SapphireOne Single Touch Payroll Phase 2 Implementation Overview

Confidentiality

All the information provided in the ‘SapphireOne Single Touch Payroll Phase 2 Implementation’ shall be confidential. All confidential information provided shall be used hereto solely for the purposes of this guideline and shall not be disclosed to any third party without the prior consent of SapphireOne – ABN 84003419930.

The preceding shall not apply to any publicly available information when provided or thereafter becomes publicly available or required to be disclosed by any regulatory authority, judicial or administrative process or otherwise by applicable law or regulation. In the same way, user names and passwords provided by SapphireOne shall remain confidential and shall not be disclosed to any third party. The trademark and other intellectual property rights, services, documentation, data, publications, and any form associated with this guideline or SapphireOne remain the sole property of SapphireOne.

Introduction

SapphireOne became Single Touch Payroll Phase 2 certified on 6 April 2022. The process for SapphireOne to become Single Touch Payroll certified was a two year development process which included being re-certified for ISO 27001. This is part of the 2019/2022 Budget Australia announced implementing Single Touch Payroll and informed all ABN holders that it would be expanded to Phase 2. The purpose of Phase 2 was to reduce the burden for employers regarding their obligations for various federal Government and Commonwealth agencies and support the administration of the Australian Social Security System.

The substantive focus of Single Touch Payroll Phase 2 is covered in the following four points:

- Pay remuneration, the income type for employees regarding whether it is salaried, wages or working holiday maker.

- The following elements that make up the components are Gross Pay, Paid Leave, Allowances, and/or Overtime.

- The amounts that the employer has withheld including PAYG.

- Information about how the calculations were performed based off of various factors such as the Tax File Number (TFN) details and the Allowance settings.

For more information you can also refer to the ATO website. The ATO website also provides a STP Phase 2 Quick Reference Guide for all payment types that you could commonly encounter during implementation.

Disaggregation of Gross Salary

In Single Touch Payroll, Gross was a singular amount. In Single Touch Payroll Phase 2, Gross is broken up into multiple amounts. Examples not included as Gross are Allowances, Overtime, Directors’ Fees, Bonuses and Commissions, and Paid Leave.

SapphireOne has automated the process of reporting Single Touch Payroll Phase 2 for the following:

- Paid parental leave

- Other paid leave

- Unused leave on termination

- Ancillary and defence leave

- Cash out of leave in service

- Workers compensation

Consideration will need to be made for the following points within your SapphireOne datafile to support STP Phase 2.

- Directors’ fees

- Commissions and bonuses

- Overtime

- Ancillary and defence leave

- Workers compensation

- Paid parental leave

- Other paid leave

- Allowances

- Lump sums

- Travel and private motor vehicle reimbursement

- Home office

- Specific task allowances

- Certification allowances

- Tool allowance

- Travel and accommodation allowances

- Award transport payments

We will now cover the specific changes you need to check and make within your SapphireOne company datafile.

Compulsory Super

Allowance needs to be filled in for every fund with the relevant superfund. For example, for Compulsory Super we will use the Allowance Super. For Payment Summary/STP Position, super must be filled in. Normally the Allowance Super is filled in with a Payment Summary Position/STP Position of Superannuation Employment contributions.

