Asset Overview

In SapphireOne an asset is any tangible or intangible resource that is owned and operated by an organisation with the potential to produce economic benefits. An asset is used to generate revenue, and retains a value of ownership that can be converted into a cash amount. Your asset will form part of your SapphireOne balance sheet. For example, SapphireOne fixed assets include property, machinery, equipment, computers, vehicles, trademarks, intellectual property, artworks and more.

The SapphireOne Asset Inquiry provides a centralised data entry point for all assets, providing full control over your Asset database. Once the list of Assets is on screen the user is able to ![]() view or

view or ![]() modify existing assets. A new asset may be added to SapphireOne by typing ‘Command/Ctl N’ or selecting the

modify existing assets. A new asset may be added to SapphireOne by typing ‘Command/Ctl N’ or selecting the ![]() New icon on the main toolbar.

New icon on the main toolbar.

SapphireOne incorporates a built-in Contact Relationship Management (CRM) system that diligently monitors all interactions across Clients, Vendors, Job Projects, Assets, Payroll/HR, Employees, and Workbook. It maintains a comprehensive history of all contacts throughout the entire duration of your data file.

The CRM functionality in SapphireOne is specifically designed to efficiently track and manage interactions with various contacts, including Clients, Vendors, Job Projects, Assets, Payroll/HR, Employees, Workbooks, and all contacts. Users can easily record and log various communication activities, such as emails, phone calls, meetings, notes, and actions associated with each contact.

By leveraging SapphireOne CRM, your organisation gains a deeper understanding of past, present, and potential Clients, Vendors, Job Projects, Assets, Payroll/HR, Employees and Workbook leading to analysis of Client buying behavior improved relationship management and customer retention. For example, through analysis of Client buying behavior, an organisation may identify that its Vendor base has not recently supplied a particular SKU inventory.

SapphireOne’s CRM (Contact Relationship Management) is seamlessly integrated into every aspect of the SapphireOne application, providing users with a powerful tool to manage and organise contact details for Clients, Vendors, Job Projects, Assets, Payroll/HR, Employees, and Workbook data. The CRM module efficiently gathers data from various communication channels, including the company’s website and the inbuilt SapphireOne Softphone. It records all outgoing and incoming telephone calls associated with a contact, ensuring a comprehensive interaction history.

The CRM module also manages emails, and it can be integrated with external tools like Mailchimp for monitoring email campaigns to contacts. It tracks when emails are sent, opened, and how many times they are opened. Additionally, all interactions with contacts are automatically recorded, streamlining communication tracking and simplifying follow-up processes.

Users have the convenience of adding actions to contacts, which are automatically populated within the SapphireOne calendar. This feature ensures that important actions and follow-ups are never missed, enhancing productivity and time management.

SapphireOne CRM allows users to attach an unlimited number of documents and digital assets to each contact. Whether it’s contracts, proposals, or multimedia files, this capability ensures all relevant information is readily accessible and organised, making collaboration and decision-making more efficient.

Summarising the Benefits of SapphireOne CRM

SapphireOne CRM delivers enhanced daily support to both Clients and Vendors by providing real-time information, enabling timely decision-making. The core benefits of SapphireOne CRM encompass centralized data management, offering a comprehensive view of contacts, fostering improved customer relationships, facilitating data-driven decision-making, streamlining marketing efforts, and optimizing sales and purchasing processes. Below are the eight core benefits of SapphireOne CRM:

- Centralised Data Management – All contact information is consolidated in one place, ensuring easy access and efficient organisation.

- Comprehensive View of Contacts – Gain a holistic perspective of Clients and Vendors, facilitating a deeper understanding of their needs and preferences.

- Improved Customer Relationships – Build stronger and more meaningful relationships with Clients and Vendors, fostering loyalty and satisfaction.

- Data-Driven Decision-Making – Utilise data insights to make informed decisions, enhancing operational efficiency and business performance.

- Streamlined Marketing Efforts – Targeted marketing campaigns can be devised, ensuring more relevant messaging and increased engagement.

- Optimized Sales and Purchasing Processes – Efficient sales and purchasing workflows lead to improved productivity and revenue generation.

- Identification of Profitable Clients & Vendors – Analyse Client & Vendor data to identify the most profitable partnerships and opportunities for growth.

- Seamless Integration – The CRM is fully integrated across all company departments within a single data file, facilitating smooth collaboration and information sharing.

In summary, SapphireOne CRM empowers businesses by offering tailored services, responsive pricing, and personalized messaging. It creates a cohesive ecosystem where all products and services are linked through contacts for all functions within SapphireOne. This synergy leads to superior supply chain effectiveness and overall operational efficiency, resulting in improved business performance and customer satisfaction.

Asset Inquiry

Asset Details Page

Asset Area

- ID – Enter an ID for the new Asset. The user should note that ID’s can not be reused in SapphireOne. It is recommended that planning is done before entering an ID as it may not be altered or deleted.

- Name – Enter the name of the Asset. Unlike the Asset ID this name may be altered at a later date.

- Risk – If required, click on the Risk field to bring up the SapphireOne graphical risk chart that is colour coded from 1 (Green) to 25 (Red).

- Class – Select a Class for the Asset if required. Assets may be grouped under classes for additional filtering and sorting when reports are generated. This is not a compulsory field.

- Company – SapphireOne will enter the company that the user is logged into when the Asset record is being created.

- Department – Select a Department for this asset if required. Assets may be grouped under departments for additional filtering and sorting when reports are generated. This is not a compulsory field, however SapphireOne General Ledger accounts are set up at the Department level.

- Job Project – If a Job Project is entered and depreciation is run it will then be linked to the Depreciation Expense Account for the particular Job Project.

- category – Select the Asset category from the list box The category selection is directly linked to the third page of the Asset Inquiry. If the category is not entered here, the Category Details page will not be displayed and SapphireOne will instead display an alert that the Asset has not been categorised.

- The options from this menu are as follows: Not Categorised, Computer Equipment, Plant Equipment, Motor Vehicles, Property/Land, Artwork, Photographic and Film Equipment, Trademark and Other Equipment.

Grouping Area

The Grouping Area includes three tags which are by default named Tag1, Tag2 and Tag3. These are default headings and the user may go to: Utilities / Controls / Master Defaults / Assets Page and rename them as required.

These three tags are also shown as part of the details displayed when the list of Assets is on screen. These tags are mainly used for reporting and reconciling the Assets details. When a detailed query is executed they form part of the list of Available Fields when a Detailed Query is run. When a Quick Report is executed they are listed as part of the Master Table.

Valuer General Area

The Date of Valuation and actual Value can be recorded here. These values are automatically updated by the creation of a Valuation Journal.

Details Area

- Purchase Price – Enter in the Purchase Price of the asset.

- Purchase Date – Enter the date of the purchase.

- Start Depreciation At – Enter the date that depreciation is to start at. Usually it will be the date of purchase.

- Warranty Expiry Date – Enter the date that the warranty will expire.

- Serial Number – Enter the serial number for the asset.

- Disposal Date – When an Asset Disposal Transaction is created, SapphireOne will enter in the date that the disposal was created in the Disposal Date data entry field.

- % Sold – When an incomplete sale or disposal is processed SapphireOne will enter the percentage that has been sold or disposed of in the % Sold field.

- Do Not Purchase Check Box – When this checkbox is selected SapphireOne will not automatically create a Purchase transaction for the new Asset when it is saved with the

tick. A purchase transaction will have to be manually entered by a user for the new Asset at a later time.

tick. A purchase transaction will have to be manually entered by a user for the new Asset at a later time.

Location Area

- ID – If Locations for assets have been set up enter the location ID here.

- Contact – Enter a contact ID here.

- Physical – Enter the physical location of the asset here. Click on the Underlined Physical heading for a map view as seen below.

A useful feature available in SapphireOne is the ability to obtain a map view from a Physical address record. To access this functionality, click on the Physical heading in the Address Area. This feature is available throughout SapphireOne, including in Sapphire Webpack and the Sapphire Custom Webpack. With this feature, the user can obtain a visual representation of the physical location associated with the contact’s address, which can be helpful for planning and logistics purposes.

The map view feature in SapphireOne is device/platform agnostic

This means that it can be used on any device or platform. When the user clicks on the Physical heading in the Address Area above, the default mapping application in either an app or web browser will be utilised to display the map view. This means that the feature is not dependent on a specific mapping application or device, and can be accessed and used on a variety of platforms and devices.

Whether using a mobile device, tablet, or desktop computer, the map view feature in SapphireOne remains accessible, providing users with a consistent experience regardless of their chosen device or platform.

Loan Liability Area

This area allows you to record details of any General Ledger account set up as a loan account that has been used to purchase this particular asset. This specific functionality in SapphireOne has been added so that specific loan accounts may be setup for the purchase of Assets. The linking of the General Ledger account setup details to this are in the Asset Inquiry are as follows.

- Contract – Enter in the General Ledger account ID. This field is light blue so wild card ‘@’ or ‘?’ searching for the appropriate G/L account ID is an option.

- Liability Amount – Enter in the amount of the current Liability for the Asset loan.

- Residual Amount – Enter in the current residual amount owing for the Asset loan.

- Repay Terms – The repayment terms will be populated by the terms as set up in the General Ledger loan account.

Description Area

This area can be used to include a detailed physical description of the Asset. There is no character limit on the field.

Contacts Area

This includes a list of contacts associated with this Asset. See below for further information on Contact management within SapphireOne.

Differences in accessing a Contact

- Within a Function – When the Details Page is displayed from a Client Inquiry, the SapphireOne CRM contacts area will only list the SapphireOne CRM contacts for the selected Client. For other functions, only the contacts directly relating to that function will be displayed in the contacts area on the first page.

- The following buttons are used to Add

or Delete

or Delete  a contact.

a contact. - To modify a contact here, double click on the selected contact.

- The following buttons are used to Add

- Workbook & Palette – When SapphireOne CRM contacts is accessed using the the SapphireOne CRM contacts from Workbook Mode or the Inquiry Palette, all contacts in SapphireOne are listed. Here the Main tool bar operates as normal.

- To enter a new contact select the New

button on the main toolbar.

button on the main toolbar.

- To modify or look at or modify a contact, select the Look

, or Modify

, or Modify  buton.

buton. - When changes are to be Saved use the Save

button.

button.

- Highlighting a contact and selecting the Delete

button on the main toolbar will remove the selected contact.

button on the main toolbar will remove the selected contact.

- To enter a new contact select the New

Once a contact has been selected for viewing or modification, the process is exactly the same. The only difference is the process of making a selection, is different as documented above. For this reason only the second of the two processes will be documented here.

When SapphireOne CRM contacts is first selected from the drop down menu SapphireOne displays a complete list of contacts. as seen below.

Contact Types

The following is a list of tables that the SapphireOne CRM contacts are stored within. This includes Clients, Vendors, Job Projects, Assets, Employees. There is also provision for the storing of multiple Client and Vendor Addresses.

Ultimately all contacts are stored as a group in one table in Workbook > General > Contacts. Each contact stored in the workbook contacts, will be denoted by a link to the unique table that the contact is stored within. When creating a unique contact from within the Contacts Area of a Clients, Vendors, Job Projects, Assets, Employees, Client Multiple Address and Vendor Multiple Address that contact will then form a permanent part of that particular record within the table.

These differences are apparent when a new SapphireOne CRM contact is created here in Workbook Mode or from the Inquiry Palette where virtually all data entry fields are blank. Whereas if a new SapphireOne CRM contact is created from a Client or Vendor inquiry for example, a number of the data entry fields are filled in for you as well as some you are not aware of such as linking to the Client, Vendor or Address . (Lookup in the Details area).

While all existing SapphireOne CRM contacts may be viewed, or modified from either the Inquiry Palette or Workbook, it is not recommended that they are created here. You may create SapphireOne CRM contacts here but SapphireOne will be unable to automatically establish the link to the function as it does not know the function to link to.

The user will have to enter the linking details manually Clients or Vendors etc.

When a SapphireOne CRM contact is created from this function, e.g. a Client Invoice, the Link to that particular Client is set up automatically by SapphireOne. Unlike the storing of Documents, there is no provision for setting up a Link by the user in the contact screens as is not unnecessary.

The link is displayed in the Type column and is displayed by SapphireOne in the Lookup Details area in the data entry screen. It is not User modifiable.

Actions and Documents may also be linked to any Contact.

Contact Area

- ID – This is a number automatically entered by SapphireOne. When creating transactions for Clients or Vendors the first contact in the respective client list will be entered in the Contact field as a number with the name of the Contact following. If a different SapphireOne CRM contact is to be used, entering the ‘@’ or ‘?’ symbol will display a list of all the contacts for that Client or Vendor allowing a selection to be made. (This is linked with the Lookup data entry field just below).

- Mailout Checkbox – Select if this contact is to receive mail outs.

- Active Checkbox – will automatically be selected for a new SapphireOne CRM contact. If a contact is not used deselect it.

When the list of contacts is on screen there is, a Sapphire Tool named Toggle Active. This will toggle the Active check box seen above to un-ticked. Any contacts that are not ticked will be ticked. This will be applied to ALL contacts in the list on screen and not just the highlighted ones.

- Paperclip – Documents may be linked to a specific contact within either a Clients, Vendors, Job Projects, Assets, Employees, Client Multiple Address and Vendor Multiple Address record.

Paperclip Management Saves Time with Easy File Attachment

The SapphireOne Document Management System (DMS) features a convenient Paper Clip button on all data entry and inquiry screens. This enables users to attach relevant documents or files to every transaction or record. The system also includes a dedicated page for managing documents related to a specific transaction or record, providing robust version control of the attached documents.

The color of the paper clip serves as a visual indicator of the status of the attached documents. A red paper clip indicates that there are no documents currently attached to the transaction or record, while a green paper clip indicates the presence of one or more attached documents. Additionally, the word “Items” is preceded by the number of attached documents, providing a clear and concise representation of the current status.

SapphireOne’s Document Management System is highly versatile and can accommodate a wide range of document types, including Adobe Acrobat, spreadsheets, word processing documents, photo files, JPEGs, CSV files, HEIFs, and MP4 files. With the ability to store an unlimited number of documents for an indefinite amount of time, the system provides users with a comprehensive and efficient solution for managing all their important files and documents.

Master Defaults

In SapphireOne, users have the flexibility to control the size of individual documents and determine where they are stored through the Master Defaults settings. These settings can be accessed by navigating to Utilities > Controls > Master Defaults > System Page.

Within the Documents area of the SapphireOne page, there is a Document Size Limit setting with a default size of 10 MB, which can be adjusted as needed. Additionally, users can choose to store the documents either as part of the data file or as separate files, by selecting the appropriate option from the two radio buttons provided.

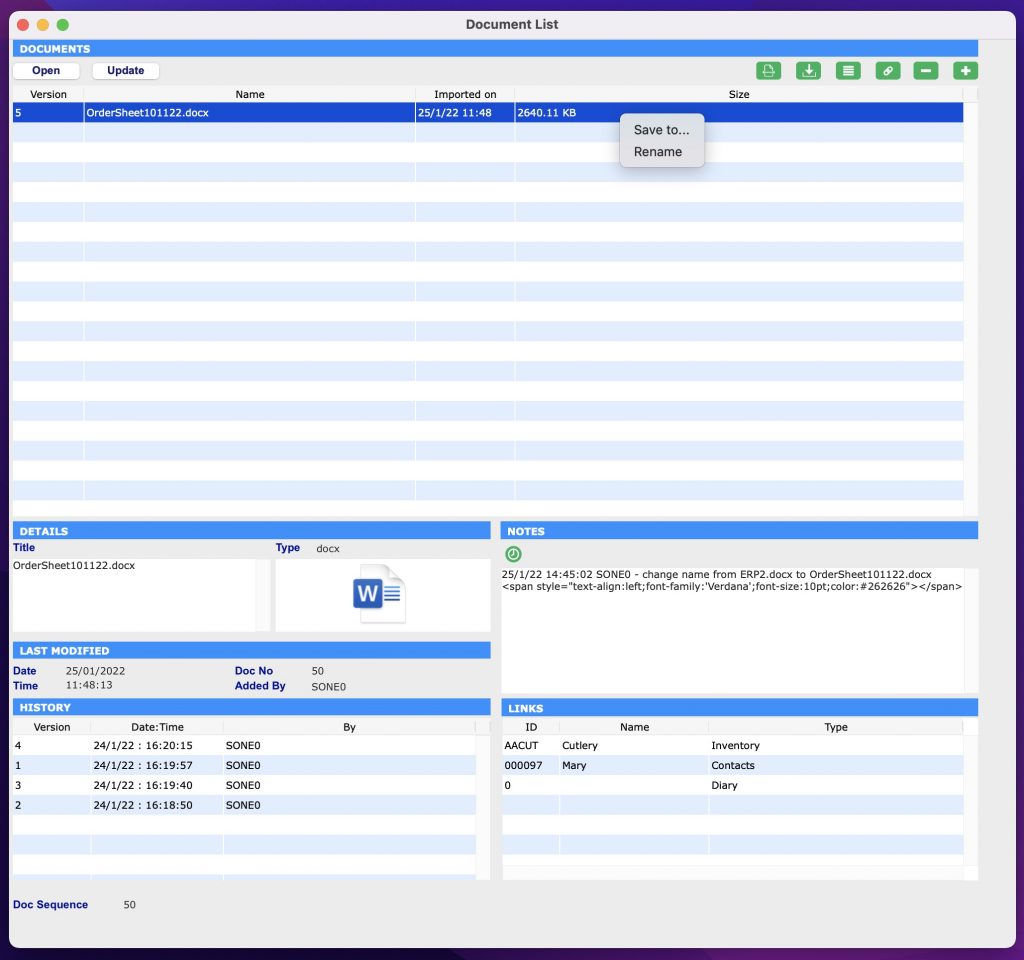

To attach a document to a transaction, simply click on either the ![]() or

or ![]() Paperclip button. The Document List window as seen below will be displayed allowing the the user to select the desired file to attach.

Paperclip button. The Document List window as seen below will be displayed allowing the the user to select the desired file to attach.

How to Attach Documents Using SapphireOne Paperclip

SapphireOne also provides users with the convenient Drag & Drop functionality to attach documents. To use this feature, simply drag a document from your local computer into the Document List screen and it will be attached automatically. This streamlined process saves time and effort and makes it easier to manage your important files and documents within SapphireOne.

If SapphireOne detects that the document name already exists, a pop-up will be displayed alerting the user. Alternatively, the user can also select the

If SapphireOne detects that the document name already exists, a pop-up will be displayed alerting the user. Alternatively, the user can also select the Plus  button to select a document to upload from the local computer.

button to select a document to upload from the local computer.

SapphireOne’s document management system provides users with the ability to easily manage their attached documents. After a document has been attached, the user has the option to rename it by right-clicking on the file and selecting Rename This feature is useful for maintaining consistency in document names across all records and helps to keep the system organised and efficient.

Documents Area within Document Management System (DMS)

- Open

– By clicking on this button, the document will be opened for viewing, allowing users to review its contents without having to leave the SapphireOne system. This feature provides a convenient and streamlined way to access and review important documents within the context of the larger document management system.

– By clicking on this button, the document will be opened for viewing, allowing users to review its contents without having to leave the SapphireOne system. This feature provides a convenient and streamlined way to access and review important documents within the context of the larger document management system. - Update

– When this button is selected an alert is displayed allowing the user to import a new version of a highlighted document, enabling version tracking. After selecting a new version, the user enters a version number. The latest version becomes available, with previous versions accessible in the History area. The updated document remains linked to associated transactions.

– When this button is selected an alert is displayed allowing the user to import a new version of a highlighted document, enabling version tracking. After selecting a new version, the user enters a version number. The latest version becomes available, with previous versions accessible in the History area. The updated document remains linked to associated transactions. - Scan

– This option in SapphireOne provides users with the ability to scan a document directly into the data file and link it to a transaction. This feature requires access to a local or network scanner, and the appropriate scanner and software must be installed on the local machine or network. By using the Scan option, users can quickly and efficiently digitise physical documents and associate them with the relevant transactions within SapphireOne.

– This option in SapphireOne provides users with the ability to scan a document directly into the data file and link it to a transaction. This feature requires access to a local or network scanner, and the appropriate scanner and software must be installed on the local machine or network. By using the Scan option, users can quickly and efficiently digitise physical documents and associate them with the relevant transactions within SapphireOne. - Save

– This button in SapphireOne allows users to save the currently highlighted document to disk. This feature provides a convenient way to export a copy of the document for backup or further use outside of the SapphireOne system. By clicking the Save button, users can easily access a digital copy of their important documents and ensure that they are properly preserved and accessible.

– This button in SapphireOne allows users to save the currently highlighted document to disk. This feature provides a convenient way to export a copy of the document for backup or further use outside of the SapphireOne system. By clicking the Save button, users can easily access a digital copy of their important documents and ensure that they are properly preserved and accessible. - Link Documents

– With SapphireOne, users have the ability to link a highlighted document to one or more transactions within the data file. To do this, the user simply clicks the “Link” button, which will bring up an alert allowing them to make their selection. This feature provides a convenient way to associate important documents with multiple transactions, ensuring that all relevant information is easily accessible from one central location. For more information about linked documents, refer to the Links Area documentation provided by SapphireOne.

– With SapphireOne, users have the ability to link a highlighted document to one or more transactions within the data file. To do this, the user simply clicks the “Link” button, which will bring up an alert allowing them to make their selection. This feature provides a convenient way to associate important documents with multiple transactions, ensuring that all relevant information is easily accessible from one central location. For more information about linked documents, refer to the Links Area documentation provided by SapphireOne. - Link Existing Documents

– SapphireOne provides users with the ability to link existing documents in the data file to the current transaction or record. To do this, the user simply clicks the Link Existing button, which will bring up an Alert allowing them to choose from a list of available documents. This feature provides a convenient way to associate existing documents with additional transactions, ensuring that all relevant information is easily accessible from one central location. For more information about linked documents, refer to the Links Area documentation provided by SapphireOne.

– SapphireOne provides users with the ability to link existing documents in the data file to the current transaction or record. To do this, the user simply clicks the Link Existing button, which will bring up an Alert allowing them to choose from a list of available documents. This feature provides a convenient way to associate existing documents with additional transactions, ensuring that all relevant information is easily accessible from one central location. For more information about linked documents, refer to the Links Area documentation provided by SapphireOne. - Delete

– This option in SapphireOne allows users to remove the currently highlighted document. By clicking the Delete button, the selected document will be removed from the system, providing users with a simple way to manage their attached documents and ensure that only relevant and up-to-date information is stored within the system.

– This option in SapphireOne allows users to remove the currently highlighted document. By clicking the Delete button, the selected document will be removed from the system, providing users with a simple way to manage their attached documents and ensure that only relevant and up-to-date information is stored within the system. - Plus

– SapphireOne includes a search function that makes it easy for users to select a document saved on their local computer. This feature provides a convenient way to quickly locate and attach the desired document, streamlining the process of adding and managing important files within the SapphireOne system.

– SapphireOne includes a search function that makes it easy for users to select a document saved on their local computer. This feature provides a convenient way to quickly locate and attach the desired document, streamlining the process of adding and managing important files within the SapphireOne system.

Details Area within Document Management System (DMS)

The Details area within SapphireOne’s Document Management System (DMS) provides users with additional information about the selected document. When a document is selected in the Documents area, the Details area will automatically display the title of the document and the type of file. This information helps users to quickly identify and manage their important files and documents, providing a more efficient and organised system for document management.

