_Barcode]ref |

| F | [Inventory_Barcode]Client_ID |

Inventory Locations #IL?

| A | #ILA | #ILD | ||

| B | [Inv_Locations]MergedID | AC | [Inv_Locations]MTDB_COS | |

| AD | [Inv_Locations]MTDB_Purc_QTY | |||

| #ILB | AE | [Inv_Locations]MTDB_Purc_val | ||

| C | [Inv_Locations]Location | AF | [Inv_Locations]MTDB_Sales_Qty | |

| D | [Inv_Locations]Current | AG | [Inv_Locations]MTDB_Sales_val | |

| E | [Inv_Locations]Allocated | AH | [Inv_Locations]MTD_COS | |

| F | [Inv_Locations]On_Backorder | AI | [Inv_Locations]MTD_Purc_Qty | |

| G | [Inv_Locations]On_Order | AJ | [Inv_Locations]MTDPurch_val | |

| H | [Inv_Locations]Unposted | AK | [Inv_Locations]MTD_Sales_Qty | |

| I | [Inv_Locations]AvailableStock | AL | [Inv_Locations]MTD_Sales_val | |

| J | [Inv_Locations]Opening | AM | [Inv_Locations]Ord_Quote_Qty | |

| K | [Inv_Locations]Maximum | AN | [Inv_Locations]Ord_Quote_Value | |

| L | [Inventory_Locations]Minimum | AO | [Inv_Locations]Pur_Quote_Qty | |

| M | [Inventory_Locations]Site | AP | [Inv_Locations]Pur_Quote_val | |

| N | [Inventory_Locations]ProductionArea | AQ | [Inv_Locations]BayActive (CB) | |

| AR | [Inv_Locations]DefaultBuildBay (CB) | |||

| #ILC | AS | [Inv_Locations]Tax_Code) | ||

| O | [Inv_Locations]Average_Cost | AT | [Inv_Locations]Tax_Rate) | |

| P | [Inv_Locations]Last_Cost | AU | [Inv_Locations]Prod_Tax) | |

| Q | [Inv_Locations]Std_Sale_Price | AV | [Inv_Locations]Tax_V_Code) | |

| R | [Inv_Locations]Price_A | AW | [Inv_Locations]Tax_V_Rate) | |

| S | [Inv_Locations]Price_B | AX | [Inv_Locations]Tax_V) | |

| T | [Inv_Locations]Price_C | |||

| U | [Inv_Locations]Price_D | #ILE | ||

| V | [Inv_Locations]Price_E | AY | [Inv_Locations]TTDB_COS | |

| W | [Inv_Locations]Price_F | AZ | [Inv_Locations]TTDB_Purch_Qty | |

| X | [Inv_Locations]Price_G | BA | [Inv_Locations]TTDB_Purch_val | |

| Y | [Inv_Locations]Price_H | BB | [Inv_Locations]TTDB_Sales_Qty | |

| Z | [Inv_Locations]Price_Exempt | BC | [Inv_Locations]TTDB_Sales_Value | |

| AA | [Inv_Locations]Fixed_Cost | BD | [Inv_Locations]TTD_COS | |

| AB | [Inv_Locations]Floor Price | BE | [Inv_Locations]TTD_Purch_Qty | |

| BF | [Inv_Locations]TTD_Purch_val | |||

| BG | [Inv_Locations]TTD_Sales_Qty | |||

| BH | [Inv_Locations]TTD_Sales_val |

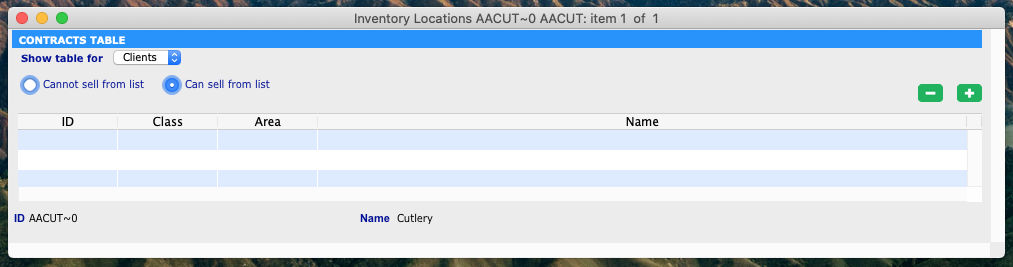

Inventory Location Contracts #ILX

Note that this gateway import function is for contracts and not Contacts!

This function will import a list of Clients or Vendors to sell to, or not to sell to.

This Contracts page may be viewed by going to Inventory > Inventory > Inventory Locations

Then select an Inventory item and select the Contracts Table Page.

| A | #ILX |

| B | [Inventory_Exclude]Inventory_ID |

| C | [Inventory_Exclude]Entry_ID |

| D | [Inventory_Exclude]Entry_type |

- Cell B – Enter in the Inventory ID.

- Cell C – Enter in the Client or Vendors ID.

- Cell D – Enter in either VE for Vendors or CL for Clients.

Sapphireone will blind import all ID’s so it would probably be better to import the Clients and Vendors in separate import files as the selection made at column D will force the table that the ID is placed in!

Once the list has been imported the user will have to select each inventory item in turn.

Then select from the Show Table for menu, either Clients or Vendors. Next select the required radio button to select either Cannot Sell/Purchase or Can Sell/Purchase as seen in the screenshot below.

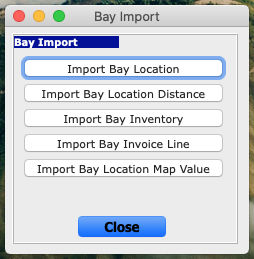

Bay Import

This function which is in Custom Tools in Utilities, allows the importing of Bay Data in to the data file. The rules are the same as for any Gateway import including the requirement that the last row in column A contains %%%% symbols to indicate end of file to the system. The file must be a Tab delineated text file.

Since this function is very specific to Bays, the syntax #??? In column A is not required as in other Gateway Import files.