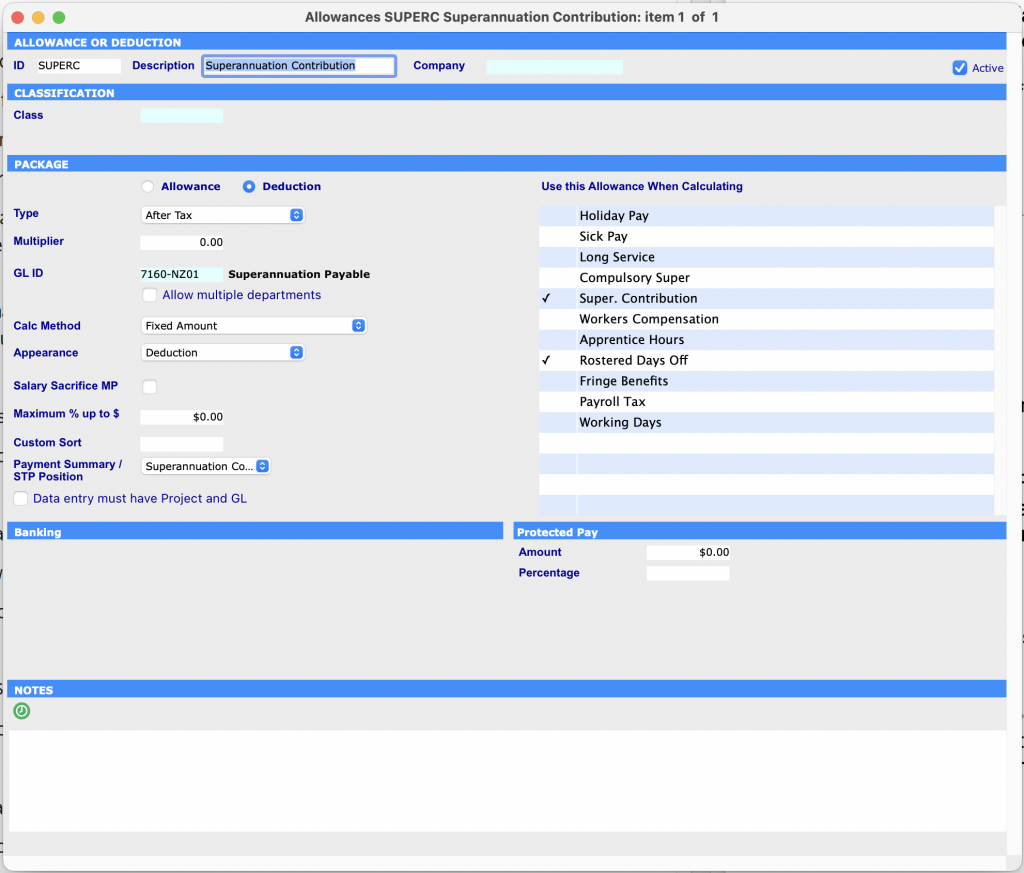

Contributory Super

Contributory Super refers to when an employee is paying additional super themselves and making additional super contributions themselves. The Allowance field will need to be filled in, for example we use SuperC. The Payment Summary Position/STP Position should be Superannuation Contributions.

Salary Sacrifice for the purpose of Superannuation

Salary Sacrifice is where an employer pays the super contributions of an employee. This is something that would normally attract Fringe Benefits Tax (FBT).