Notes Area within Document Management System (DMS)

The Notes area is for entering any notes related to the document. The user can select the green clock button ![]() to create a time and date stamp for every note added.

to create a time and date stamp for every note added.

The Notes area will also keep an automatic user log when any changes are made to the document. For example, if the document is renamed or new links are created. SapphireOne will record the date, time and user that made the modifications.

Document Details Area within Document Management System (DMS)

The Document Details area within SapphireOne’s Document Management System (DMS) provides additional information about the selected document. This area automatically displays information such as the date and time the document was added, the document number, and the user who added the document. This information helps users to quickly understand the context of the selected document and provides a comprehensive history of the document’s status and interactions within the system. The Document Details area is a valuable resource for managing and tracking important documents within SapphireOne.

History Area within Document Management System (DMS)

The History area within SapphireOne’s Document Management System (DMS) provides a record of the complete version history of the selected document. SapphireOne tracks all version changes and automatically displays the document’s history in this area.

As new versions of the document are imported using the  button, the History area will be automatically updated, ensuring that all previous versions of the document are recorded and available for viewing. This enables users to access the most recent version of the document, while still maintaining a complete history of all versions.

button, the History area will be automatically updated, ensuring that all previous versions of the document are recorded and available for viewing. This enables users to access the most recent version of the document, while still maintaining a complete history of all versions.

The History area provides a valuable resource for tracking the evolution of a document and understanding how it has changed over time. By having a complete record of the document’s history, users can easily review past versions and understand the context of the changes that have been made.

Links Area within Document Management System (DMS)

The Links area within SapphireOne’s Document Management System (DMS) is used to link documents to specific transactions or areas within SapphireOne. This area provides a comprehensive view of all linking information related to the document, including any functions used to import the document into SapphireOne.

By linking documents to transactions and areas within SapphireOne, users can easily associate important information and files with the relevant transactions, providing a more organised and efficient system for document management. The Links area is a valuable resource for understanding the relationships between documents and transactions within SapphireOne.

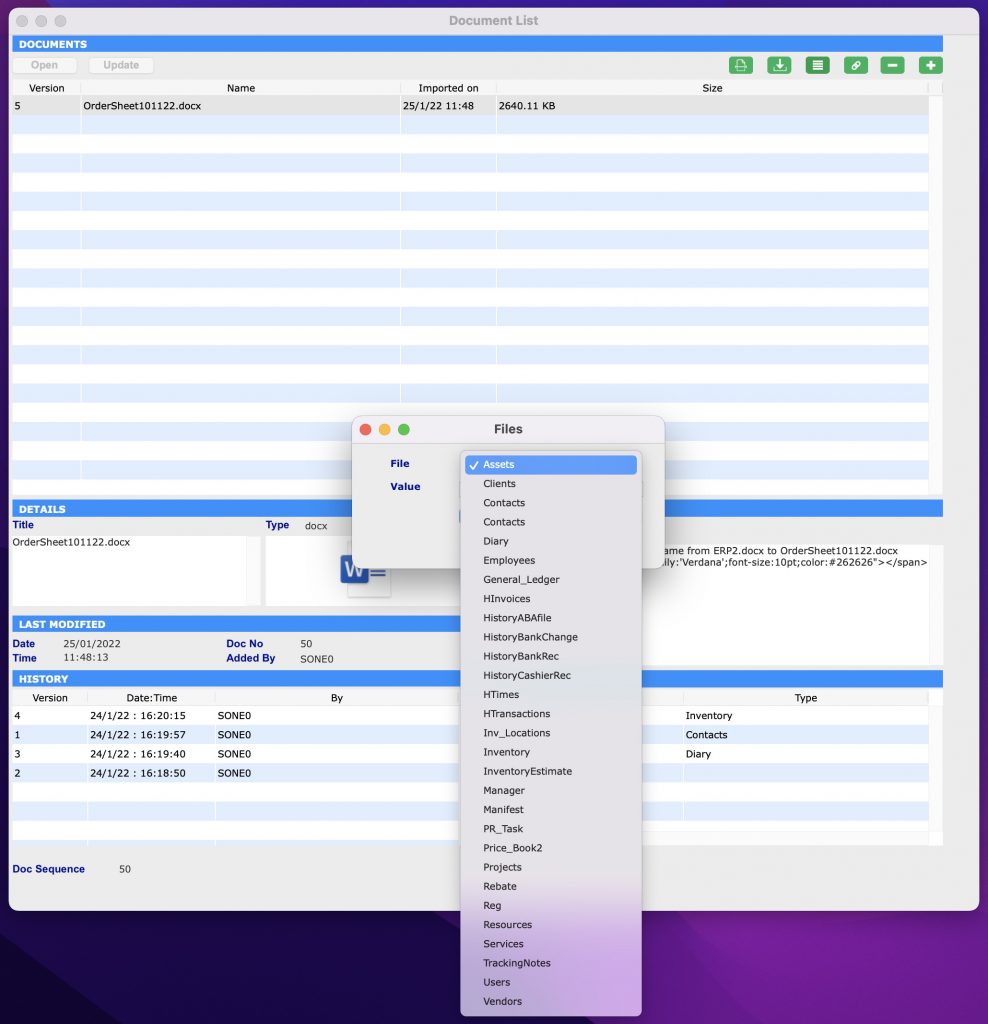

To add additional links to a document in SapphireOne, follow these steps:

- Select/highlight the document you wish to link.

- Click the

Link Document button.

Link Document button. - The Files pop-up window will be displayed.

- From the File drop-down menu, select the item you want to link the document to.

- In the Value data entry field, enter the necessary details (ID).

Note that the Value data entry field has a light blue background and is searchable by entering the wildcard symbols ‘?’ or ‘@’, making it easier to find the information you need. By linking documents to specific transactions and areas within SapphireOne, users can create a more organised and efficient system for document management.

Updating a Document within Document Management

The process for updating a document in SapphireOne is straightforward:

After clicking the “Update” button in SapphireOne, the user will be asked to confirm if they would like to import a new version of the document:

- Confirm that you wish to import a new version of the document by selecting Yes.

- The user will then be prompted to choose the updated document to open.

- After selecting the updated document, a secondary dialogue will appear, asking the user to enter an alphanumeric value for the new version.

- Enter the desired value for the new version and select OK

By following these steps, SapphireOne will replace the previous version of the document with the updated document. It will also maintain a complete record of all previous versions in the History area. This process ensures that the most up-to-date information is always readily accessible within the SapphireOne system.

Document Management using SapphireOne Documents Inquiry

In addition to SapphireOne’s Document Management Paperclip functionality, SapphireOne Documents Inquiry function in Workbook Mode provides users with a centralised repository of all documents and files stored within the SapphireOne data file. This function gives users the ability to add new documents, modify, view, or delete existing documents from within the Documents Inquiry screen.

Any revisions made to a document within the Documents Inquiry screen will be automatically updated across all areas where the document is linked within SapphireOne. Similarly, any modifications made to documents within the SapphireOne Paperclip Document List window will be reflected within the Documents Inquiry window.

For example, if a document is renamed within a transaction Paperclip Document List screen, the updated document name will be reflected when viewing the document in the Documents Inquiry screen.

You can learn more about SapphireOne Documents Inquiry functionality within the Documents Inquiry article.

Document Control within Document Management

In this example, we have an inventory item with documents attached, such as installation instructions and a packing checklist. The item is added to a sales order, manufactured, shipped, and the job is completed. SapphireOne’s Document Management Paperclip functionality allows for easy attachment and access to all relevant documents throughout the entire process, from sales order to completion. This improves efficiency and helps ensure all relevant information remains consistently available and up-to-date.

A year after the completion of the job, a revision of the inventory item is made, along with updates to its associated Documents (DMS). To keep the information organised and up-to-date, it is not necessary to create a new inventory item for the revision. Instead, the documents and files can be easily updated using SapphireOne’s DMS file that are attached.