When SapphireOne finds a record that is the same it will overwrite the record with the data that is in the import file that is currently being imported.There are 5 Import functions available.

| Import Bay Location | Import Bay Location Distance | ||

|---|---|---|---|

| A | Location ID (Must be valid Location ID) | A | From Bay Name |

| B | Bay Location Name | B | To Bay Name |

| C | Bay Order number (0->?) | C | Location ID (Must be a valid Location ID) |

| D | Bay Level | D | Bay Level |

| E | Start Distance | E | Distance |

Import Bay Inventory

| A | Inventory Location ID (MUST be a valid Inventory Location ID) |

| B | Bay Name (Exact) |

| C | Current Stock |

| D | Unposted stock |

| E | Allocated Stock |

| F | Priority (0 ->? Determines which bay to first use when creating an invoice) |

Import Bay Invoice Line

| A | Location ID (MUST be a valid location ID) |

| B | Inventory Sequence number |

| C | Bay Name (Exact) |

| D | $ Order Value |

| E | $ Back Order Value |

| F | Quantity (Known as Delivery or Arrival as well) |

| G | Type (E.g. OVI, PMP) |

| H | Date (format dd/mm/yyyy) |

Projects #PR?

| A | #PRA | AH | [Projects]Markup | |

| B | [Projects]ID | AI | [Projects]Est_Stock | |

| C | [Projects]Name | AJ | [Projects]Est_StockC | |

| D | [Projects]Class | AK | [Projects]BroughtForwardCost | |

| E | [Projects]Client_LK | AL | [Projects]BroughtForwardCostA | |

| F | [Projects]Address1 | AM | [Projects]BroughtForwardCharge | |

| G | [Projects]Address2 | |||

| H | [Projects]City | #PRD | ||

| I | [Projects]State | AN | [Projects]Fnished (See Note) | |

| J | [Projects]Zip | AO | [Projects]Actual_Finish | |

| K | [Projects]Client_Order | AP | [Projects]Tag (On Details Page) | |

| L | [Projects]Client_Proj_No | |||

| M | [Projects]Contact1 | A | #PRX | |

| N | [Projects]Phone1 | B | [Projects]ID | |

| O | [Projects]Project_Brief | C | [Projects]Alpha_1_20 | |

| D | [Projects]Alpha_2_20 | |||

| #PRB | E | [Projects]Alpha_3_20 | ||

| P | [Projects]Delivery1 | F | [Projects]Alpha_4_20 | |

| Q | [Projects]Delivery2 | G | [Projects]Alpha_5_40 | |

| R | [Projects]DCity | H | [Projects]Alpha_6_40 | |

| S | [Projects]DState | I | [Projects]Alpha_7_60 | |

| T | [Projects]DZip | J | [Projects]Alpha_8_80 | |

| U | [Projects]Contact2 | K | [Projects]Real_1 | |

| V | [Projects]Phone2 | L | [Projects]Real_2 | |

| W | [Projects]Start_Date | M | [Projects]Real_3 | |

| X | [Projects]Estimated_Finis | N | [Projects]Real_4 | |

| Y | [Projects]Quoted | O | [Projects]Real_5 | |

| Z | [Projects]Quote_no | P | [Projects]Real_6 | |

| AA | [Projects]Quote_Date | Q | [Projects]Real_7 | |

| AB | [Projects]Quoted_Value | R | [Projects]Date_1 | |

| AC | [Projects]Notes | S | [Projects]Date_2 | |

| T | [Projects]Date_3 | |||

| #PRC | U | [Projects]Date_4 | ||

| AD | [Projects]Est_Disburse | V | [Projects]Time_1 | |

| AE | [Projects]Est_DisburseC | W | [Projects]Time_2 | |

| AF | [Projects]Est_Disburse_Charge | X | [Projects]Text_1 | |

| AG | [Projects]Est_Expenses | Y | [Projects]Text_2 |

- For the above items, each new code extends the code above, unless otherwise stated.

- #PRD AN Cell – Enter the numbers as follows, 1 = Finished, 2 = Hold and 3 = Active.

- #PRD AO Cell – On the Details Page it is the actual finish Date for the Project

- #PRD AP Cell – On the Details Page it is the ta1 heading.

Resource #RA

| A | #RA | G | [Resource]Cost/Unit | |

| B | [ResourceID | H | [Resource]Charge/Unit | |

| C | [Resource]Name | I | [Resource]Charge_FX | |

| D | [Resource]Activity_ID | J | [Resource]Units | |

| E | [Resource]Activity_Name | K | [Resource]Transfer | |

| F | [Resource]Allowance_ID |

When the word, SAPCLEAR is into column D Activity_ID field, SapphireOne will Delete all Activities currently set-up in the Resource as listed in cell B when the file is imported into the system.

Build #BU

| A | #BU |

| B | [BillMaterials]Link_ID |

| C | [BillMaterials]ID |

| D | [BillMaterials]Notes |

| E | [BillMaterials]Quantity |

Comments for the #BU table

- B Cell – The Link ID is the Base Inventory ID of the component inventory.

- C Cell – The ID is the base inventory ID of the Master Inventory item.

| Component Inventory #BUR | |

|---|---|

| A | #BUR |

| B | [BillMaterials]Link_ID |

| C | [BillMaterials]ID |

| D | [BillMaterials]Quantity |

| E | [BillMaterials]Notes |

| Master Inventory #BUR | |

|---|---|

| A | #BUR |

| B | [BillMaterials]Link_ID |

| C | [BillMaterials]ID |

| D | [Build]Quantity Markup quantity |

| E | Leave blank |

Comments for #BUR

- Master Inventory – Importing the master line will delete existing Bill of materials and update the mark-up quantity.

- Components Inventory – Importing the component line will add the line to the bill of materials.

The difference between #BU and #BUR are as follows:

- #BU – Using this syntax does not update the line if the line already exists.

