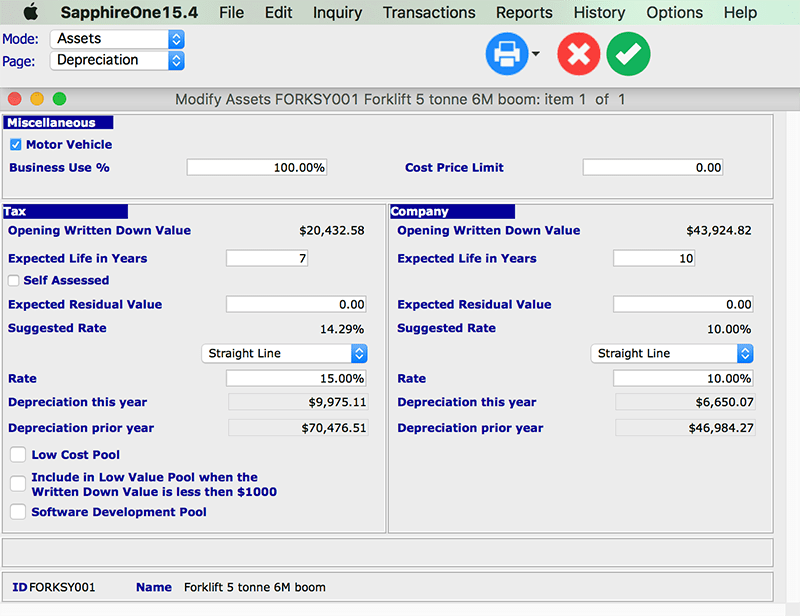

Depreciation Page

Miscellaneous area:

This provides the ability to record the Cost Price Limit as applicable to Luxury Motor Vehicles (as is the requirement in Australia) and any Business Use that is applicable for the Asset from zero to 100%. Since this limit is varied from time to time, provision has been made for the user to enter this limit.

The screenshot here is for an asset that is a Motor Vehicle.

Once the ‘motor vehicle’ checkbox is selected the ‘Cost Price Limit’ will be displayed as seen in the screenshot here, enabling the entry of the current Cost Price Limit.

In Australia, as of the 2010/2011 financial year, the limit is $57,466 inclusive of GST and Luxury Car Tax. This limit will alter as the years progress, so for more information visit the ATO website for up-to-date details.