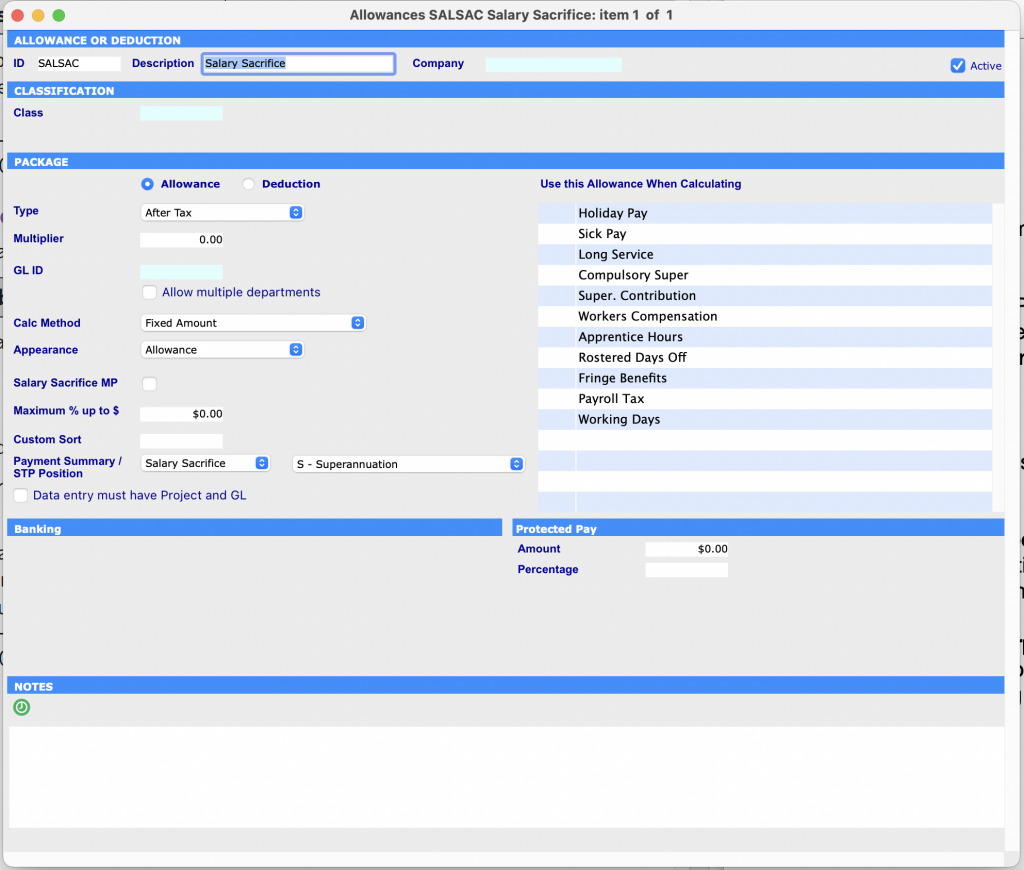

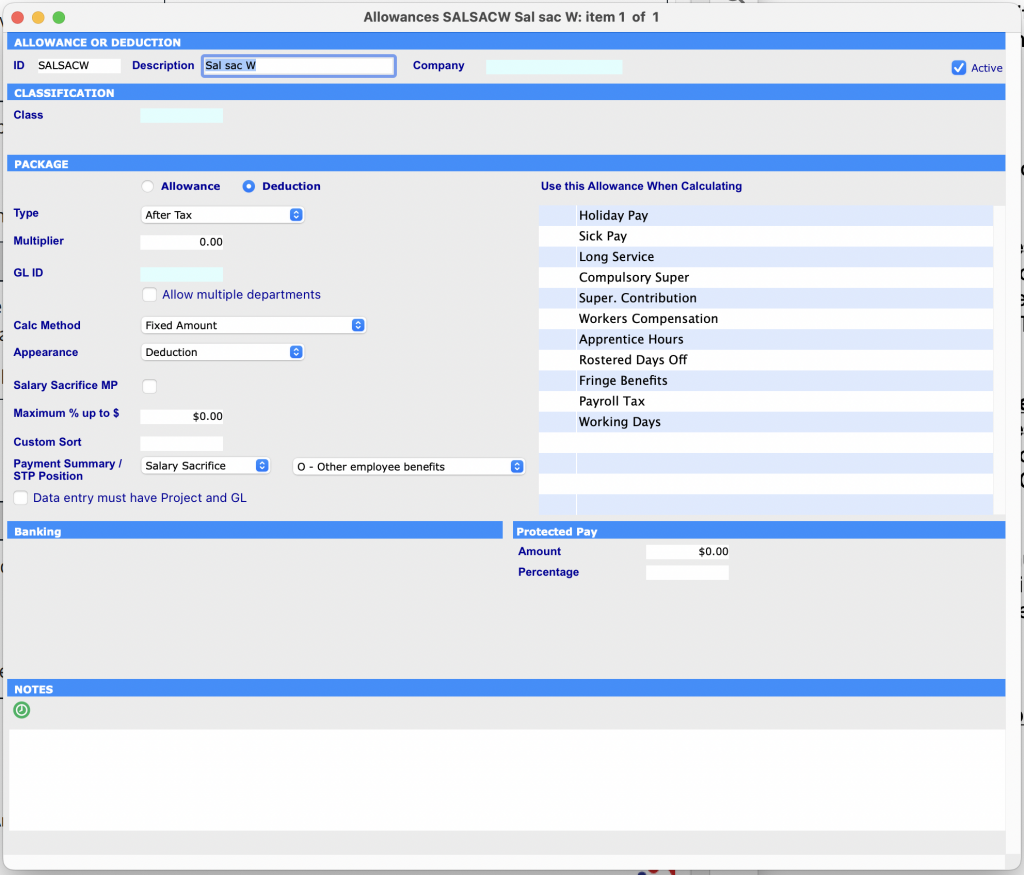

Salary Sacrifice

Allowance will need to be filled in, for example Sal Sac. The STP Position should be Salary Sacrifice. The user will need to select Superannuation from the secondary drop down menu.