- #BUR – This syntax requires the creation of the master item for new inventory. (eg a #BUR line with both ID and Link_ID to be the master inventory item)

Examples

In the following example, the bill of materials for KITPACKB will be deleted and the lines for AUTOBATCHB will be added to the existing bill of materials.

| #BUR | KITPACKB | KITPACKB | 2 | x |

| #BUR | KITPACKB | FLIGHTB | 4 | x |

| #BUR | KITPACKB | AASILB | 6 | x |

| #BUR | AUTOBATCHB | FFOVEB | 1 | x |

| #BUR | AUTOBATCHB | DWADLB | 2 | x |

| %%%% |

Using #BUR syntax will result in an empty bill of materials for KITPACKB.

| #BUR | KITPACKB | FLIGHTB | 4 | x |

| #BUR | KITPACKB | AASILB | 6 | x |

| #BUR | KITPACKB | KITPACKB | 2 | x |

| %%%% |

Transactions(#TR?)

The next files are transaction types, which have a header, and then allow for the inclusion of multiple detail lines, which are repeated until completed. These templates are unusual as the additional templates add additional functionality from cell N and not cell A as follows.

- #TR – This template ends at cell S and note again cell S. Other tables listed below overlap and start from cell N ignoring cells N to cell S when the #TR syntax is used.

- #TRA – This template carries on from cell N to Cell U inclusive.

- #TRB – This template carries on from cell N to cell V inclusive.

- #TRC – This template carries on from cell N to cell Z inclusive.

- #TRQ – This template carries on from cell N all the way to cell AFinclusive.

| A | #TR |

| B | [Transactions]Sequence **Overridden |

| C | [Transactions]Depart |

| D | [Transactions]Type |

| E | [Transactions]Period **Overridden, based upon the date in. |

| F | [Transactions]Date_In |

| G | [Transactions]Internal_Ref |

| H | [Transactions]External_Ref |

Note that I and J below follow H from above. Cells I & J will alter depending on the Type of transaction being imported at Cell D for these seven transaction types, GJ, MR, MP,C@, CR, VQ, and VP.

Please leave cells I and J blank for any other type of transaction.

| [Transactions]Type = GJ | |

| I | Leave Blank |

| J | Leave Blank |

| [Transactions]Type = MR | |

| I | Leave Blank |

| J | [Transactions]Bank_LK |

| [Transactions]Type = MP | |

| I | Leave Blank |

| J | [Transactions]Bank_LK |

| [Transactions]Type = C@ | |

| I | [Transactions]Client_LK |

| J | Leave Blank |

| [Transactions]Type = CR | |

| I | [Transactions]Client_LK |

| J | [Transactions]Bank_LK |

| [Transactions]Type = V@ | |

| I | [Transactions]Vendor_LK |

| J | Leave Blank |

| [Transactions]Type = VP | |

| I | [Transactions]Vendor_LK |

| J | [Transactions]Bank_LK |

| Everything Else ?? | |

| I | Leave Blank |

| J | Leave Blank |

Cell K follows cell J above.

| K | [Transactions]Notes |

| L | [Transactions]Drawer |

| M | [Transactions]Total |

When the #TR syntax is used SapphireOne will continue to read or write from cell N through to cell S as seen in the table below.

| #TR | Carries on from cell M when the #TR syntax is used. | |||

| N | [Transactions]Breakdown’GL_LK | Q | [Transactions]Breakdown’Tax_Code | |

| O | [Transactions]Breakdown’Project_LK | R | [Transactions]Breakdown’Tax | |

| P | [Transactions]Breakdown’Amount | S | [Transactions]Breakdown’Total |

When the #TRA, #TRB, #TRC and #TRQ syntaxes are used, SapphireOne will append these items commencing at cell N for these tables as seen below.

| #TRA | #TRB | |||

| N | [Transactions]Bank | N | [Transactions]Bank | |

| O | [Transactions]Branch | O | [Transactions]Branch | |

| P | [Transactions]Breakdown’GL_LK | P | [Transactions]Date_Due | |

| Q | [Transactions]Breakdown’Project_LK | Q | [Transactions]Breakdown’GL_LK | |

| R | [Transactions]Breakdown’Amount | R | [Transactions]Breakdown’Project_LK | |

| S | [Transactions]Breakdown’Tax_Code | S | [Transactions]Breakdown’Amount | |

| T | [Transactions]Breakdown’Tax | T | [Transactions]Breakdown’Tax_Code | |

| U | [Transactions]Breakdown’Total | U | [Transactions]Breakdown’Tax | |

| V | [Transactions]Breakdown’Total | |||

| #TRC | #TRQ | |||

| N | [Transactions]Bank | N | [Transactions]Bank | |

| O | [Transactions]Branch | O | [Transactions]Branch | |

| P | [Transactions]Date_Due | P | [Transactions]Date Due | |

| Q | [Transactions]Discount_Per | Q | [Transactions]Discount_Per | |

| R | [Transactions]Discount_Days | R | [Transactions]Discount_Days | |

| S | [Transactions]Expiry_Date | S | [Transactions]Expiry_Date | |

| T | [Transactions]Finance_Per | T | [Transactions]Finance_Per | |

| U | [Transactions]Breakdown’GL_LK | U | [Transactions]TRA1 | |

| V | [Transactions]Breakdown’Project_LK | V | [Transactions]TRA2 | |

| W | [Transactions]Breakdown’Amount | W | [Transactions]TRA3 | |

| X | [Transactions]Breakdown’Tax_Code | X | [Transactions]Breakdown’GL_LK | |

| Y | [Transactions]Breakdown’Tax | Y | [Transactions]Breakdown’Project_LK | |

| Z | [Transactions]Breakdown’Total | Z | [Transactions]Breakdown’Amount | |

| AA | [Transactions]Breakdown’Tax_Code | |||

| AB | [Transactions]Breakdown’Tax | |||

| AC | [Transactions]Breakdown’Total | |||

| AD | [Transactions]Breakdown’Retention Perce | |||

| AE | [Transactions]Breakdown’TRBalpha_1_35 | |||

| AF | [Transactions]Breakdown’TRBReal_1 |

For the #TR table previously, and the #TRA, #TRB, #TRC, and #TRQ, tables above, the detail lines in the table below are already included.

