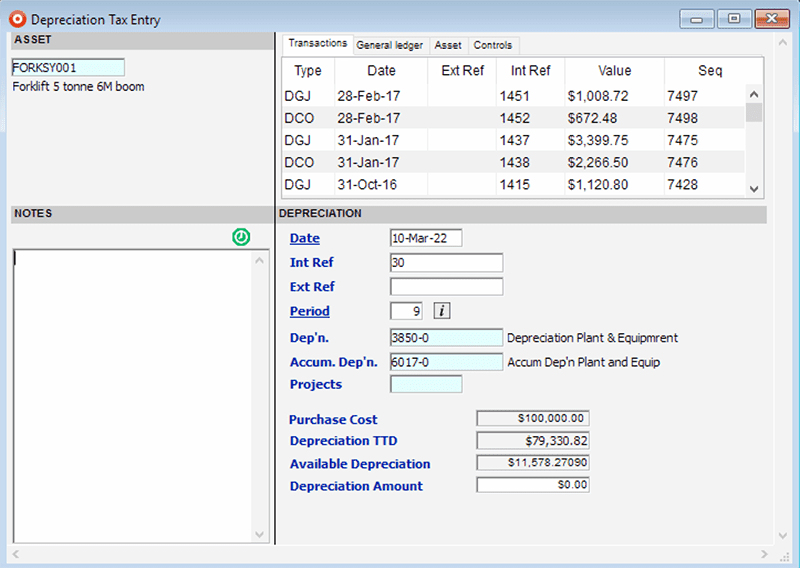

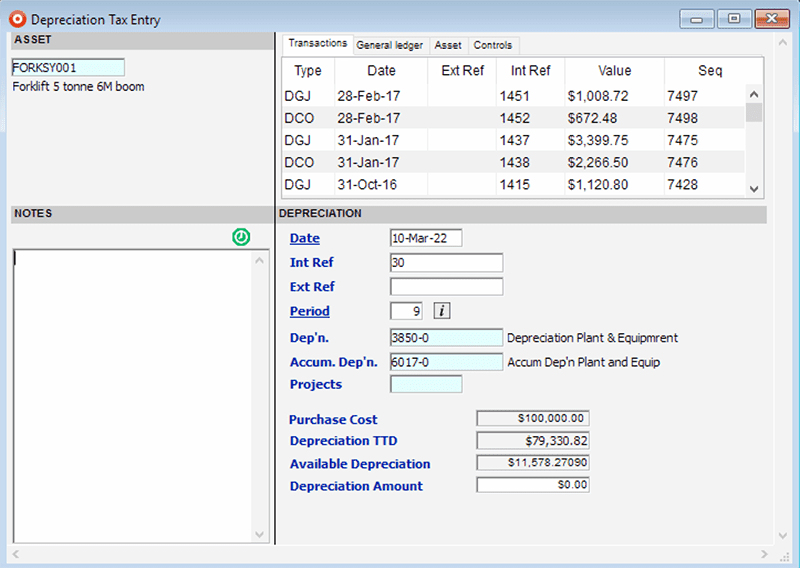

Assets Transactions - Depreciation Tax

Depreciation Tax allows the manual entry of a depreciation value, instead of using the auto function. If a Project is entered and depreciation is run it will then be linked to the Depreciation Expense Account.

The two key features of SapphireOne Assets Transactions module are:

SapphireOne automatically creates depreciation transactions on all assets in your registry with the click of a button or depreciate individual assets manually. SapphireOne allows the user to calculate depreciation instantaneously for both tax and company reporting purposes.

Asset Disposal, Purchase & Revaluation

Update your General Ledger with an easy-to-use process for the part/full sale, purchase or revaluation of your company assets.

Repair, Service & Loan

Take full control of your asset registry by tracking assets that are being repaired, require servicing or are out on loan.

The Transaction menu provides data entry functions which assist with asset control, data entry functions affect general ledger (GL), allows viewing of asset transactions, auto depreciation function, post transactions within assets, reversal of disposal and reversal of depreciation.