There is also the provision of other examples. These other examples include:

- Recognition of skill level allowance

- Dirt and wet weather allowance

- Hire duties or supervisor allowance

- Site distraction and loyalty allowance

- Leading Hand allowance

- Inconvenience or disability allowance

- Height or danger allowance

- Hot or cold allowance

- All-purpose allowance

- Industry allowance

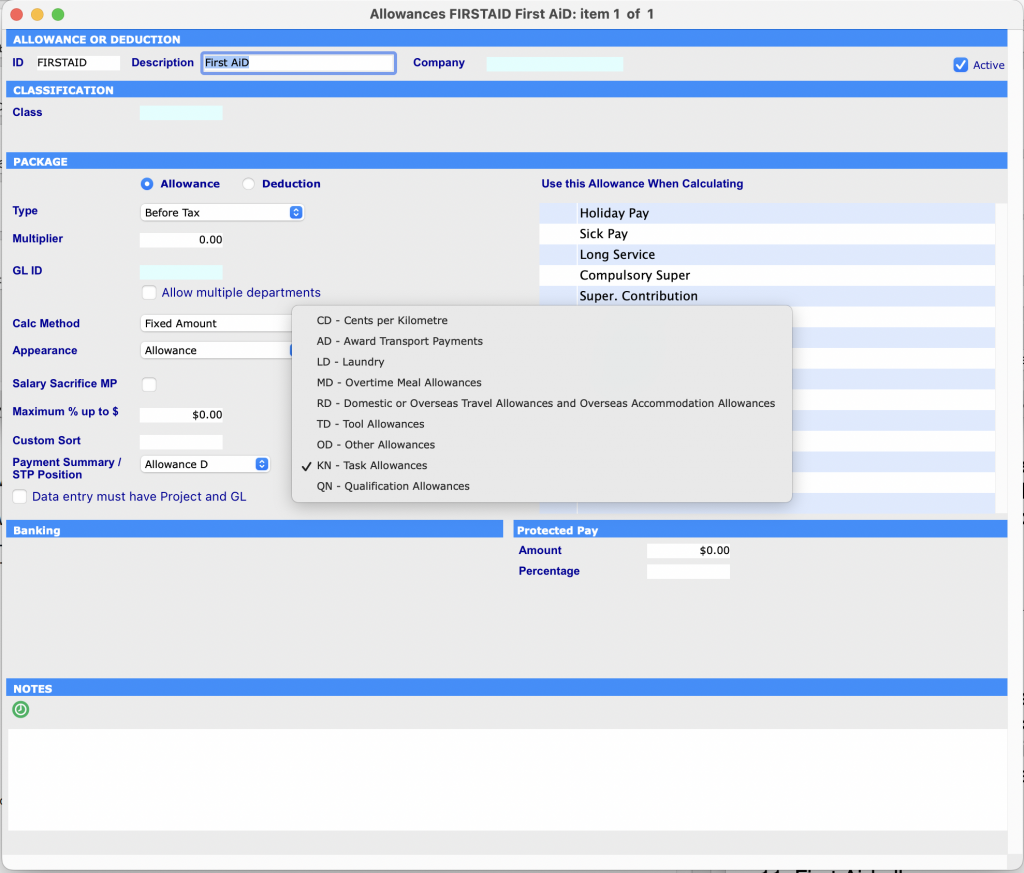

- First Aid allowance

- On call during ordinary hours allowance

Specific Task Allowances

You may previously have these set up to use one of the options on the Payment Summary Position/ STP Position such as Allowance A, B, C, D, etc. Now you will also need to select a secondary position option such as Task Allowances, Tool Allowances, etc.

Additional leave types within the Allowances page on both Company and Employee

- Directors’ fees

- Commissions and bonuses

- Overtime

- Ancillary and defence leave

- Cashing out of annual leave

- Workers compensation

- Paid parental leave

- Other paid leave

- Allowances

- Lump sums

- Travel and private motor vehicle reimbursement

- Home office

- Specific task allowances

- Certification allowances

- Tool allowance

- Travel and accommodation allowances

- Award transport payments

Ancillary or Defence Leave

Ancillary or Defence Leave refers to the type of leave an employee takes when they are engaged in a volunteer program or specific community activity. This includes volunteering or participating in Australian Defence Forces, jury duty and community or emergency services (RSPCA, State Emergency services, Country Fire Authority).

To take Ancillary Leave the SapphireOne user will mark it Type D or select Ancillary Leave.

Cash Out Leave

Cash Out of Leave refers to an employee opting to be paid out leave entitlements instead of taking that time out from work. This includes annual leave, personal leave, long service leave, leave loading and rostered days off.