However, they are displayed below to indicate that they are detail lines, and that they are repeated until end of line (Packet). E.g. for #TR, the spreadsheet columns will run as follows:

(N O P Q R S), (T U V W X Y), (Z AA AB AC AD AE). You would continue repeating across the spreadsheet for each additional line in the transaction. For #TRA repeating the 6 columns starts at P, for #TRB at Q and so on.

| #TR | #TRA | #TRB | #TRC | #TRQ | |

| N | P | Q | U | X | [Transactions]Breakdown’GL_LK |

| O | Q | R | V | Y | [Transactions]Breakdown’Project_LK |

| P | R | S | W | Z | [Transactions]Breakdown’Amount |

| Q | S | T | X | AA | [Transactions]Breakdown’Tax_Code |

| R | T | U | Y | AB | [Transactions]Breakdown’Tax |

| S | U | V | Z | AC | [Transactions]Breakdown’Total |

General Ledger Journals – GJ’s. If value in amount, this becomes the debit figure, or the Total figure becomes the credit figure. * If period is negative then this period is used, or the system will override the period based upon the transaction date.

Invoices #IV?- API Gateway Tables

Cells E and G will change depending on the Type of transaction being imported.

Also note that they are not consecutiove.

#IV is the only table that ends at cell AL and is used when there is a single line in transaction/s. This is provided for with the cells from AD to AL. For multiple lines in transactions use the #IVJ syntax which is documented later in this article under the heading on vertical importing.

| A | #IV |

| B | [Invoices]Sequence |

| C | [Invoices]FX_Type |

| D | [Invoices]FX_Rate |

| E | [Invoices]Type See beow! |

| F | [Invoices]Period |

| Where: E & G are as follows | |

| E | [Invoices]Type = SCI |

| G | [Invoices]Client_LK |

| E | [Invoices]Type = SCC |

| G | [Invoices]Client_LK |

| E | [Invoices]Type = SMR |

| G | Blank |

| E | [Invoices]Type = SMP |

| G | Blank |

| E | [Invoices]Type = PVI |

| G | [Invoices]Vendor_LK |

| E | [Invoices]Type = PVC |

| G | [Invoices]Vendor_LK |

| E | [Invoices]Type = PMR |

| G | Blank |

| E | [Invoices]Type = PMP |

| G | Blank |

| E | [Invoices]Type = JCI |

| G | [Invoices]Client_LK |

| E | [Invoices]Type = JCC |

| G | [Invoices]Client_LK |

| E | [Invoices]Type = AGJ |

| G | Blank |

| E | [Invoices]Type = JGJ |

| G | Blank |

| E | [Invoices]Type = WGJ |

| G | Blank |

| H | [Invoices]Internal Ref |

| I | [Invoices]External Ref |

| J | [Invoices]Date In |

| K | [Invoices]Date Due |

| L | [Invoices]Delivery Date |

| M | [Invoices]Tax code |

| N | [Invoices]Tax rate |

| O | [Invoices]Mailing Address |

| P | [Invoices]Mailing State |

| Q | [Invoices]Mailing Zip |

| R | [Invoices]Delivery Addres |

| S | [Invoices]Delivery State |

| T | [Invoices]Delivery Zip |

| U | [Invoices]Delivery Instructions |

| V | [Invoices]Bank |

| W | [Invoices]Branch |

| X | [Invoices]Drawer |

| Y | [Invoices]Text |

| Z | [Invoices]Footer |

| AA | [Invoices]Bank_LK |

| AB | [Invoices]Sales Rep |

| AC | [Invoices]AreaAC |

| There must only be a single line in Invoice. | |

| AD | [Invoices]Stock Breakdown’Inventory ID |

| AE | [Invoices]Stock_Breakdown’Project_ID |

| AF | [Invoices]Stock_Breakdown’Description |

| AG | [Invoices]Stock_Breakdown’Quantity |

| AH | [Invoices]Stock_Breakdown’Rate |

| AI | [Invoices]Stock_Breakdown’Discount_Code |

| AJ | [Invoices]Stock_Breakdown’Discount_Percen |

| AK | [Invoices]Stock_Breakdown’Tax_code |

| AL | [Invoices]Stock_Breakdown’Tax_Rate |

| AD to AL are not used for #IVJ |

These tables follow on from #IV after AC in the table above and not after AL.