This function allows the manual entry of depreciation into the primary method of depreciation (usually the official taxation allowed rate of depreciation) for tax purposes.

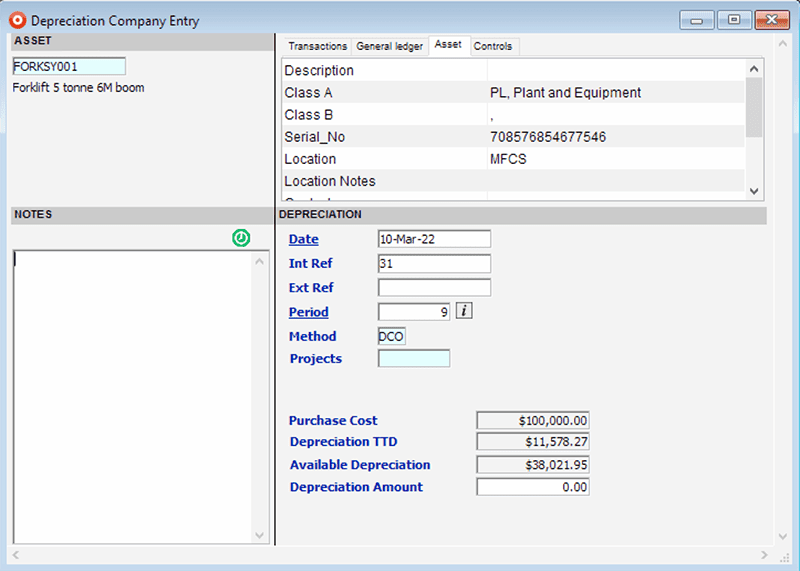

This function allows the manual entry of depreciation into the secondary method of depreciation (usually the company’s specified rate of depreciation).

Allows the recording of the disposal of an asset.

Allows the recording the purchase of an asset.

Allows the revaluation of an asset.

Allows the recording of when any repairs are being done on an asset is being repaired for some reason.

Records any servicing done to an asset.

Allows the attachment of notes as a transaction entry.

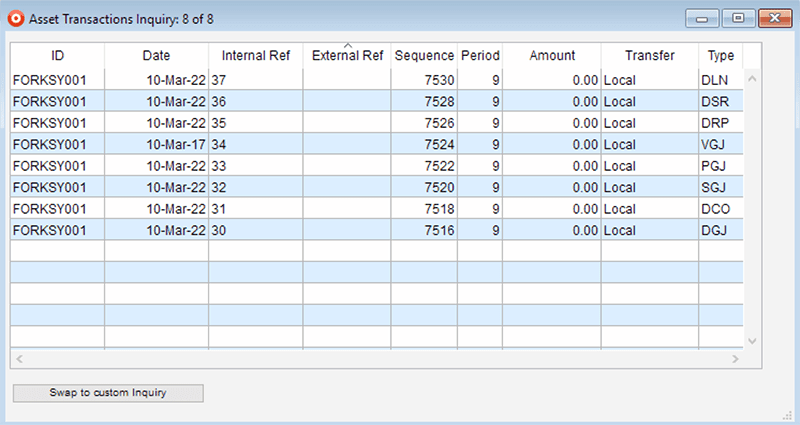

This inquiry lists all the transactions in a standard Inquiry screen.

Locks the transaction selected from any modification. Transactions must be posted within Assets prior to sending them to the General Ledger.

This function will automatically create depreciation transactions for the current period.

This function will reverse the last Auto Depreciations function last operation. Conditions apply, check with SapphireOne support before running this procedure.

Allows the complete reversal of the disposal of an asset.

Depreciation Tax allows the manual entry of a depreciation value, instead of using the auto function. If a Project is entered and depreciation is run it will then be linked to the Depreciation Expense Account.

Depreciation Company allows the manual entry of a depreciation value, instead of using the auto function. Enter in the particular method of depreciation to be used.

Transaction Inquiry provides a list of all transactions in the system. Once transactions are posted they are automatically transferred to Financials. You may see this in the Transfer Column as transactions that have a posted status of Transferred.

Types of transaction within Assets mode: