How Single Touch Payroll Works

A regular pay cycle (pay event) is when an employer carries out payroll at fixed regular intervals to remunerate employees. This is usually weekly, fortnightly or monthly. When you start reporting through your Single Touch Payroll-enabled solution, your pay event will need to include minimum reporting requirements in order for the ATO to receive the file. The employer must report the year-to-date values of gross salary or wages, allowances or other payments (as relevant), deductions and PAYG withholding for each employee included in each pay event.

The ATO then matches this information set to the corresponding employer/ employee profiles. As a result, businesses will no longer be required to complete payment summaries at the end of the financial year as it will have already been done and available to employees through myGov.

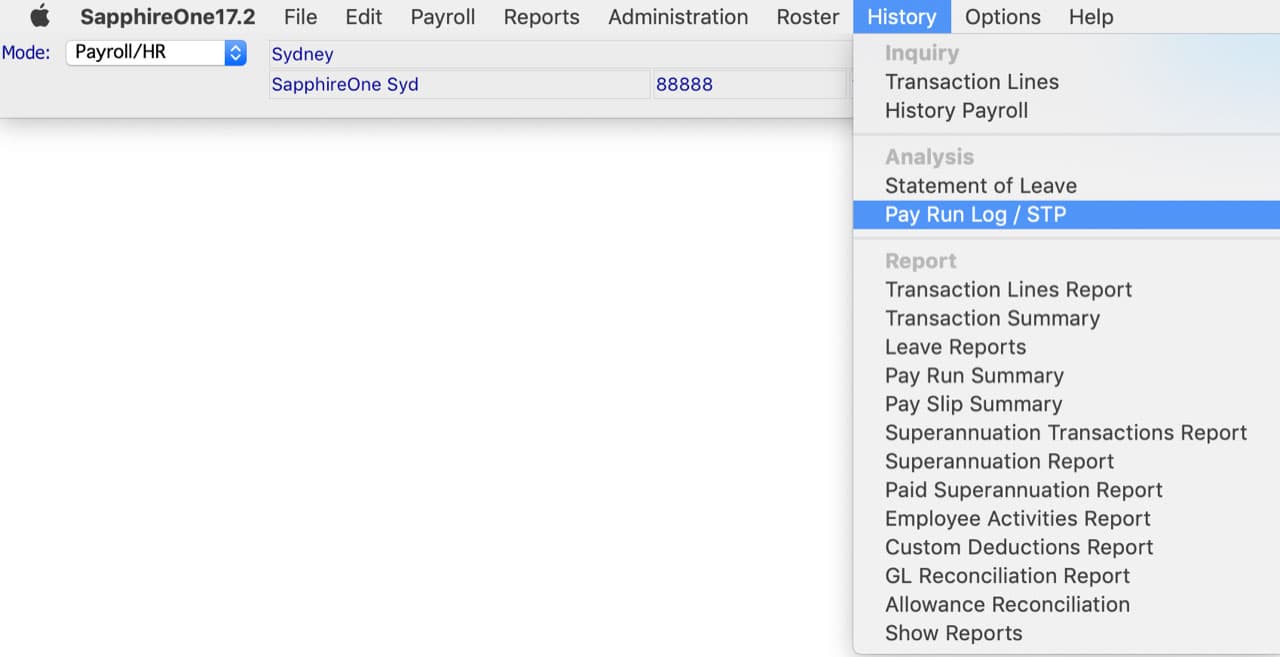

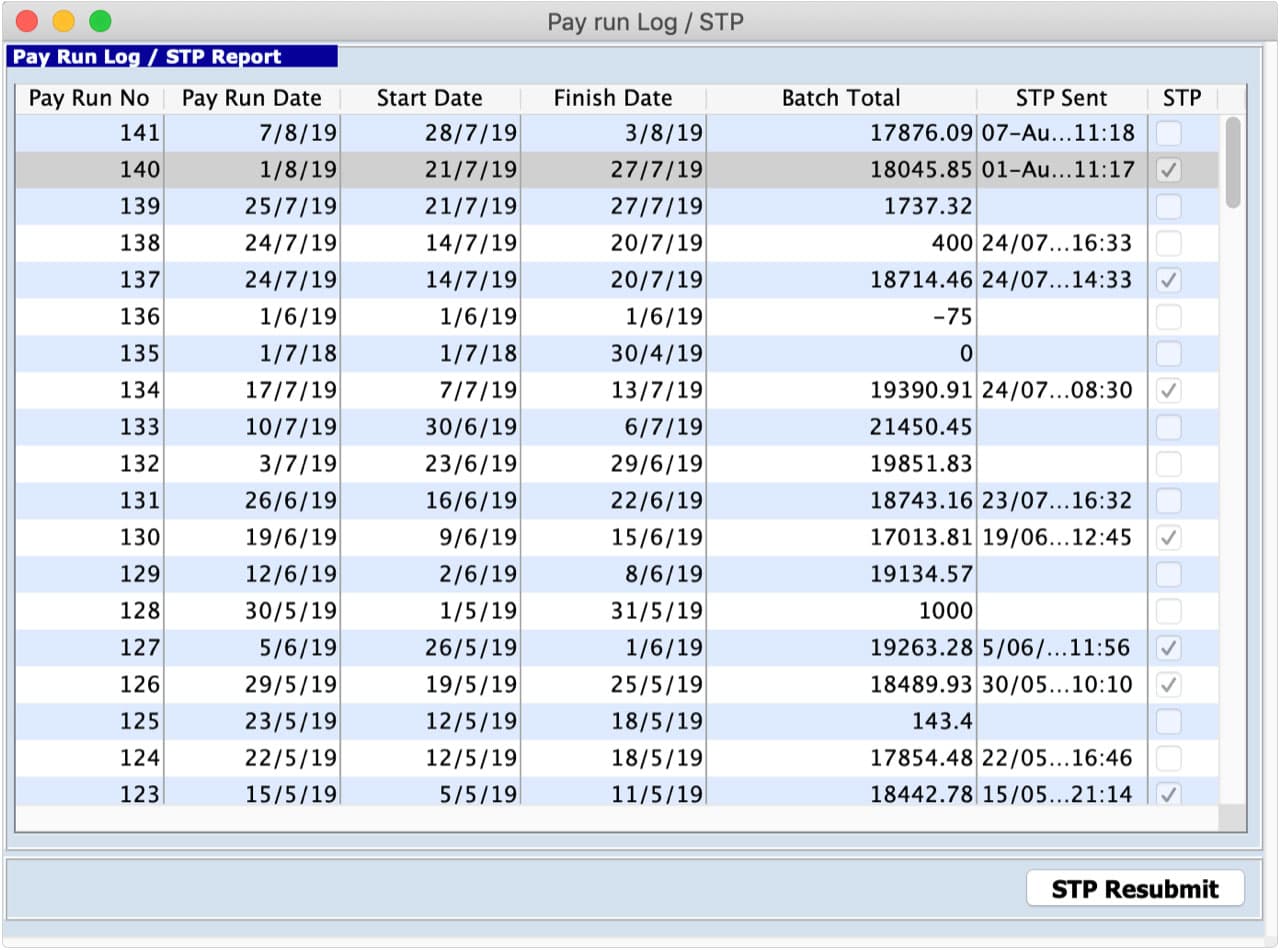

How to Submit an STP report in SapphireOne:

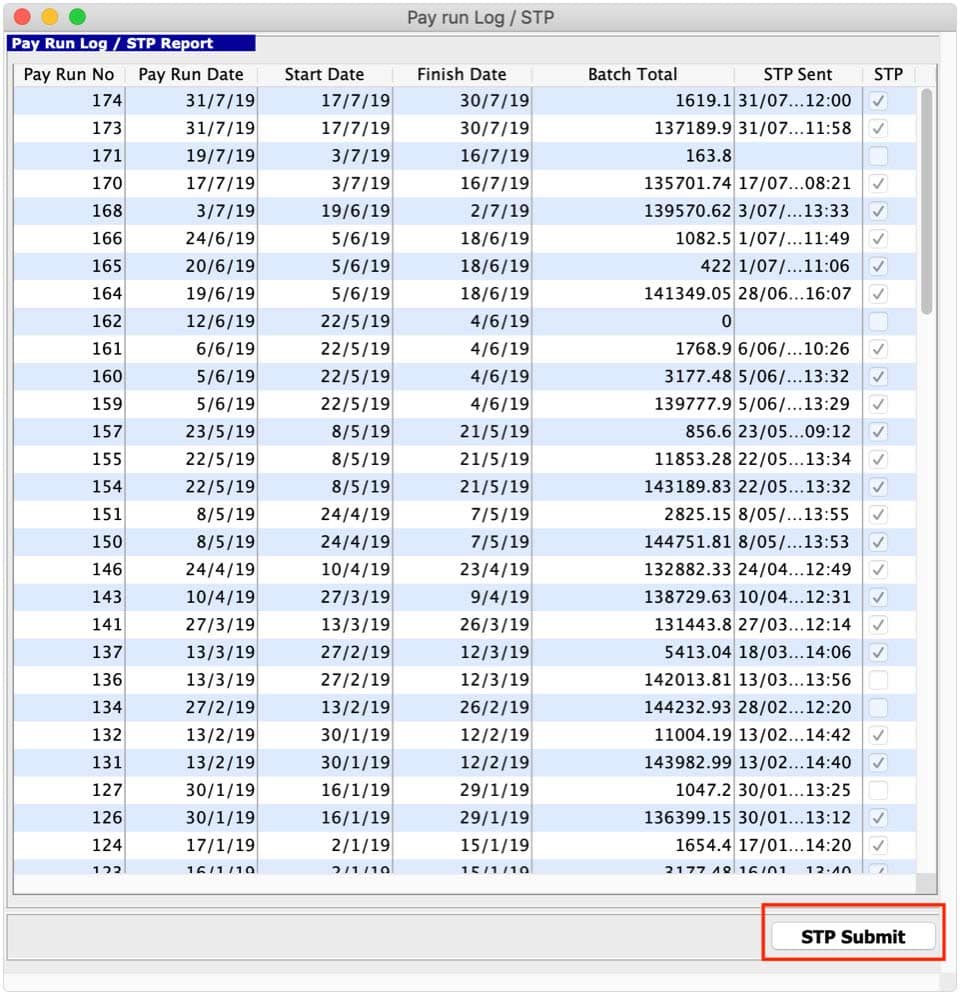

Select the latest Pay Run and click Submit button:

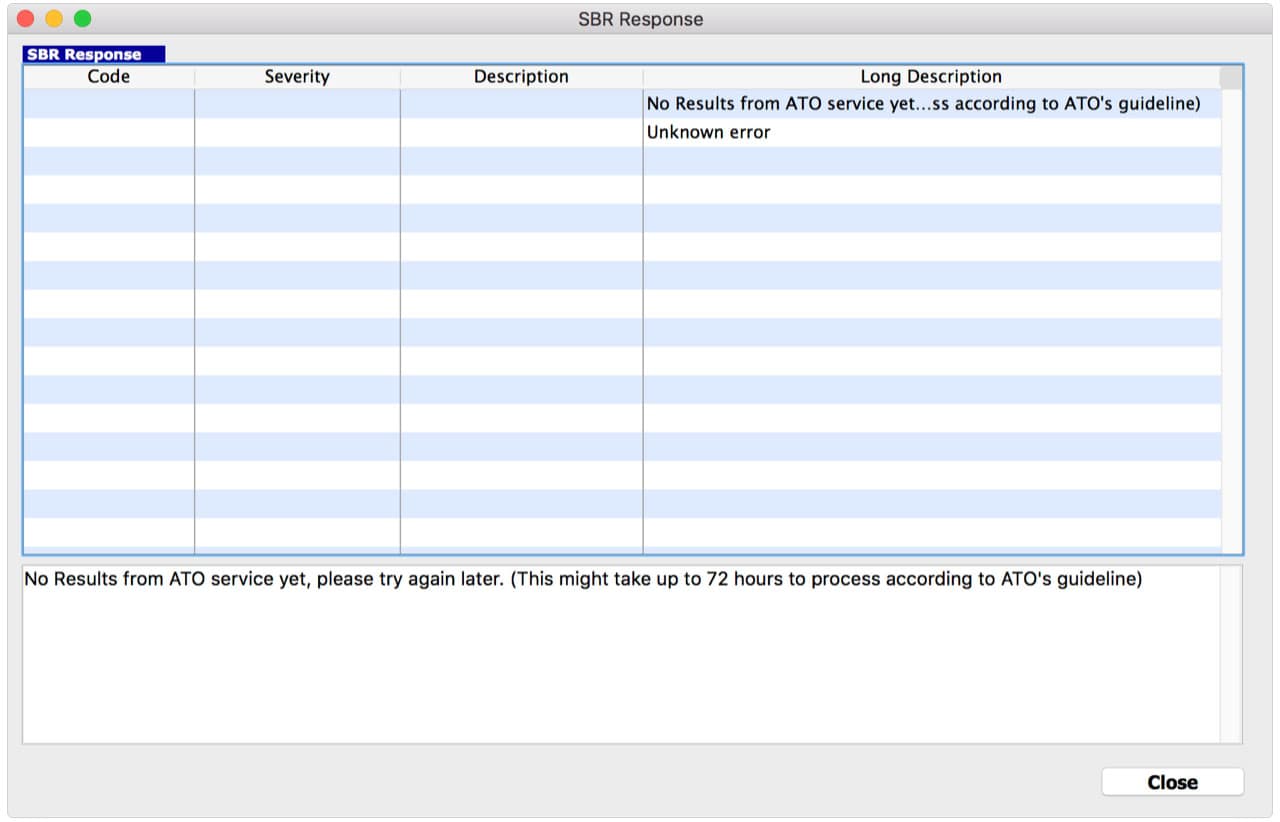

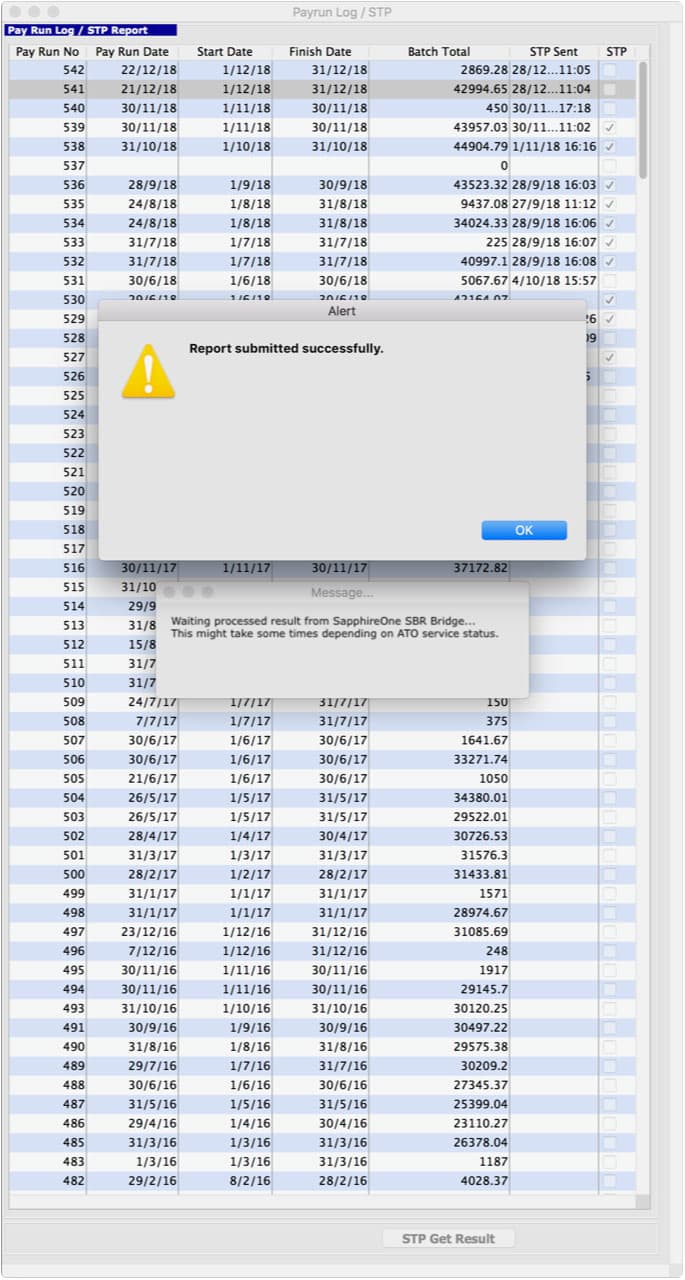

You will often find the ATO will not respond immediately and you will see the message below:

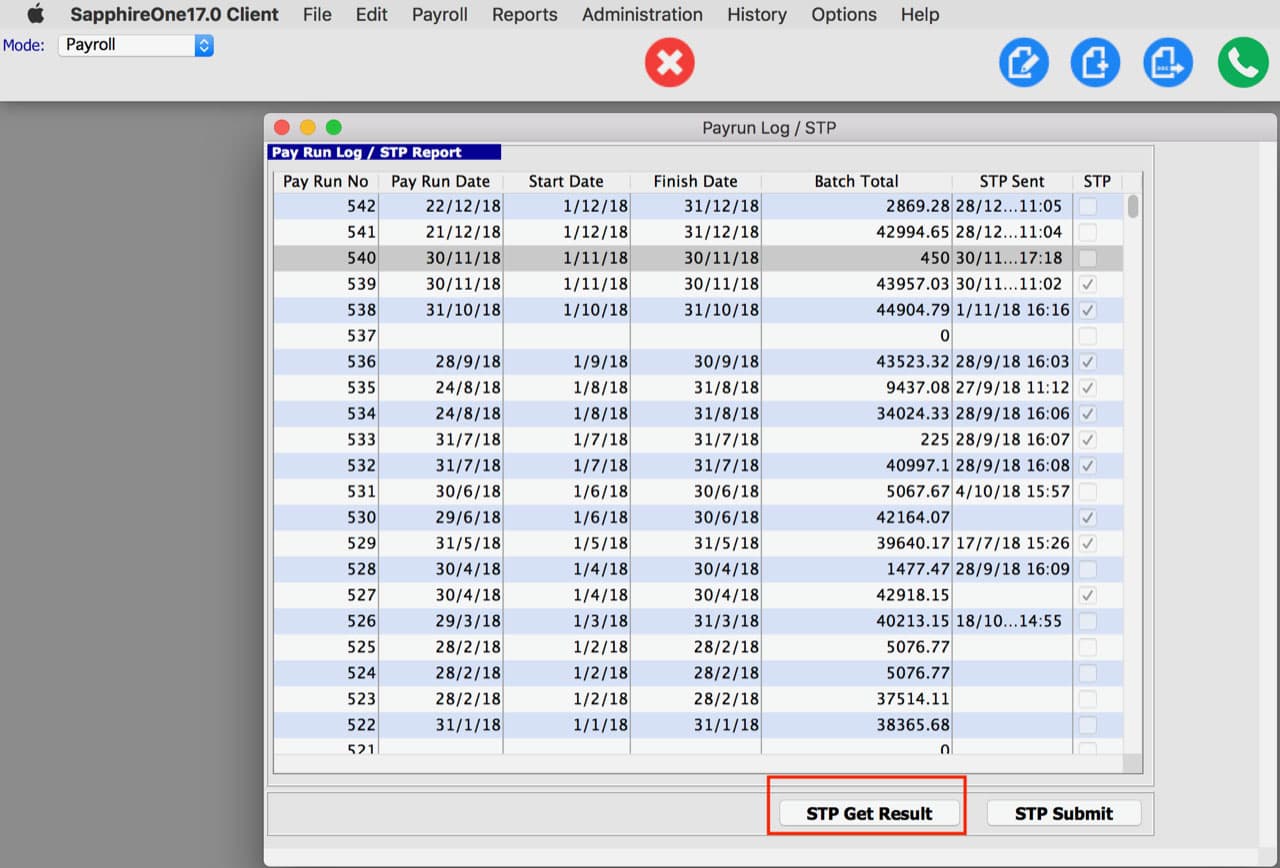

If you do not receive an immediate response, revisit after 30-60 minutes, highlight the same Pay Run/ STP and select STP Get Result.

You may need to return the following day if there is still no result, it may take up to 72 hours to get a result from the ATO.

When the STP report has been accepted by the ATO you will receive confirmation “Report Submitted Successfully”

If you do not receive a response from the ATO after 72 hours, please contact SapphireOne Support.

Errors:

Common errors often relate to incorrect data in the employee records, for example Date of Birth, Postcode or Suburb are missing, or invalid Tax File Number.

If you receive ATO message relating to these fields, correct the data, select the Pay run and ‘Resubmit’.

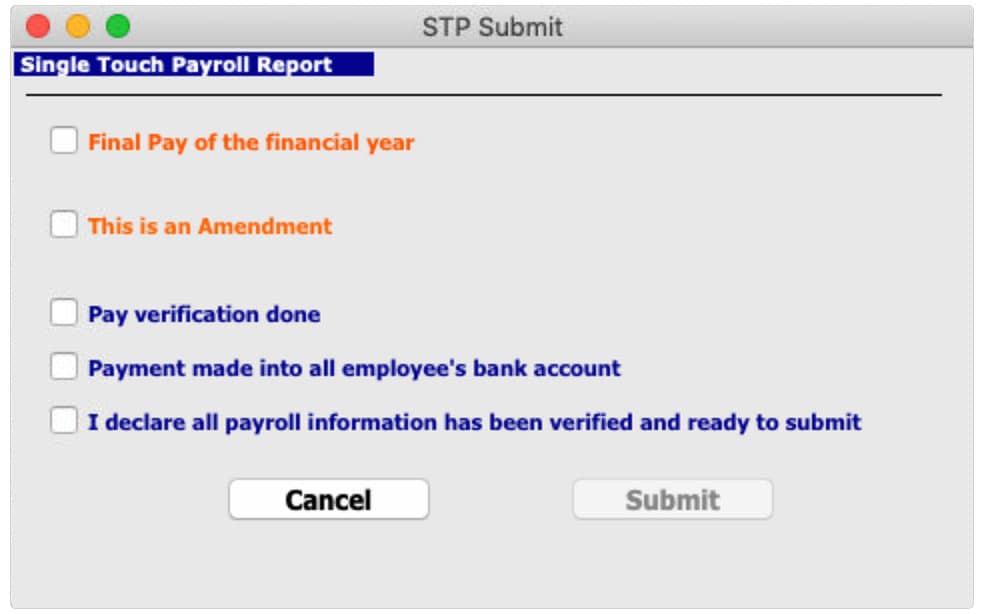

Tick the box “This is an Amendment”.

Note: After your final payrun and you have reconciled for the year, tick ‘Final Pay of the financial year”. (you will be able to submit amendments until the ATO cut off date).