| #IVA | |||

| AD | [Invoices]Discount Percentage | ||

| AE | [Invoices]Discount Days | ||

| AF | [Invoices]Expiry Date | ||

| AG | [Invoices]Finance_Per | ||

| AH | [Invoices]contact link | ||

| AI | [Invoices]Stock Breakdown’Inventory | ||

| AJ | [Invoices]Stock_Breakdown’Project | ||

| AK | [Invoices]Stock_Breakdown’Description | ||

| AL | [Invoices]Stock_Breakdown’Quantity | ||

| AM | [Invoices]Stock_Breakdown’Rate | ||

| AN | [Invoices]Stock_Breakdown’Discount_Code | ||

| AO | [Invoices]Stock_Breakdown’Discount_Percen | ||

| AP | [Invoices]Stock_Breakdown’Tax_code | ||

| AQ | [Invoices]Stock_Breakdown’Tax_Rate | ||

| AR | [Invoices]Stock_Breakdown’Ordered | ||

| AS | [Invoices]Stock_Breakdown’Backordered | ||

| #IVB | |||

| AD | [Invoices]Discount Percentage | ||

| AE | [Invoices]Discount Days | ||

| AF | [Invoices]Expiry Date | ||

| AG | [Invoices]Finance_Per | ||

| AH | [Invoices]contact link | ||

| AI | [Invoices]Stock Breakdown’Inventory | ||

| AJ | [Invoices]Stock_Breakdown’Project | ||

| AK | [Invoices]Stock_Breakdown’Description | ||

| AL | [Invoices]Stock_Breakdown’Quantity | ||

| AM | [Invoices]Stock_Breakdown’Rate | ||

| AN | [Invoices]Stock_Breakdown’Discount_Code | ||

| AO | [Invoices]Stock_Breakdown’Discount_Percen | ||

| AP | [Invoices]Stock_Breakdown’Tax_code | ||

| AQ | [Invoices]Stock_Breakdown’Tax_Rate | ||

| AR | [Invoices]Stock_Breakdown’Ordered | ||

| AS | [Invoices]Stock_Breakdown’Backordered | ||

| AT | [Invoices]Stock_Breakdown’NewRate | ||

| AU | [Invoices]Stock_Breakdown’Amount | ||

| AV | [Invoices]Stock_Breakdown’Tax | ||

| AW | [Invoices]Stock_Breakdown’Total |

| #IVC | |

| AD | [Invoices]discount percentage |

| AE | [Invoices]discount days |

| AF | [Invoices]expiry date |

| AG | [Invoices]finance_per |

| AH | [Invoices]contact link |

| AI | [Invoices]Stock Breakdown’Inventory |

| AJ | [Invoices]Stock_Breakdown’Project |

| AK | [Invoices]Stock_Breakdown’Description |

| AL | [Invoices]Stock_Breakdown’Quantity |

| AM | [Invoices]Stock_Breakdown’Rate |

| AN | [Invoices]Stock_Breakdown’Discount_Code |

| AO | [Invoices]Stock_Breakdown’Discount_Percen |

| AP | [Invoices]Stock_Breakdown’Tax_code |

| AQ | [Invoices]Stock_Breakdown’Tax_Rate |

| AR | [Invoices]Stock_Breakdown’ordered |

| AS | [Invoices]Stock_Breakdown’back ordered |

| AT | [Invoices]Stock_Breakdown’NewRate |

| AU | [Invoices]Stock_Breakdown’amount |

| AV | [Invoices]Stock_Breakdown’tax |

| AW | [Invoices]Stock_Breakdown’total |

| AX | [Invoices]Stock_Breakdown’GL |

| #IVQ | AS | [Invoices]Stock_Breakdown’Description | ||

| AD | [Invoices]Discount Percentage | AT | [Invoices]Stock_Breakdown’Quantity | |

| AE | [Invoices]Discount Days | AU | [Invoices]Stock_Breakdown’Rate | |

| AF | [Invoices]Expiry Date | AV | [Invoices]Stock_Breakdown’Discount_Code | |

| AG | [Invoices]Finance_Per | AW | [Invoices]Stock_Breakdown’Discount_Percen | |

| AH | [Invoices]IVAlpha1_20 | AX | [Invoices]Stock_Breakdown’Tax_code | |

| AI | [Invoices]IVAlpha2_20 | AY | [Invoices]Stock_Breakdown’Tax_Rate | |

| AJ | [Invoices]IVAlpha3_30 | AZ | [Invoices]Stock_Breakdown’Ordered | |

| AK | [Invoices]IVAlpha4_30 | BA | [Invoices]Stock_Breakdown’Backordered | |

| AL | [Invoices]IVAlpha5_10 | BB | [Invoices]Stock_Breakdown’IVBAlpha1_20 | |

| AM | [Invoices]IVReal1 | BC | [Invoices]Stock_Breakdown’IVBAlpha2_20 | |

| AN | [Invoices]IVReal2 | BD | [Invoices]Stock_Breakdown’IVBAlpha3_30 | |

| AO | [Invoices]IVDate1 | BE | [Invoices]Stock_Breakdown’IVBAlpha4_30 | |

| AP | [Invoices]IVDate2 | BF | [Invoices]Stock_Breakdown’IVBAlpha5_10 | |

| AQ | [Invoices]Stock Breakdown’Inventory | BG | [Invoices]Stock_Breakdown’IVBReal1 | |

| AR | [Invoices]Stock_Breakdown’Project | BH | [Invoices]Stock_Breakdown’IVBDate1 | |

| BI | [Invoices]Stock_Breakdown’Retent |

Vertical Importing #IVJ – API Gateway Table

Vertical Importing of invoice line items is now supported. For single line invoices #IV may be used and the format for #IVJ follows this format through to cell AC.

By using #IVJ multiple lines for each invoice may be entered. SapphireOne will only stop writing lines into the current invoice when ^^^^ has been entered into cell T in the spreadsheet.

System Procedure:

- Correct Syntax – The syntax for this vertical import function is #IVJ which uses a combination of #IV and #IVJ as seen previously and below. This import function will contain 2 types of data. Invoice details and Line entry details.

- Invoice Details – These details are read from Cell A the cell containg the syntax through to cell AC. At this point it stops and looks to the next row expecting to find a valid Inventory ID in cell A.

- Line Details – SapphireOne expects to find an Inventory ID in cell A with additional details for the first line in the invoice ending with cell S.

- End of Invoice – It then looks to see if there are ^^^^ symbols in Cell T.

- Cell T – If this cell does not have ^^^^, SapphireOne will return to cell A on the next line looking for a valid Inventory ID and enter this as the second line in the invoice. It will then continue to repeat reading from Cell A to cell S entering a line for each line in the spreadsheet and checking the status of cell T for each line.

- End of Invoice – Once SapphireOne sees ^^^^ in column T, it closes of the current Invoice and goes to the next line in the template and expects to see the #IVJ syntax.

- Next Invoice – If the #IVJ syntax is on the next line it will commence the procedure for the next invoice from thre first sep in this list above.

- End of Invoice – The system uses the #IV chart on a previous page and reads all the way across to column AC. This gives it all of the information it needs about the transaction apart from the actual inventory lines in the transaction.

- End of File – The last row in the spreadsheet must have %%%% symbols in column A to indicate to the system that it has reached the end of the import file.

Invoice Lines #IVJ

Unlike other spreadsheets in gateway a number of columns actually perform two functions during this import. Also, unlike other import functions in gateway the first column does not require the instruction of #IVJ as it is assumed by the SapphireOne. Column A must contain the inventory ID as seen below and not have #IVJ in cell A as in all other import files.