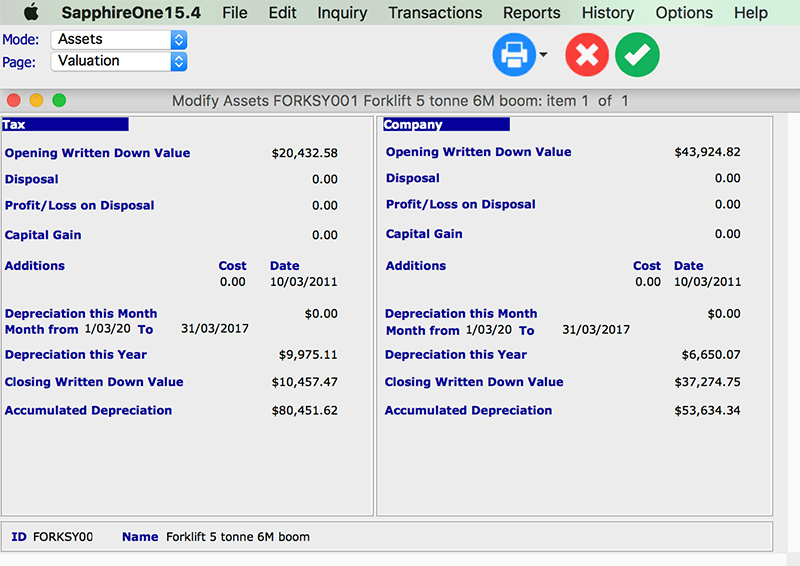

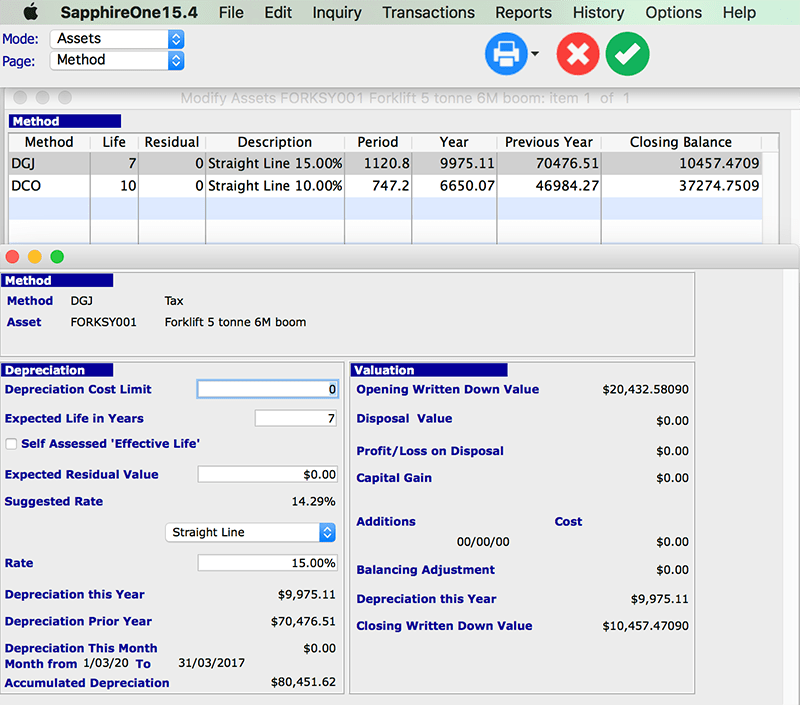

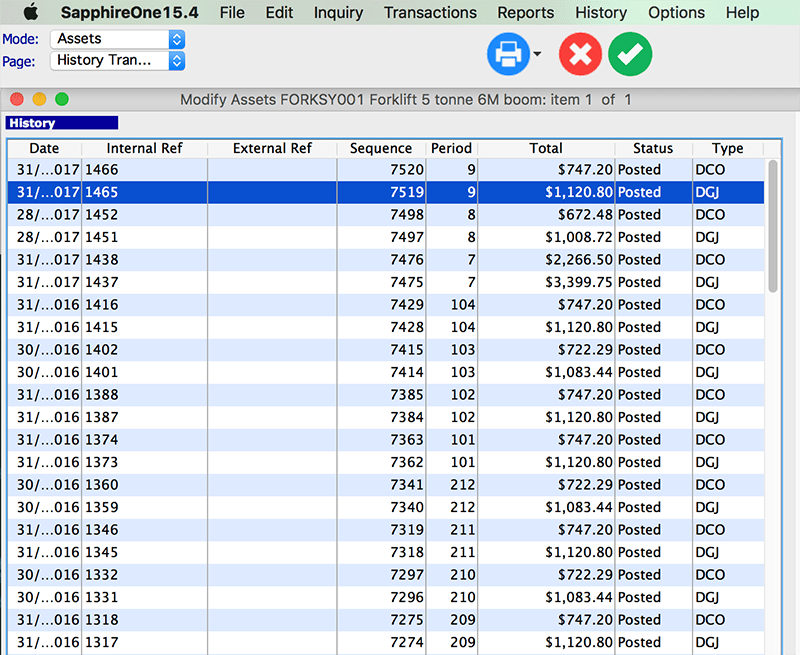

The Primary/Tax and Secondary/Company depreciation schedule information is also displayed on this page.

Tax Area:

- This area contains the Opening Written Down Value and the Depreciation for this year, and last year is displayed as calculated by the system.