By using the Update button within the DMS, users can import a new version of the document and SapphireOne will automatically keep track of all version changes, ensuring that the most recent information is readily available. This process saves time and effort by allowing users to simply update the documents and files, rather than creating a new inventory item for each revision.

In SapphireOne, when referring back to the original completed sales client invoice or job projects client invoice, the associated documents and files will be displayed in their original state or as they have been updated. The user has the option to view the documents and files as they were at the time of completion or as they currently are, providing a comprehensive and accurate record of all relevant information.

In the screen shot above, both the current and historical documents are attached to the inventory item. As a SapphireOne user, you have the ability to edit the list and choose to delete the historical document by simply selecting the Minus button.

Additionally, you also have the ability to modify the existing document, keeping a log file of each and every time the document has been revised. This ensures that a complete and accurate record of all revisions to the document is maintained, allowing you to easily reference the most recent version or any previous versions as needed.

The ability to manage both current and historical documents, as well as the option to modify and delete them, provides users with a flexible and efficient solution for document management within SapphireOne.

- Name – The normal entry of First name and Surname are entered here.

- Position – This is a user created drop down menu.

- Lookup – This is linked to the data entry field.

- Area – This is a user created drop down menu.

All SapphireOne CRM contacts for any function such as a Clients, Vendors, Job Projects, Assets, Employees, Client Multiple Address and Vendor Multiple Address are assigned a number as seen on the previous page. If a name such as Ken is entered here, a search may then be done for contact number of 000095 or Ken. SapphireOne in both cases will find the same contact because to it 000095 and Ken is the same contact. Some thought will have to be given to exactly what is the be entered into the lookup field.

- Look Up – Any SapphireOne CRM contact created in the Address Page of a Clients, Vendors, Job Projects, Assets, Employees, Client Multiple Address and Vendor Multiple Address must have an entry in this field, so as to display it in the first column of the list when the button is selected, when changing the address in a transaction. The list displays the data entered into the Lookup field in the first column, followed by the address in the second column.

- Code – data entry field is another field which can be manually set and used for extra reporting, e.g., the area the contact works in, Admin, Sales etc.

- The fields Company, Rep, Class and Link are all entered from information in the Clients, Vendors, Job Projects, Assets, Employees, Client Multiple Address and Vendor Multiple Address master records. If the SapphireOne CRM contact is created here by accessing the Inquiry Palette they will all have to be entered manually.

- Order – Entering a number in the field specifies where the contact will be in the contact list on the Clients, Vendors, Job Projects, Assets, Employees, Client Multiple Address and Vendor Multiple Address inquiry screen number one being at the top of the list. If you already have a list of contacts, you will have to check the list first then make a decision as to where in the list you want this any new contacts placed. Also SapphireOne will by default enter the contact with the lowest order number into any transactions for that Clients, Vendors, Job Projects, Assets, Employees, Client Multiple Address and Vendor Multiple Address.

Address area

- Provision is made for the entry of both a Postal and a Physical address. Using the Up

arrow will copy the Postal address details to the Physical address fields.

arrow will copy the Postal address details to the Physical address fields.

SapphireOne Mapping Feature – Apple/Google Maps

A useful feature available in SapphireOne is the ability to obtain a map view from a Physical address record. To access this functionality, click on the Physical heading in the Address Area. This feature is available throughout SapphireOne, including in Sapphire Webpack and the Sapphire Custom Webpack. With this feature, the user can obtain a visual representation of the physical location associated with the contact’s address, which can be helpful for planning and logistics purposes.

The map view feature in SapphireOne is device/platform agnostic

This means that it can be used on any device or platform. When the user clicks on the Physical heading in the Address Area above, the default mapping application in either an app or web browser will be utilised to display the map view. This means that the feature is not dependent on a specific mapping application or device, and can be accessed and used on a variety of platforms and devices.

Whether using a mobile device, tablet, or desktop computer, the map view feature in SapphireOne remains accessible, providing users with a consistent experience regardless of their chosen device or platform.

Lookup Details area

- Of particular interest, here is the Type data entered by SapphireOne. This contact was created while modifying a Client so SapphireOne has automatically set as the Type code as CLLink. (CL = Client and Link = link).

Phone Details area

- The details in this area are self-explanatory. The labels associated with the fields in the left hand columns cannot be altered. However, the labels associated with the fields in the right hand column may be altered as required by the user. To do this go to: Utilities > Controls > Master Defaults > System. The feature is located in the Contact Phone Titles area on the right hand side.

- Anywhere in SapphireOne that you see the Call

button next to a telephone number means that if you have the appropriate software installed, SapphireOne will dial the number. The button will turn red indicating that a call is in progress. Click on the End Call

button next to a telephone number means that if you have the appropriate software installed, SapphireOne will dial the number. The button will turn red indicating that a call is in progress. Click on the End Call  button to hang up the call.

button to hang up the call.

Notes area

- This area can be used to make permanent notes or reminders when you deal with Contacts. When you click on the button a time stamp will be created at the beginning of the notes section [Command] places it at the end, and you can input the note straight away.

- Selecting the Expand

button will make the notes screen maximise. You can click the same

button will make the notes screen maximise. You can click the same  button again to minimise the notes the same as with the list of contacts.

button again to minimise the notes the same as with the list of contacts.

Keywords & Notes Overview

The Keywords and Notes page is a standard feature found on all inquiry pages in SapphireOne, providing a central location to add and manage keywords and notes for each record.

Keywords Area

The Keywords and Notes page is consistent across all inquiry pages in SapphireOne. Users can add customisable keywords to the list and reuse them. Additionally, keywords can be added that apply specifically to the current record. To remove keywords from the list, users can hold down the Command key on a Mac or the Ctrl key on Windows.

Notes Area

The notes area serves as a diary, allowing users to enter notes and include a date and time stamp by clicking on the green clock button. Users can also customise the font, style, colour, and background colour of the text in the Notes area by highlighting it and right-clicking.

As mentioned at the beginning of the section on the contacts the Page Menu below the mode menu in the top left hand corner of the screen has additional items on it.

- Details: The screen described earlier in this article.

- Actions: Is documented later in this manual and may be accessed from individual functions or directly from the Inquiries Palette.

- Custom: This Page seen below, allows you to set a number of custom fields, these include fields for pictures, numbers and alphanumeric characters.

Custom Page Overview

SapphireOne’s Custom page features text fields designed for versatile, user-defined purposes. Each field is assigned a variable by SapphireOne, which is displayed as the default field heading label. Users can take note of the desired field or heading variable for customisation and modify it by navigating to Utilities > Controls > Change Names. Detailed instructions on this process will be provided below.

The Custom page is organised into the following sections:

- Alpha – Allows letters and numbers, but cannot be used for arithmetic functions

- Real – Allows numbers only, and can be used for arithmetic functions

- Date / Time – Date fields store date values and can be used for date functions, while Time fields store time values and can be used for time functions

- No Heading Defined – Features eight alphanumeric fields that cannot be used for arithmetic functions

- Text – Accepts letters, numbers, and special characters, but cannot be used for arithmetic functions

The data entry fields in these Custom Pages can also be employed in Sapphire Custom Reports, Quick Reports, Custom Inquiries, 4D View Pro, and 4D Write Pro Reports, just like any other data entry fields within SapphireOne.

The example Custom Page below is from an Asset Inquiry; however, the process for customising this page remains the same, irrespective of the function in which the Custom Page is located.

Default Variable Values

In the default variable values defined by SapphireOne, the first number signifies the position of the field within the group, while the second number denotes the maximum number of characters for the data entry field.

For instance, ASAlpha_1_20 indicates that it is the first data entry field in the group and can hold up to 20 characters. Similarly, ASAlpha_8_80 shows that it is the eighth data entry field in the group, with a capacity for a maximum of 80 characters.

To modify the headings on a Custom Page:

- Write down the exact names of the headings you wish to modify.