#IVJ

| A | I[nvoices]Stock Breakdown’Inventory_ID | K | [Invoices]Stock_Breakdown’Backordered | |

| B | [Invoices]Stock_Breakdown’Project_ID | L | [Invoices]Stock_Breakdown’IVBAlpha1_20 | |

| C | [Invoices]Stock_Breakdown’Description | M | [Invoices]Stock_Breakdown’IVBAlpha2_20 | |

| D | [Invoices]Stock_Breakdown’Quantity | N | [Invoices]Stock_Breakdown’IVBAlpha3_30 | |

| E | [Invoices]Stock_Breakdown’Rate | O | [Invoices]Stock_Breakdown’IVBAlpha4_30 | |

| F | [Invoices]Stock_Breakdown’Discount_Code | P | [Invoices]Stock_Breakdown’IVBAlpha5_10 | |

| G | [Invoices]Stock_Breakdown’Discount_Percen | Q | [Invoices]Stock_Breakdown’IVBReal1 | |

| H | [Invoices]Stock_Breakdown’Tax_code | R | [Invoices]Stock_Breakdown’IVBDate1 | |

| I | [Invoices]Stock_Breakdown’Tax_Rate | S | [Invoices]Stock_Breakdown’Retent | |

| J | [Invoices]Stock_Breakdown’Ordered | T | [Invoices] ^^^^ Last Line item Indicator |

If you have a multi-line invoice the last line is terminated with a “^^^^” (shift-6, excluding quotations) in cell T which is the last column as seen above.

If you enter the characters PB into the rate field for an IVJ import, price book is looked up and the rate is calculated accordingly.

Periodic Invoices #PER – API Gateway Tables

This gateway function will import or export Periodic Invoices into the system.

The actual period is set by a number entered into column E as follows.

| A | #PER |

| B | [PerInvoice]Sequence_Number |

| C | [PerInvoice]End_Date |

| D | [PerInvoice]Internal-Ref_Number |

| E | [PerInvoice]Period. 1 = Weekly, 2 = Fortnightly, 3 = Monthly and 4 = Daily |

| F | [PerInvoice]Client_ID |

| G | [PerInvoice]Amount |

| H | [PerInvoice]Tax |

| I | [PerInvoice]Total |

Serial Number’s #SN and #SNA – API Gateway Tables

| A | #SN | #SNA | ||

| B | [Serial_Nºs]Serial_No | K | [Serial_Nºs]Common_ID | |

| C | [Serial_Nºs]Inventory_LK | L | [Serial_Nºs]Cost | |

| D | [Serial_Nºs]Qty | M | [Serial_Nºs]Expiry_Date | |

| E | [Serial_Nºs]Type | N | [Serial_Nºs]Period | |

| F | [Serial_Nºs]Date | O | [Serial_Nºs]Invoice_Seq **Overriden | |

| G | [Serial_Nºs]Status | P | [Serial_Nºs]Invent_Class | |

| H | [Serial_Nºs]Serial_Sequence **Overriden | |||

| I | [Serial_Nºs]Qty_Available **Overriden | |||

| J | [Serial_Nºs]Qty_Unposted |

PriceBook 2 #PB2 – API Gateway Table

| A | #PB2 | Q | [Price_book2]Min_Quantity | |

| B | [Price_book2]Reference_ID | R | [Price_book2]Max_Quantity | |

| C | [Price_book2]Inventory_Field | S | [Price_book2]Units | |

| D | [Price_book2]Inventory_FieldValue | T | [Price_book2]Ignore_Discounts | |

| E | [Price_book2]Master_Table | U | [Price_book2]Date_Start | |

| F | [Price_book2]Master_Field | V | [Price_book2]Date_Finish | |

| G | [Price_book2]Master_FieldValue | W | [Price_book2]Date_Alarm | |

| H | [Price_book2]Project_ID | X | [Price_book2]Department | |

| I | [Price_book2]Rule_Type | Y | [Price_book2]Inventory_Tag 1 | |

| J | [Price_book2]Rule_Number | Z | [Price_book2]Inventory_Tag 2 | |

| K | [Price_book2]LU_Code | AA | [Price_book2]Inventory_Tag 3 | |

| L | [Price_book2]Rate | AB | [Price_book2]Inventory_Tag 4 | |

| M | [Price_book2]Discount | AC | [Price_book2]Inventory_Tag 5 | |

| N | [Price_book2]Markup | AD | [Price_book2]Inventory_Tag 6 | |

| O | [Price_book2]Margin | AE | [Price_book2]Inventory_Ignore discount rule | |

| P | [Price_book2]Fixed_Quantity | AF | [Price_book2]NOT Used yet |

Price Book 2 Details

- Periods – If period is negative, then this period is used, else the system will override the period based upon the invoice date.

- Serial Numbers – These must appear in the next packet for linking with the invoice.

- Project ID’s – If JCI or JCC, the Project LK fields must be the same for each line as SapphireOne then copies this into the header file.

- B – This must be a Valid Unique Reference ID

- C – Enterable options are: ID CL LC (To select if it is Inventory ID, Class , Location)

- D – This must be a valid Inventory ID, Class ID or Location ID

- E – Enterable options are: C or V (To select eitherClient or Vendor).

- F –The enterable options are: ID CL ALL

- G – THis must be a valid Client ID, Vendor ID or Client Class ID, Vendor Class ID

- H – This must be a valid project ID

- I – This must be a number corresponding to the drop-down menu position in the list, 1, 2 or 3. (Note, oddly 3 is the first one at the top of the drop-down list! Test it and see).

- J – This must be a number corresponding to the drop-down menu the size of which will be determined by the selection made at I.

- K L M N O P Q R S – THese are linked to the selections made at I and J and will vary a lot.

- T – Enterable options are True Ticked or False Un-ticked. (Linked to I when number 2 is selected.

- U V W – These are entered as dates DD/MM/YY. If 00/00/00 the date is not set active.