- Other items such as Expected Life, Residual Value and the Type of depreciation are user-entered.

- If the Asset purchased has an initial value of less than $1000 you may select the checkbox and the Asset will be placed in the low cost pool.

- ‘Include in Low-Value Pool when the written Down Value is less then $1000’

- If the Asset has an initial value of over $1000.00 and the depreciation is set at Diminishing Value you may select this option to move it into the Low-Value Pool automatically when it’s written down value drops below $1000.00.

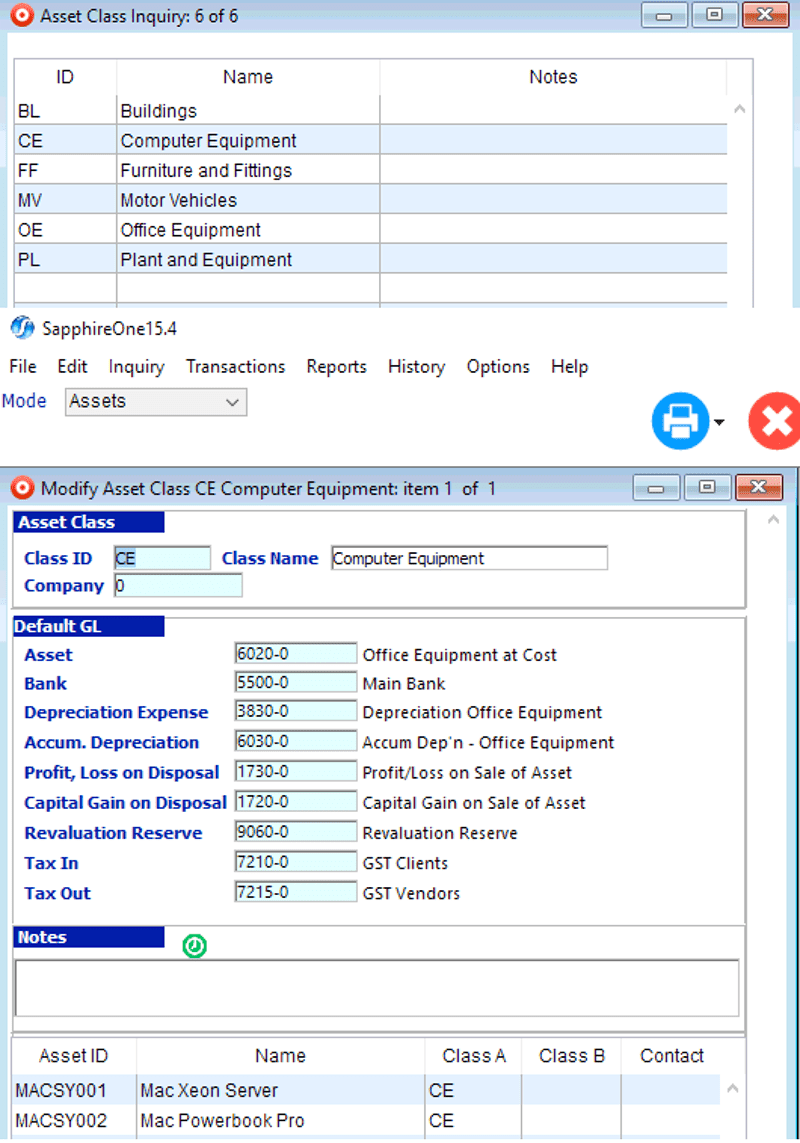

- The Asset may also be placed in the Software development pool. This is a special pool for software developed by that company. These Assets are depreciated over 4 years at 0, 40, 40 and 20% straight line. Company Area: Apart from the official ATO tax rates for an Asset, the company may also elect to depreciate the Asset at different figures to the tax office and the user may enter these figures into this area. If they are entered the system has the ability to record, track and report on these figures for the Asset as well as the Official rates for the tax office.