- Navigate to Utilities > Controls > Change Names. Keep in mind that when performing this procedure, you will be warned that only one user should be logged into the data file.

- Upon accessing the Change Names function, a dialogue box will appear. Then, refer to your list of names and scroll down the list to find the headings you want to modify.

- For each heading:

- Highlight the name.

- Enter your new name in the lower data entry field.

- Click the Update button to save the changes in SapphireOne.

Asset Inquiry More Details Page

The More Details page records the additional important details of an Asset.

Insurance Area

The Insurance Area includes relevant details regarding any insurance relating to the particular Asset. This includes the policy number, insurer, expiry date, replacement value, premiums (ex GST), insured amount and expiry.

Insurance Notes

Any relevant notes regarding the insurance can be included here.

Dictation and Speech to Text Overview

SapphireOne’s implementation of both Dictation (MacOS) and Speech to Text (Windows) is a game changer for data entry. Any data entry field you can type into using a keyboard can use this feature.

You can also use this functionality on all inquiry screens within SapphireOne. For example, the user is in a Contact within a Client. They may have made a phone call to that particular client using the Softphone technology. Consequently, this will automatically date and time stamp both the contact and the phone number you called.

As soon as the call is completed, the user has the ability to use Speech to Text (Windows) or Dictation (MacOS). They can dictate into the memo field of the CRM contact, adding as much description as they require.

Dictation and Speech to Text Procedure

This functionality applies across every single Data Entry screen. For example, the SapphireOne user is entering a Vendor Invoice (VI). Additionally, you may want to add a memo within the Vendor Invoice (VI). The user can utilise the tool and simply dictate the memo.

Another example is if the user wants to add additional lines to the General Ledger account, within each General Ledger account. When the user is completing data entry using a General Ledger, there’s always a unique memo field for each GL account line.

The user can then utilise this feature to quickly add the information they need to add. Alternatively, you may have an interview with an employee. After the interview process is completed, the user can then make notes about the employee.

Speech to Text or Dictation is an extremely powerful tool. It is something that we at SapphireOne, as well as our clients, utilise daily. It is a massive time saver.

General Ledger Accounts Area

All General Ledger accounts must be set up before an Asset is purchased as all of the fields in this area are linked to the existing G/L accounts in SapphireOne. The wild card search “@ or ?” symbols may be used to search for the G/L Account. This allows you to set the control accounts up for this individual Asset, overriding any generic setup from the Company entered Control accounts.

Miscellaneous Area

Miscellaneous information about the Asset is entered and stored here. An estimated usage per day may be entered if required. SapphireOne will also keep a running total of days since the Asset was purchased.

Costing Split Area

The Asset Inquiry function has the ability to perform a costing split across multiple General Ledger departments with a unique percentage split across each department as follows. It should be noted that the ![]() Delete and

Delete and ![]() Add icons perform the same functions as in other areas of SapphireOne.

Add icons perform the same functions as in other areas of SapphireOne.

- Department – Select the

Add icon to commence adding in a new Department to this Costing Split function. SapphireOne will place the cursor in the department field ready for the entry of a department ID. It is wild card searchable so the “@” and “?” may be used when searching for a Department ID.

Add icon to commence adding in a new Department to this Costing Split function. SapphireOne will place the cursor in the department field ready for the entry of a department ID. It is wild card searchable so the “@” and “?” may be used when searching for a Department ID. - Percentage – As each department is entered enter the split for each department as a percentage. At least two departments will have to be entered and the total for all departments will have to total 100%. If it does not add up to 100%, on attempting to save the page an alert will be displayed warning the user.

Backlog Area

A notational backlog area that allows you to record various numerical events in whatever context you are using the Asset, for example kilometers between service. The fields in relation to the backlog are Log Date, By, Type, Operator, Description, Reading and Completed Date. As above select the ![]() add icon to add a new item to the list.

add icon to add a new item to the list.

Asset Inquiry Category Details Page

Overview of all Categories

For all Asset certain records need to be kept for tax purposes. In the case of computer based assets, if the software has to be re-installed, what was the license number, what was the serial number etc. This category page is a repository for the storing of all these details which may be lost over time after the initial purchase of the asset.

This Category Page is directly linked to the Type Selection made by the user on the very first page in this Asset Inquiry in the Details Page. For each Category selected from the Type drop down menu, there is a different Category Page displayed here. There are 8 categories, these include: Not Categorised, Computer Equipment, Plant Equipment, Motor Vehicles, Property/Land, Artwork, Photographic Equipment and Other Equipment.

Not Categorised Category Details Page

The Type option of Not Categorised on the Details Page is the default setting when a new Asset is brought into the SapphireOne Asset registry. If it is not altered from the Details Page and you cause SapphireOne to save the Asset, SapphireOne will display an alert stating that the Asset has not been categorised. You will still be able to select the ![]() tick and save the Asset.

tick and save the Asset.

Computer Equipment Category Details Page

There are no designated areas on this page. SapphireOne displays the name of the category at the top of the screen on the right hand side.

- ID & Name – SapphireOne will enter the ID & Name as per the details on the Details Page.

- Owner – Enter the ID of the owner or user who is using this Asset. They must have a user record established in SapphireOne so the entry of a valid user ID is required.

- Notes Style Text Fields – These 4 fields are not formally structured in any way and are set up simply as note fields which will accept any type of character. This allows the user maximum flexibility when entering information into them. The 4 data field headings as entered are a best fit for for recording details of your Computer equipment.

- Site Address – Entering the Site address where the Computer Equipment is located is recommended here.

- Office – The Office address can be entered here.

- Rack – Racking details can be entered here.

- Shelf – Shelving details can be entered here.

Most of the commonly used data entry fields for entering the details of computer based equipment are setup for data entry. These 16 fields go from Box Configuration through to NetBIOS Name. There are 5 drop down menus within this group of 16 fields documented below. As in other areas of SapphireOne the items on the menus may be added or deleted by the user as required. Several of these menus already have some commonly used items written into the list and can be removed if required. The remainder of these 16 data entry fields are not formally structured in any way and will accept any type of character so as to allow for maximum flexibility when recording details about the computer equipment.

- Box Configuration – Items already in this menu are, Desktop, Laptop and Rack Mount, others could be added.

- Device Type – Items currently in this menu are Backup Service, Firewall, RAID, Server and Workstation others could be added as required.

- Manufacturer – No items have entered to the menu so enter the manufacturer as required. When the alert is displayed and you have correctly spelt the new item, select Yes.

- Platform – Linux, Macintosh and Windows and the most common platforms have been entered for you. Add to the list as required.

- Version – Enter the version number.

- Model Number – Enter the model number of the computer equipment.

- Mac Address – enter the Mac address if known or required. These are important details when using routers.

- IP Addresses – Most Computer Equipment requires an IP address so the following items when entered will assist anyone who is setting the Asset up. If these details are entered initially they may be referred back to when the Asset has to be set up again or is replaced.

- DHCP | Fixed – The default is for the IP address to be Fixed. When the DHCP checkbox is selected, DHCP protocol will be turned on for the Asset so the Asset will expect to receive its IP address from a DHCP server on the network.

- I.P. Address Range Min – This sets a minimum IP address for the Asset.

- I.P Address Range Max – This sets a maximum I.P. Address for the Asset.

- I.P Address Internal – Enter in an Internal I.P. address for the Asset if required.

- I.P. Address External – Enter in an external I.P. Address for the Asset if required.

- Firewall Zone – Enter firewall zone details.

- Host – Enter host details.

- Encryption Key – Enter any encryption keys here.

- Encryption Level – Encryption levels have been entered in this menu from 64 bit through to 1024 bit. Select them or add to them as required.

- Service – Entering the next service date would be one option for this field.

- Software – Enter in details of the software.

- Version – Enter in the version number of the software.

- Version Date – Enter in the Version date of the software.

- Hardware serial Number – Enter in the hardware serial number.