To Cash Out Holiday, Long Service or Personal Leave, the SapphireOne user will select the Cash Out check box. The Australian Taxation Office (ATO) does not appear to distinguish between what leave is cashed out.

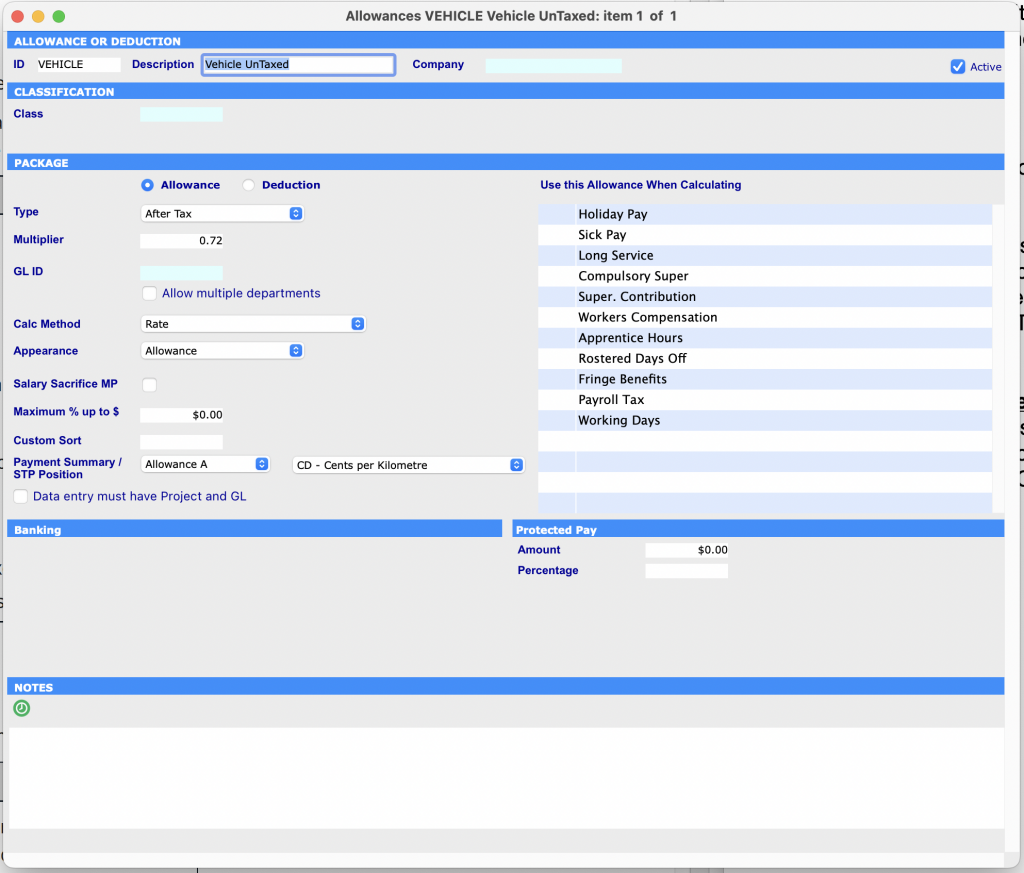

Travel and Private Motor Vehicle Reimbursement

You may previously have these set up to use one of the options on the Payment Summary Position/STP Position. You also need to select a secondary position such as Cents per Kilometre.

