“After completion of the payment process, you can submit STP with the ATO using SapphireOne”

“After completion of the payment process, you can submit STP with the ATO using SapphireOne”

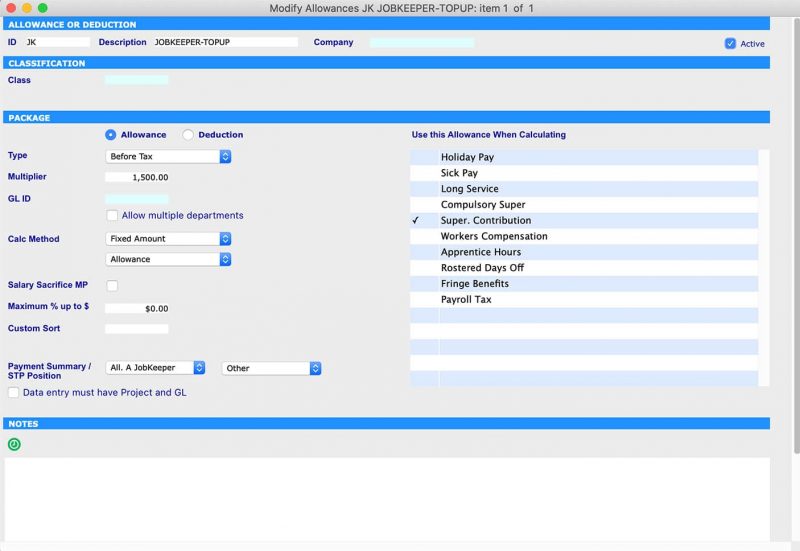

Every employer has to pay a minimum of gross $1,500 per fortnight to each eligible employee, withholding income tax as appropriate.

Employers are advised to pay their employees every fortnight under the JobKeeper scheme in order to maintain eligibility. The first fortnight runs from 30 March 2020 until 12 April 2020 and the last fortnight ends on 27 September 2020, respectively.

If an employee earns a wage of less than $1,500, their employer is only allowed to receive reimbursement under the JobKeeper program if they pay an according ‘top up’ in order to reach the value of gross $1,500 per fortnight. If the employer fails to pay this minimum amount to an eligible employee, he or she forfeits their claim under the subsidy scheme for the relevant fortnight.

All JobKeeper payments are considered assessable income of the eligible business. Further, the normal rules for tax deductibility apply in respect of the wages a company pays to its employees and for which they receive subsidies under the JobKeeper scheme.

Employers need to give each eligible employee a JobKeeper Employee Nomination notice, informing them on the intention to participate in the scheme and asking for their approval to be nominated and receive payments under the program. These forms should be kept as records, but do not need to be sent to the ATO.

The notice can be accessed via following link:

https://www.ato.gov.au/Forms/JobKeeper-payment—employee-nomination-notice/

Additionally, the ATO requires companies participating in the JobKeeper scheme to make monthly declarations through the ATO’s business portal about their eligible employees and their turnover via STP and SBR2.