- X – This is for a valid department ID

Contacts #CN – API Gateway Table

| A | #CN | AD | [Contacts]Phone2 | ||

| B | [Contacts]CN_ID | AE | [Contacts]Phone3 | ||

| C | [Contacts]First_Name | AF | [Contacts]Phone4 | ||

| D | [Contacts]Surname | AG | [Contacts]Email | ||

| E | [Contacts]Company | AH | [Contacts]Order | ||

| F | [Contacts]Address1 | AI | [Contacts]CNA1_20 | ||

| G | [Contacts]Address2 | AJ | [Contacts]CNA2_20 | ||

| H | [Contacts]City | AK | [Contacts]CNA3_30 | ||

| I | [Contacts]State | AL | [Contacts]CNA4_30 | ||

| J | [Contacts]Zip_Code | AM | [Contacts]CNA5_60 | ||

| K | [Contacts]Main_Phone | AN | [Contacts]CNA_6_40 | ||

| L | [Contacts]Salutation | AO | [Contacts]CNA_7_60 | ||

| M | [Contacts]Initails | AP | [Contacts]CNA_8_80 | ||

| N | [Contacts]Class | AQ | [Contacts]CNDate1 | ||

| O | [Contacts]Physical_1 | AR | [Contacts]CNDate2 | ||

| P | [Contacts]Physical_2 | AS | [Contacts]CNDate3 | ||

| Q | [Contacts]Physical_3 | AT | [Contacts]CN_Date4 | ||

| R | [Contacts]Physical_4 | AU | [Contacts]CNReal1 | ||

| S | [Contacts]List_Name | AV | [Contacts]CNReal2 | ||

| T | [Contacts]Al_Date | AW | [Contacts]CNReal3 | ||

| U | [Contacts]Last_Date | AX | [Contacts]CNReal4 | ||

| V | [Contacts]Area_LK | AY | [Contacts]CNReal5 | ||

| W | [Contacts]Type_Link_ID | AZ | [Contacts]CNReal6 | ||

| X | [Contacts]Active | BA | [Contacts]CNReal7 | ||

| Y | [Contacts]MailOut | BB | [Contacts]CNReal8 | ||

| Z | [Contacts]GenderIsMale | BC | [Contacts]CNText | ||

| AA | [Contacts]MobilePhone | BD | [Contacts]CNtext2 | ||

| AB | [Contacts]HomePhone | BE | [Contacts]CNTime1 | ||

| AC | [Contacts]Fax_No | BF | [Contacts]CNTime2 |

Comments:

To link these Contacts to the appropriate Client you will have to first Import all of the Clients. Then enter in the Client that they are to be associated with at column W Client ID in the above spreadsheet.

To complete the linking the CL_Type will have to be set at CLLink using an applied formula.

To link these Contacts to the appropriate Vendor you will have to first Import all of the Vendors. Then enter in the Vendor that they are to be associated with at column W Client ID in the above spreadsheet. To complete the linking the VE_Type will have to be set at VELink using an applied formula.

Note: data entry for cell Z, EmployeesIsMale is no longer entered as true or false as we now have 3 options as follows: 0 not given, 1 Male and 2 Female.

Timesheets #RS – API Gateway Table

| A | #RS | |||

| B | [Times]Sequence | G | [Times]Internal_Ref | |

| C | [Times]Type | H | [Times]Date_In | |

| D | [Times]Period | I | [Times]Start_Date | |

| E | [Times]Resource_LK | J | [Times]Fin_Date | |

| F | [Times]Project_LK | K | [Times]Memo |

Sublines (Repeat until end of line (packet))

| L | [Times]Sublines’Resource LK | #RSA | ||

| M | [Times]Sublines’Project LK | U | [Times]Sublines’TLAlpha_20 | |

| N | [Times]Sublines’Date | V | [Times]Sublines’TLReal | |

| O | [Times]Sublines’Hours | |||

| P | [Times]Sublines’Rate | |||

| Q | [Times]Sublines’Amount | |||

| R | [Times]Sublines’Activity LK | |||

| S | [Times]Sublines’Cost | |||

| T | [Times]Sublines’Act Description |

Comments

- C Cell – [Times]Type Either RS = Resource or PR = Project.

- D Cell – [Times]Period Leave blank if you want it to be the current period.

- H Cell – [Times]Date_In (Format is YYYYMMDD) (E.g. 20070428 is 28 April 2007).

Resources: #RR All fields Refer to the field listing for the names and order of the fields.

Diary: #DL ll fields Refer to the field listing for the names and order of the fields.

Thin 1-5:

#TH1 All fields Refer to the field listing for the names and order of the fields.

#TH2 All fields Refer to the field listing for the names and order of the fields.

#TH3 All fields Refer to the field listing for the names and order of the fields.

#TH4 All fields Refer to the field listing for the names and order of the fields.

#TH5 All fields Refer to the field listing for the names and order of the fields.

Award #AW? – API Gateway Table

Comments

#AWR and #AWT are very simple 1 and 2 cell tables both of which begin with cell A.

#AWA, #AWB and #AWC is the one table commencing with cell A.

| A | #AWR | #AWB | ||

| B | [Award]ID | W | [Award]UseLeave | |

| C | [[Award]Description | X | [Award]HourlyDailyhol | |

| Y | [Award]LLFirstyear | |||

| A | #AWT | Z | [Award]Hol1 | |

| B | [Award]ID | AA | [Award]Hol2 | |

| AB | [Award]Hol3 | |||

| A | #AWA | AC | [Award]Hol4 | |

| B | [Award]ID | AD | [Award]Hol5 | |

| C | [[Award]Description | AE | [Award]HolidayAnni | |

| D | [Award]Sal1 | AF | [Award]HolidayAnniDate | |

| E | [Award]Sal2 | AG | [Award]ResetLeave | |

| F | [Award]Sal3 | AH | [Award]AccumHoliday | |

| G | [Award]Time1 | AI | [Award]Sick1 | |

| H | [Award]Time2 | AJ | [Award]Sick2 | |

| I | [Award]Time3 | AK | [Award]Sick3 | |

| J | [Award]UseRDO | AL | [Award]Sick4 | |

| K | [Award]RDOTrigger | AM | [Award]Sick5 | |

| L | [Award]RDOPerc | AN | [Award]SickAnni | |

| M | [Award]RDOAuto | AO | [Award]SickAnniDate | |

| N | [Award]RDOMax | AP | [Award]ResetSick | |

| O | [Award]RDOtrigperc | AQ | [Award]Usesetsick | |

| P | [Award]SuperRate | |||

| Q | [Award]SuperFixed | #AWC | ||

| R | [Award]ExemptionMin | AR | [Award]LSL1 | |

| S | [Award]SuperCPer | AS | [Award]LSL2 | |

| T | [Award]SuperCFixed | AT | [Award]LSL3 | |

| U | [Award]WorkCPer | AU | [Award]LSLAnni | |

| V | [Award]WorkCFixed | AV | [Award]LSLAnniDate | |

| AW | [Award]Deferred1 | |||

| AX | [Award]Deferred2 | |||

| AY | [Award]Deferred3 | |||

| AZ | [Award]Deferred4 | |||

| BA | [Award]Deferred5 | |||

| BB | [Award]Deferred6 | |||

| BC | [Award]Deferred7 | |||

| BD | [Award]AccumLSL |

Employee Payroll #EM? – API Gateway Table

#EMR and #EMT are very simple tables both of which begin with Cell A.