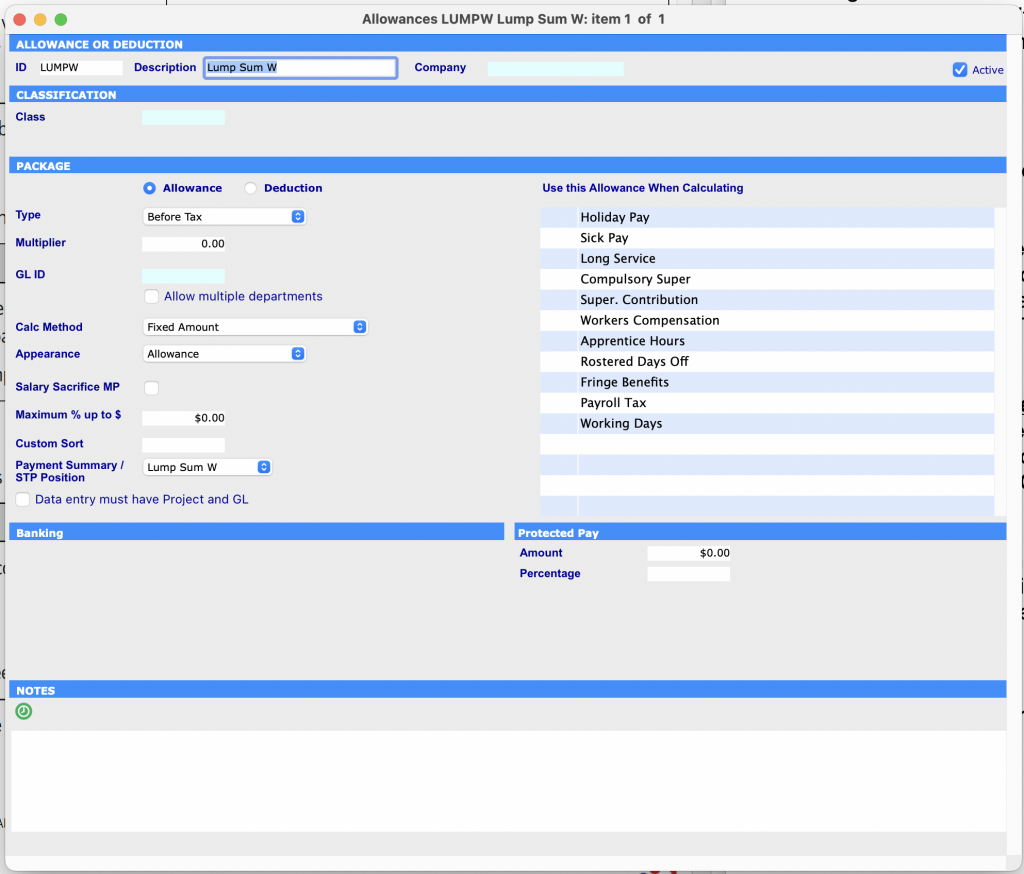

Lump Sums

You may previously have a number of Lump Sum Payment options set up within SapphireOne. We also now cover Lump Sum W, which covers bonuses involving Return to work for an existing employee.

Salary Sacrifice for other purposes besides Superannuation

You will need to select an STP Position of Salary Sacrifice and a secondary position of Other Employee Benefits.