- License Number – Enter in the license number for the Asset.

- Primary User – If you have a user that uses the asset or manages it, enter their name here.

- NetBIOS Name – If known enter the NetBIOS name here.

- Updated Date – If any updates have been completed for this Asset enter the date here.

- Is Active Checkbox – This checkbox is automatically selected when creating an Asset category. You can unselect the checkbox to make the category inactive.

- Notes – Any notes or comments may be entered here.

- Remote Access Procedure – Any remote access procedures may be documented.

Password Area

The Password area will automatically update when an Asset is categorised as ‘Computer Equipment’ and is linked to a particular Password. Passwords can be linked to the Computer Equipment asset by navigating to Assets > Assets > Password Inquiry > an entering the Asset ID within the Hardware or Software data entry fields.

Plant Equipment Category Details Page

- ID & Name – SapphireOne will display the assets ID and Name populated from the data that was entered on the Details Page.

- Manufacturer – Enter in the manufacturer of the Asset.

- Version – Enter in the version of the Asset.

- Version Date – Enter in a Version date with the format as seen in the field.

- Is Active Checkbox – This checkbox is automatically selected when creating an Asset category. You can unselect the checkbox to make the category inactive.

- Hardware Serial Number – Enter the serial number for the Asset.

- License # – Enter in a License number for the Asset if required.

- Updated Date – If any updates have been completed for this asset enter the date here.

- Notes – Any notes or comments about the Asset may be entered here.

Motor Vehicles Category Details Page

Any type of Vehicle that has to be registered for on road usage will fall into this category. Specific provision has been made for the storing of registration details and other associated information about the registered Asset.

Most of the items in the list below will be found on the registration papers for the registered vehicle. If this is lost and these details have been entered into the Category Details page they can be recovered.

Registration Details

- Registration Number – Enter the registered number for the vehicle, the plate number.

- Registration Expiry – Enter the expiry date for the vehicle in the format dd/mm/yyyy.

- VIN Number – Enter the VIN number. All vehicles today have a VIN number stamped on them.

- Manufacture Year – Enter the year of manufacture.

- Make – Enter the make of the Vehicle.

- Model – Enter the model of the Vehicle.

- Type – Enter the Type of Vehicle.

- Color – Enter in the Color of the Vehicle.

- Engine Number – Enter in the Engine number.

- Transmission Number – Enter in the Transmission number for the vehicle.

- Genset Number – This item applies to a generator and is the generators serial number.

- Genset Type – This item applies to a generator and the the generators type.

Service Periods and Dates

- Last Service – Enter the data that the vehicle was last serviced. Enter manually or use the date pick calendar.

- Next Service – Enter the date of the next service due for the vehicle. Enter manually or use the date pick calendar.

- Current km – Enter the current odometer reading in kilometres/miles for the vehicle.

- Next Service km – Enter the number of kilometres/miles to the next service.

- Current Operate – This field will accept any characters and can be used for anything that the user wants.

- Next Service Operation – This field will accept any characters and can be used for anything that the user wants.

- Volume per load – This fields may be used to store the volume per load or the weight or payload of the vehicle.

Property/Land Category Page

When this option is is selected, SapphireOne will display the asset ID and Name at the top of the screen.

Artwork Category Details Page

- Artwork – When this option is is selected from the Type menu on the Details Page, SapphireOne will display the asset ID and Name at the top of the screen.

- Art Category – This is a drop down menu where the user is able to add and delete items from it as required.

- Value – Enter in a value for the artwork.

- Valuers Notes – Any notes concerning the artwork may be entered here. This would include any valuers reports.

Other Equipment Category Details Page

Other Equipment – When this option is selected from the Type Drop down menu on the Details Page, SapphireOne will only display the asset ID and Name at the top of the screen. When the Asset is saved, there will be no alert displayed stating that the Asset has not been categorised.

Asset Inquiry Custom Page

This is the Custom page for Assets. All of the Area Headings and Field Names can be customised to your needs. You may do this through the Change Names function by going to: Utilities / Controls / Change Names. We have a total of eight customisable alpha fields, eight customisable numerical fields, six customisable date fields and two text fields.

Asset Inquiry Depreciation Page

This Depreciation Page allows for the set up and recording of depreciation values for both Tax and Company based rates of depreciation for an Asset. This information is then used by SapphireOne when the Auto Depreciation function is executed. The Auto Depreciation function will have the Tax option selected while the Company option is available for the user to select each time the Auto Depreciation function is run.

If your company uses more than two depreciation methods you will have to use a Method Inquiry to add in additional methods. To do this go to Assets > Assets > Method Inquiry. Create the new Method there with the basic details. Once the new Method has been created it will be displayed in the Method Page which is the next page in this Asset Inquiry. This can also be activated by the Auto Depreciation function. In the two methods displayed here the user has a choice to select Straight Line, Diminishing Value or Cost Price.

Miscellaneous Area

The miscellaneous area allows the recording of miscellaneous details regarding the asset depreciation, these are common across both DGJ, Tax and DCO Company depreciation methods.

- Motor Vehicle Checkbox – Select only if the Asset is to be classed as a Motor Vehicle.

- If the checkbox above is selected an additional data entry field will be displayed as Cost Price Limit. Enter in a value if required.

- Business Use – By default SapphireOne will enter in 100%. If the business usage is less than 100% enter in a numerical value without the % symbol.

The designation of both Tax and Company in the two areas documented below can be renamed by going to Master Defaults > Assets.

Tax Area

The Tax area allows the entry of Tax related depreciation information. This is the main depreciation method and Depreciation generated using this method will generate General Ledger Journals in Accounts mode.

- Opening Written Down Value – SapphireOne will enter the Tax Written Down Value.

- Expected Life in Years – Enter the expected life of the Asset in Years as determined by the Tax office.

- Self Assessed Checkbox – If the depreciation is to be self assessed.

- Expected Residual Value – Enter the expected residual Value of the asset.

- Suggested Rate – SapphireOne will enter a rate based on data entered elsewhere in this asset.

- Depreciation Type – This drop down menu has three options as follows.

- Straight Line, Diminishing Value and Cost Price.

- Rate – Enter the actual rate of depreciation.

- Depreciation this year – If the Asset has had the Auto depreciation function executed during the financial year SapphireOne will display that amount here.

- Depreciation Prior Year – SapphireOne will display the previous years depreciation here.

- Checkboxes – As itemised below we have five checkboxes.

- Low Cost Pool – If this checkbox is selected SapphireOne will not be included when the Auto Depreciation function is run and include it in the Low Cost Pool.

- Include in the Low Cost Pool when the WDV is less than $100 – This Asset will be included in any Auto Depreciation runs until its WDV is less than $100. It will the be switched to the Low Cost Pool automatically.

- Software Development Pool – When this checkbox is selected SapphireOne will place the Asset in the Software Development pool.

- Fully Depreciate On Auto – When this check box is selected SapphireOne will not move the item out of the list when the Auto function is executed. SapphireOne will continue to depreciate the item down to zero if allowed to continue.

Its important to note that if there appears to be no accumulated depreciation for the Asset, SapphireOne will assume that the Asset is New this Financial Year.

Company Area

The Company area allows the entry of “Company” related depreciation information. This is a secondary depreciation method and Depreciation generated using this method will NOT generate any General Ledger Journals in Accounts mode.

- Opening Written Down Value – Enter the Company Written Down Value.

- Expected Life in Years – Enter the Companies expected life in Years.

- Expected Residual Value – Enter the Companies Expected Residual Value.

- Suggested Rate – Enter the Companies rate of depreciation.

- Depreciation Type – This drop down menu has three options as follows.

- Straight Line, Diminishing Value and Cost Price.

- Rate – Enter the companies rate of depreciation.

- Depreciation this year – If the Asset has had the Auto depreciation function executed and the Company Checkbox selected during the financial year, SapphireOne will display that amount here.

- Depreciation Prior Year – If the Asset has had the Auto depreciation function executed and the Company Checkbox selected during the previous financial year, SapphireOne will display the previous years company depreciation here.