#EMA, #EMB, #EMC, #EMD, #EME, #EMF and #EMX are all the one very long table commencing with cell A. Select the read or write option carefully as the last couple of options will make the reading or writing spreadsheet very wide across to cell GR.

| A | #EMR | AE | [Employees]RoundDown | |

| B | [Employees]Code | AF | [Employees]LLAllow | |

| C | [Employees]Surname | AG | [Employees]Apprentice | |

| AH | [Employees]QuickPay | |||

| A | #EMT | AI | [Employees]Start_Date | |

| B | [Employees]Code | AJ | [Employees]Finish_Date | |

| AK | [Employees]Review_Date | |||

| A | #EMA | AL | [Employees]Paid_to_date | |

| B | [Employees]Code | AM | [Employees]Lastpaid | |

| C | [Employees]Surname | AN | [Employees]BSB1 | |

| D | [Employees]First_Names | AO | [Employees]BSB2 | |

| E | [Employees]Title | AP | [Employees]BSB3 | |

| F | [Employees]Job_Title | AQ | [Employees]BSB4 | |

| G | [Employees]Class | AR | [Employees]Bank1 | |

| H | [Employees]Department | AS | [Employees]Bank2 | |

| I | [Employees]AwardLink | AT | [Employees]Bank3 | |

| J | [Employees]Address_1 | AU | [Employees]Bank4 | |

| K | [Employees]Address_2 | AV | [Employees]BankAccName1 | |

| L | [Employees]Suburb | AW | [Employees]BankAccName2 | |

| M | [Employees]State | AX | [Employees]BankAccName3 | |

| N | [Employees]Zip | AY | [Employees]BankAccName4 | |

| O | [Employees]Country | AZ | [Employees]BankCode1 | |

| P | [Employees]Phone | BA | [Employees]BankCode2 | |

| Q | [Employees]MbPhone | BB | [Employees]BankCode3 | |

| R | [Employees]Email | BC | [Employees]BankCode4 | |

| S | [Employees]Date_of_Birth | BD | [Employees]Bank1per | |

| T | [Employees]Sex | BE | [Employees]Bank2Per | |

| U | [Employees]Next_of_Kin | BF | [Employees]Bank3per | |

| V | [Employees]NKinRelation | BG | [Employees]Bank4per | |

| W | [Employees]NKPhone | BH | [Employees]Cheque_per | |

| BI | [Employees]Cash_per | |||

| #EMB | BJ | [Employees]Bank1Max | ||

| X | [Employees]RDOtrigperc | BK | [Employees]Bank2Max | |

| Y | [Employees]RDOTrigger | BL | [Employees]Bank3Max | |

| Z | [Employees]RDOPerc | BM | [Employees]Bank4Max | |

| AA | [Employees]RDOMax | BN | [Employees]Cheque_Max | |

| AB | [Employees]RDOOwed | BO | [Employees]Cash_Max | |

| AC | [Employees]RDOAuto | BP | [Employees]Notes | |

| AD | [Employees]GcertDedName |

Employees Headers

- [Employees]Code: The unique identifier or code for the employee within SapphireOne.

- [Employees]Surname: The employee’s last name.

- [Employees]First_Names: The employee’s given names.

- [Employees]Title: The title or salutation of the employee (e.g., Mr., Mrs., Dr.).

- [Employees]Job_Title: The employee’s job title within your organisation.

- [Employees]Class: The classification or category of the employee’s role.

- [Employees]Department: The department in which the employee works.

- [Employees]Review_Date: The date scheduled for the employee’s next review.

- [Employees]Paid_to_date: The total amount paid to the employee up to the current date.

- [Employees]Lastpaid: The date on which the employee was last paid.

- [Employees]BSB1: The BSB number for the employee’s first bank account.

- [Employees]BSB2: The BSB number for the employee’s second bank account.

- [Employees]BSB3: The BSB number for the employee’s third bank account.

- [Employees]BSB4: The BSB number for the employee’s fourth bank account.

- [Employees]Bank1: The name of the employee’s first bank.

- [Employees]Bank2: The name of the employee’s second bank.

- [Employees]Bank3: The name of the employee’s third bank.

- [Employees]Bank4: The name of the employee’s fourth bank.

- [Employees]BankAccName1: The account name for the employee’s first bank account.

- [Employees]BankAccName2: The account name for the employee’s second bank account.

- [Employees]BankAccName3: The account name for the employee’s third bank account.

- [Employees]BankAccName4: The account name for the employee’s fourth bank account.

- [Employees]BankCode1: The bank code for the employee’s first bank account.

- [Employees]BankCode2: The bank code for the employee’s second bank account.

- [Employees]BankCode3: The bank code for the employee’s third bank account.

- [Employees]BankCode4: The bank code for the employee’s fourth bank account.

- [Employees]Bank1per: The percentage of the employee’s pay directed to the first bank account.

- [Employees]Bank2Per: The percentage of the employee’s pay directed to the second bank account.

- [Employees]Bank3per: The percentage of the employee’s pay directed to the third bank account.

- [Employees]Bank4per: The percentage of the employee’s pay directed to the fourth bank account.

- [Employees]Cheque_per: The percentage of the employee’s pay issued by cheque.

- [Employees]Cash_per: The percentage of the employee’s pay issued in cash.

- [Employees]Bank1Max: The maximum amount that can be paid into the employee’s first bank account per pay run.