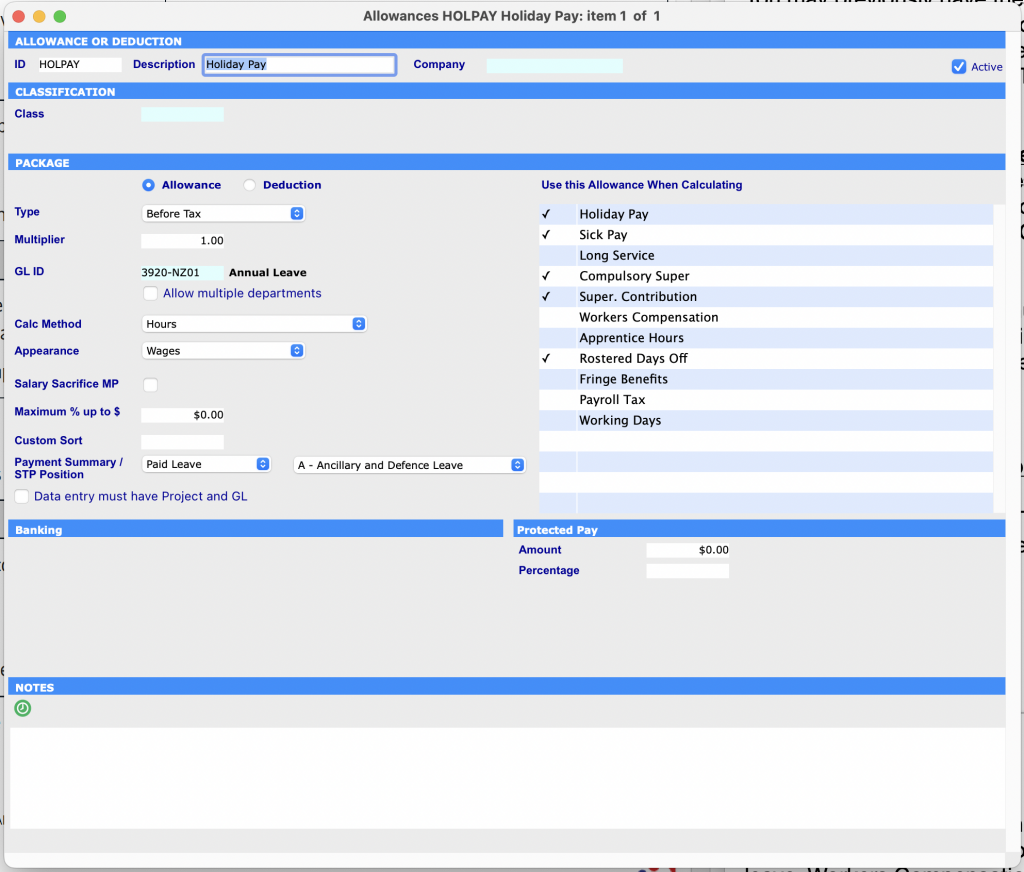

Allowances for Leave

Allowances for Leave includes Ancillary leave and Defence leave. You will need to select a Payment Position of Paid Leave and, depending on what it is for, a secondary position of Ancillary and Defence leave, Workers Compensation Leave, Paid Parental Leave, Cash out of Leave in Service, Unused leave on termination, or other paid leave. These options were previously marked as Gross Salary.

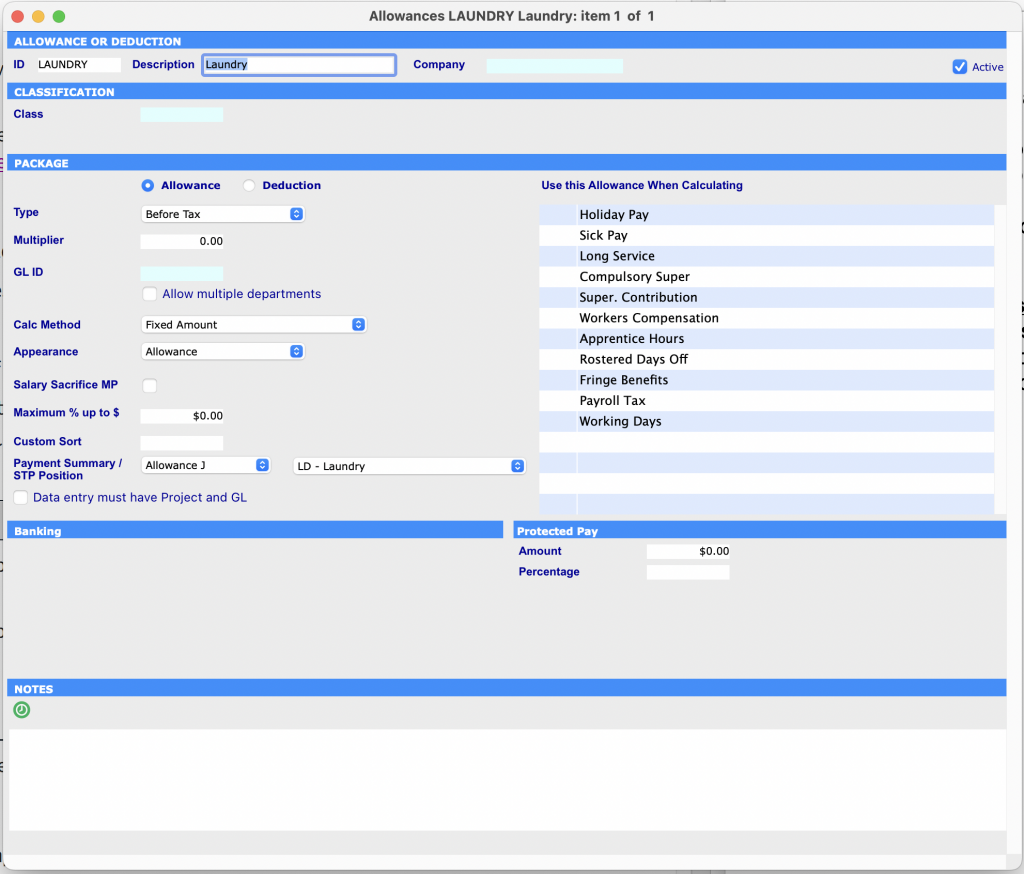

Award Transport Payments

You may previously have these set up to use one of the options on the Payment Summary Position/ STP Position such as allowance A, B, C, D, etc. The user will then need to select a secondary position of Awards transport payments, Laundry, Overtime Meal Allowance, etc.