- Fully Depreciate On Auto – When this check box is selected SapphireOne will not move the item out of the list when the Auto function is executed. SapphireOne will continue to depreciate the item down to zero if allowed to continue.

Asset Inquiry Valuation Page

This Valuation page in and Asset Inquiry displays valuation information generated from depreciation and purchasing the asset. If your company uses more than two depreciation methods you will want to use the method page. Note that addition methods will have to be created first by going to Assets > Assets > Method Inquiry, before they will be displayed in the Methods Page here in an Asset Inquiry.

Tax & Company Areas

Since both the Tax and Company areas are identical we will document the Tax area only as all data fields populated by SapphireOne in the Company area are the same. This will avoid some duplication of the documentation.

There are no user entered data entry fields on this Valuation page in an Asset Inquiry.This page displays valuation information generated from Depreciation and Purchasing. It also displays the required information when an asset is disposed of or sold.

The Tax area displays Tax related depreciation information. This is the main depreciation method and Depreciation generated using this method will generate General Ledger Journals in Accounts mode.

The Company area also displays ‘Company’ related depreciation information which is the second depreciation method which is the company based depreciation method.

- Opening Written Down Value – This displays the current opening Written Down Value of the Asset.

- Disposal – If a disposal Journal has been created for this Asset SapphireOne will display the value in this field.

- Profit/Loss on Disposal – From the disposal Journal above SapphireOne will display any profit or loss made on the disposal of the Asset.

- Capital Gain – If a capital gain is applicable for the disposal it will be displayed here.

- Additions – If any additions are made to the asset they will be displayed in the Cost and Date fields below.

- Cost – The dollar value of the cost of the addition.

- Date – The date that the addition was made.

- Depreciation this Month – This display any depreciation entered for the current Month.

- Month From – The commencement date for the month.

- Month To – The ending date foe the month.

- Depreciation this Year – Total depreciation for the current financial year.

- Closing Written Down Value – The current closing written down value.

- Accumulated Depreciation – The depreciation for the Asset from day one.

Asset Inquiry Method Page

Select the method to edit or view by double clicking. If you use multiple methods of depreciation they will initially need to be created by going to Assets > Assets > Method Inquiry. Once these additional methods have been created they will added to the list as seen below.

Then double click on the method to add or modify it. In a Method Inquiry when the method was first created there was provision for the entry of some basic details. The user may now in this methods page add in additional values that are unique for this Asset.

It should be noted that while there is both the Tax method, DGJ, and the Company method, DCO, both screens are identical. For this reason we will only document one of the methods.

Method area

Details in this are are inserted by SapphireOne. The Method and Asset ID and Name are inserted from the details already in this Asset Inquiry

Depreciation Area

- Depreciation Cost Limit – Enter in a Cost limit for depreciation.

- Expected Life in Years – Enter the life in years for the Asset.

- Expected Residual Value – Enter in the residual value of the Asset.

- Suggested Rate – SapphireOne will enter an expected residual rate for the Asset.

- Rate Type Menu – There are three options, Straight Line, Diminishing Value, Cost Price.

- Rate – Enter in the percentage that you want the asset depreciated at.

The remainder of the items on this Method page are for the display of existing accumulated Depreciation for the asset.

- Depreciation this Year – The value of depreciation for the Asset for the current financial year.

- Depreciation prior year – The depreciation accumulated for the previous financial year.

- Depreciation this Month – Depreciation accumulated during the current month will be displayed here.

- Month From & To – The current month, From and To.

- Accumulated Depreciation – This displays the total accumulated depreciation for this Asset.

- Fully Depreciate on Auto checkbox – This asset is not to be moved to the Low Value Pool and depreciated there. It must remain in the list when Auto Depreciation function is run and continue to be depreciated down to zero if left in the list.

Valuation Area

All the values in this valuation area are entered from other areas of SapphireOne and are for viewing only.

- Opening Written Down Value – The opening WDV.

- Disposal Value – An estimated disposal value.

- Profit / Loss on Disposal – When a Disposal Journal is created for this Asset SapphireOne will display the value.

- Capital Gain – From the disposal Journal SapphireOne will calculate and display if a capital gain or loss has been inccurred.

- Additions – If any additions have been made to the asset, SapphireOne will display the date and cost of the addition to the Asset.

- Balancing Adjustment – The value of the balance.

- Depreciation This year – The total depreciation for the current financial year.

- Closing Written Down Value – The closing WDV.

- Revaluation Value – The revaluation values.

Asset Inquiry Transactions Page

The Transaction page displays a simple list of the current asset based transactions relating to this asset. Asset transaction for the current month are displayed.

Asset Inquiry History Transactions Page

The History Transaction page displays a list of historical transactions relating to this asset.

Digital Assets Page

The Digital Assets Page enables users to attach an unlimited number of media files to almost any record in SapphireOne. Only the digital assets that have been entered by users for the selected record will be listed from the page menu in the selected record.

It should be noted that there is a Digital Asset item in Workbook mode on the General drop-down menu as well. This Digital Asset item lists all digital assets within the data file as a complete list. While very limited modifications are allowed from this list, it is very handy for getting an overall view of the digital assets in the data file. SapphireOne has provided the search function, enabling the user to search for a specific digital asset.

The key to successful image optimisation for performance is finding the perfect balance between the lowest file size and acceptable image quality. There are three things that play a huge role in image optimisation:

Image File Format

For most website owners, the three image file formats that matter the most are JPEG, PNG, and GIF. Choosing the right file type is crucial in image optimisation. To simplify things, JPEGs are ideal for photos or images with lots of colors, PNGs are recommended for simple images or transparent images, and GIFs are suitable for animated images only. PNG images are uncompressed, making them higher-quality, but also much larger in file size. JPEGs are a compressed file format that slightly reduces image quality to provide a significantly smaller file size. GIFs only use 256 colors along with lossless compression, making them the best choice for animated images.

Compression

Image compression plays a significant role in image optimisation. Various types and levels of image compression are available, and the settings for each will depend on the image compression tool you use. Most image editing tools such as Adobe Photoshop, ON1 Photo, GIMP, Affinity Photo, among others, have built-in image compression features. You can also save images normally and use web tools such as TinyPNG or JPEGmini to compress images before uploading them to SapphireOne. Although they require some manual effort, these two methods allow you to compress images efficiently.

Image Dimensions

When you import a photo from your phone or a digital camera, it usually has a high resolution and large file dimensions (height and width). These photos typically have a resolution of 300 DPI and dimensions starting from 2000 pixels or more. Although high-quality photos are perfect for print or desktop publishing, their dimensions can still be optimised. Reducing the image dimensions can significantly decrease image file size. You can resize images easily using image editing software on your computer.

To illustrate the impact of image optimization, let’s consider an example. We optimized a photo with a resolution of 300 DPI and image dimensions of 4900 x 3200 pixels. The original file size was 1.8 MB. We selected the JPEG format for higher compression and adjusted the dimensions to 1200 x 795 pixels. The resulting file size was reduced to just 103 KB. That’s a remarkable 94% reduction in file size from the original.

Choosing the Digital Assets option from the Page menu in a record displays a list of digital assets currently stored in the data file for the selected record.

This screen, as well as any subsequent screens, will overlay the existing screen displayed in your major table. This feature facilitates the attachment of digital assets to your Master Record, providing an efficient way to manage and organise media files associated with your data.

- To add a picture, simply click the Add

button.

button. - To delete a picture, select the Delete

button.

button.

Considerations for Adding Digital Assets

Adding digital assets can impact your data file size and system performance. It is important to consider the following:

- Storage capacity: Assess your storage capacity to ensure it can accommodate an increase in file size.

- System performance: Adding a large number of media files can potentially slow down your system. Evaluate the impact on system performance before attaching a significant number of digital assets.

You can review our Blog and YouTube channel for additional information and resources on SapphireOne ERP, CRM and Business Accounting software.