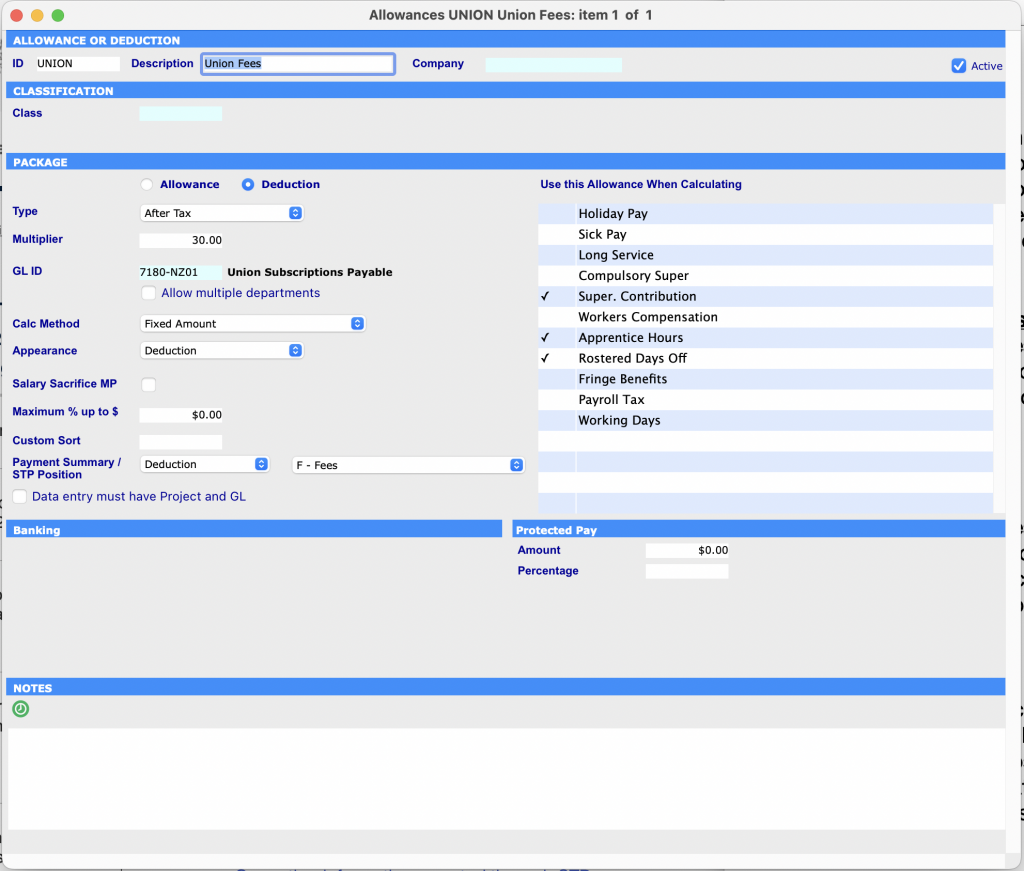

Deductions

You may previously have these set up to use one of the options on the Payment Summary Position/ STP Position such as Deductions. You will also need to select a secondary position such as (Union) Fees, Workplace Giving, Child Support Garnishee, Child Support Deduction.

Conclusion

In general, you will need to check every Allowance and make sure the Payment Summary Position / STP Position is correct and check the secondary position to see if there is an appropriate option, paying attention to items that were previously marked as Gross salary and may now be Disaggregated.

Additional Requirements of Single Touch Payroll Phase 2

In the Employee Control screen on the left hand side, if the employee has given you a Medicare Levy Declaration NAT 0929 form, please fill in that information on that form. The Tax Details section on the right hand side of the screen corresponds to the Tax File Declaration NAT 3092 form, in which the user can set the relevant Income Type, for example, Working Holiday Maker, Seasonal Worker Programme, Foreign Employment, Labour Hire, etc.

You can review our Blog and YouTube channel for additional information and resources on SapphireOne ERP, CRM and Business Accounting software.